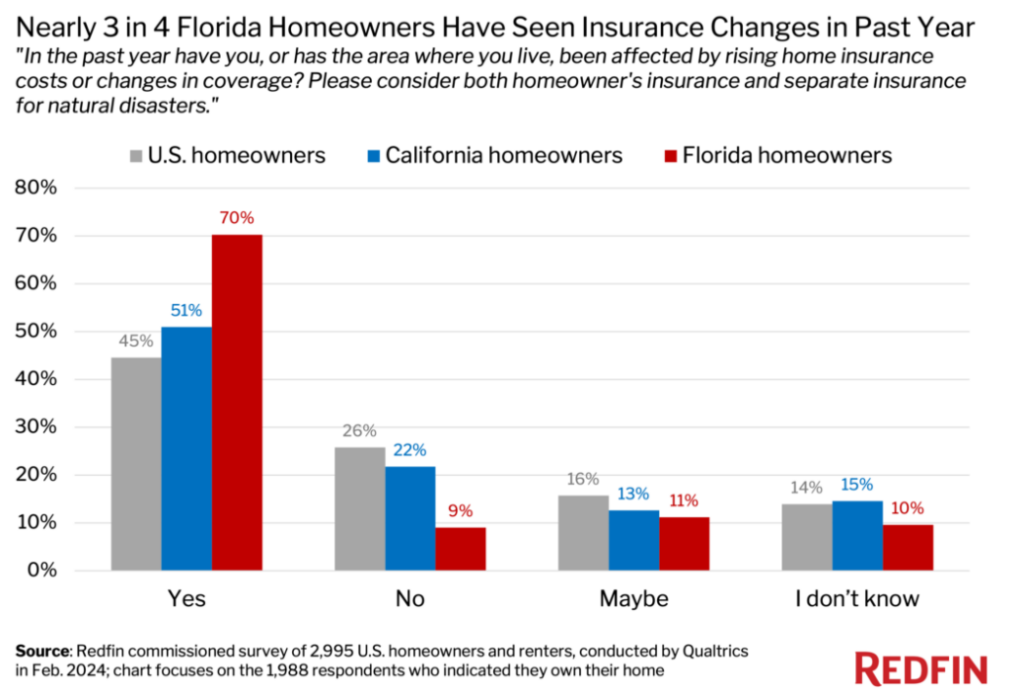

As inflation grows nationwide, the cost of home insurance seems to be denting wallets nationwide as well, as Redfin reports that 70.3% of Florida homeowners and 51% of California homeowners say they or the area they live in has been affected by rising home insurance costs or changes in coverage (e.g., their insurer dropped them) over the past 12 months.

For the analysis, Redfin commissioned a survey by Qualtrics in February 2024, polling 2,995 U.S. homeowners and renters.

Where are premiums rising the most?

Home insurance is top of mind for homeowners in the states of Florida and California where many homeowners have seen their premiums skyrocket, and some have lost coverage altogether due to intensifying natural disaster risk, which has prompted many insurers to stop doing business in those states altogether. According to Redfin, seven of California’s largest property insurers have recently opted to limit new policies in the Golden State amid increasing wildfire risk. And in the Sunshine State, 11 insurers have liquidated amid growing flood and storm risk.

Mounting insurance costs and natural disasters are prompting some people to relocate. In Florida, 11.9% of survey respondents who plan to move in the next year cited rising insurance costs as a reason—roughly twice the national share of 6.2%. And in California, 13.1% of people who intend to relocate in the coming year cited concern for natural disasters or climate risks as a reason, compared with 8.8% of respondents nationwide.

“Homeowners living in areas where insurance premiums are surging are at-risk of seeing their properties gain less value than homeowners in areas with stable premiums—and in some cases, they may even lose money,” said Redfin Chief Economist Daryl Fairweather. “Homes with low disaster risk and low insurance costs will likely become increasingly popular, and thus more valuable, as the dangers of climate change intensify.”

Insurers dropping clients

Redfin asked homeowners in areas impacted by rising home insurance costs or changes in coverage about their concerns. Of the 1,198 respondents, roughly one in eight Florida respondents (12%) and one in nine California respondents (10.7%) said their insurance company stopped offering coverage for their home, compared with 8.3% of respondents overall.

Other homeowners are worried they will be dropped by their insurer in the future: Over one-quarter (27.7%) of respondents in Florida said they are or have been concerned their insurer may stop offering coverage for their home, compared with 13.5% of respondents in California and 8.9% of respondents as a whole.

Most respondents have seen a rise in insurance costs: Overall, nearly three-quarters (71.7%) said their policy premium increased, with a slightly higher share in Florida (76%) and a slightly lower share in California (62.9%).

The average annual U.S. home insurance rate is expected to rise 6% this year to $2,522 after surging 19.8% between 2021 and 2023, according to Insurify. In Florida, the average annual rate is $10,996—higher than any other state.

Loss of coverage forcing migration

Roughly 100 homeowners who participated in the survey indicated that their insurance company stopped offering coverage for their home. One-third (33.2%) of those respondents moved or plans to move to a new area where coverage is available. But nearly the same share (30%) are staying in their home with little or no coverage.

Redfin reported that 46% of respondents who lost insurance coverage said they’ve found a new insurer to cover their home, while 44.5% said they pay a significantly higher premium for coverage than before.

Policy awareness

Thirty-four percent of those polled knew which natural disasters their insurance for their home covers. An even smaller share—27.2%—know which natural disasters their insurance covers and how much damage is covered under their policy.

A recent study by HouseFresh’s G. John Cole examined the areas most at-risk of damage from weather events and other conditions brought on by global warming. The report found that U.S. homes exposed to flood risk are overvalued by $121–$237 billion, and that lower-income households suffer “greater risk of losing home equity from price deflation.”

The HouseFresh team identified the cities and states with the highest proportion of home listings at substantial risk from climate change-related to fire, flood, wind, or heat in the next 30 years.

Insurance issues complicating transactions

A separate Redfin-commissioned survey of 500 real estate agents found that 34.4% experienced an increase in issues related to home insurance during transactions over the past year. The share was significantly higher in Florida and California. In the Sunshine State, 73% of agents have seen an uptick in insurance issues in the last year, and in California, the share was 64%.