Homeownership rates in America have been declining rather steadily this millennium. Economists blame factors such as limited housing supply, high sale prices, and slow-growing income levels, and they don’t expect that downturn to reverse significantly anytime soon.

Those who plan to purchase their dream home this year stand a better chance shopping in certain markets surrounding Phoenix or in a number of other American cities where homeownership is calculably more attainable, according to FinanceBuzz.

Reporters analyzed government and housing industry data from America’s 100 largest cities. In each locale, they compared median household income, median home sale price, income to home price ratio, monthly mortgage costs as a percentage of income, median mortgage interest rate, rates of new home construction, homeowner vacancy rate, and other indicators to determine those most and least conducive to buying a home. Data journalists Josh Koebert and Gabriela Walsh recently shared their full findings and methodology at financebuzz.com.

Most favorable locations

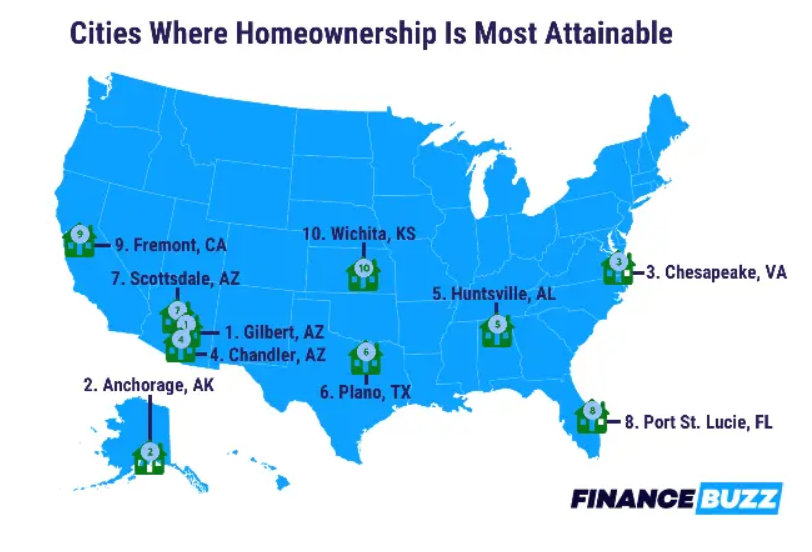

They determined cities most accommodating for house hunting Americans were as follows:

- Gilbert, Arizona

- Anchorage, Alaska

- Chesapeake, Virginia

- Chandler, Arizona

- Huntsville, Alabama

- Plano, Texas

- Scottsdale, Arizona

- Port St. Lucie, Florida

- Fremont, California

- Wichita, Kansas

What specifically makes Gilbert the most homebuyer friendly city in the nation? The median household income in this Maricopa County municipality tops $110,000, placing it among the 10-highest nationwide, while the median home sale price is in the middle $400,000s. Additionally, the median mortgage payment amounts to just 21% of the median household income in Gilbert, and that is the lowest rate in the country. Gilbert is one of three Phoenix-area metros on the “most attainable” list.

The other end of the spectrum

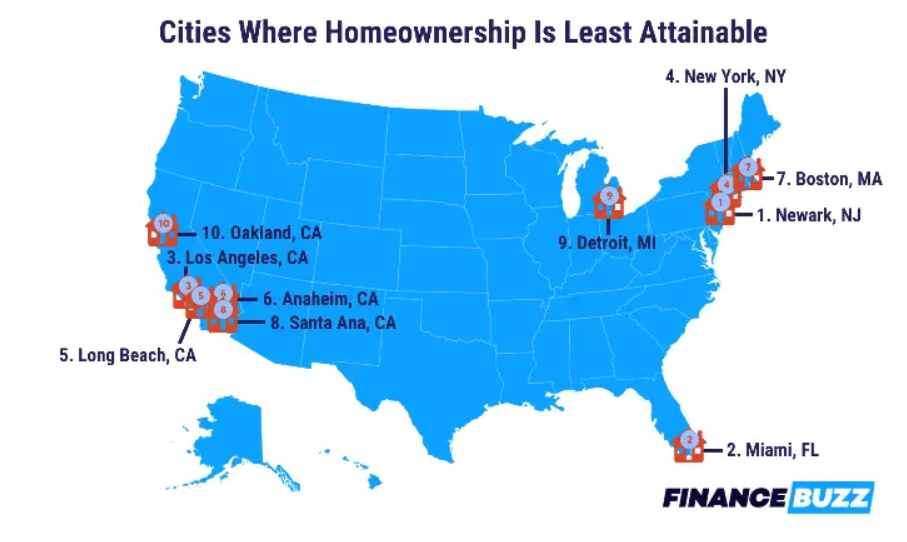

As for the least attainable, researchers said Newark, New Jersey received the highest overall “unattainability scores.” The market has one of the 10 lowest median household incomes at about $50,000, and one of the country’s 20 highest median home prices, $665,000.

Newark is followed by when it comes to unattainability:

- Miami, Florida

- Los Angeles

- New York, New York

- Long Beach, California

- Anaheim, California

- Boston

- Santa Ana, California

- Detroit, Michigan

- Oakland, California

California is the toughest state for home shoppers seeking the American dream, with seven cities among the country’s least attainable.

More details of the study are available at FinanceBuzz.