A new survey conducted by Discover Home Loans polled Americans’ intentions for their homes, and whether they are choosing to renovate their current property, or purchase a new home that may better fit their needs.

The survey found that the current interest rate environment, where Freddie Mac reports the 30-year fixed rate mortgage (FRM) is at 7.22%, are having a profound impact on American homeowners and potential buyers.

Of those polled, 84% who were planning to buy a new home felt that interest rates have impacted their decision. Of those impacted, 46% indicated they are no longer looking, 35% are less committed in their search, and 30% have lowered their budget. For most in this group, rates would need to fall significantly with 66% of respondents planning to wait for 30-year mortgage rates to dip below 5% before they would seriously consider purchasing a home.

Discover’s survey of 1,500 homeowners was conducted by Dynata (formerly Research Now/SSI), an independent survey research firm, and was fielded from February 9-March 13, 2024.

Rates drive the decision-making process

“When the Fed does gain confidence that inflation is under control, rate decreases are likely to be modest and gradual,” said Rob Cook, VP of Marketing at Discover Home Loans. “In the meantime, the housing market may remain sluggish. Consumers should reset their expectations and budgets accordingly.”

Interest rates are also modifying homeowners’ preferred financing options, as only 9% of homeowners plan to use a cash-out refinance for their home improvement project, down significantly from 24% in 2023.

“Homeowners are understandably avoiding lending options that would impact the rate they currently have on their primary mortgage,” said Cook. “In this rate environment, home equity loans are an attractive option as they allow homeowners to leverage the available equity they have in their homes without modifying their existing mortgage.”

Inflation also has a significant impact on homeowners’ finances, with 49% of respondents reducing discretionary spending and 33% choosing to delay home renovation projects. For those who pursue home renovations, many are feeling inflation’s impact with 47% of respondents indicating their project is costing more than they expected, and 30% stating they have reduced the size of their project.

The ICE Home Price Index for March showed the annual rate of growth easing slightly from an upwardly revised 6.0% in February to 5.6% in March. Prices were up a seasonally adjusted +0.42% month over month in March, a pullback from February’s +0.58%. On an unadjusted basis, however, prices rose +1.2% from the month prior, more than 25% above the 25-year average gain of +0.96% for the month of March.

“Such strong price gains continue to plague would-be homebuyers in today’s higher-rate environment, but for existing homeowners the picture keeps growing brighter,” said Andy Walden, ICE’s VP of Enterprise Research Strategy. “Homeowners with mortgages closed out the first quarter of 2024 with just a hair under $17T in home equity–an all-time high. Of that, a record $11T is tappable, meaning available for a homeowner to leverage while retaining a 20% equity cushion in the property. On average, that works out to roughly $206K in tappable equity per mortgage holder.”

What types of renovations are gaining in popularity?

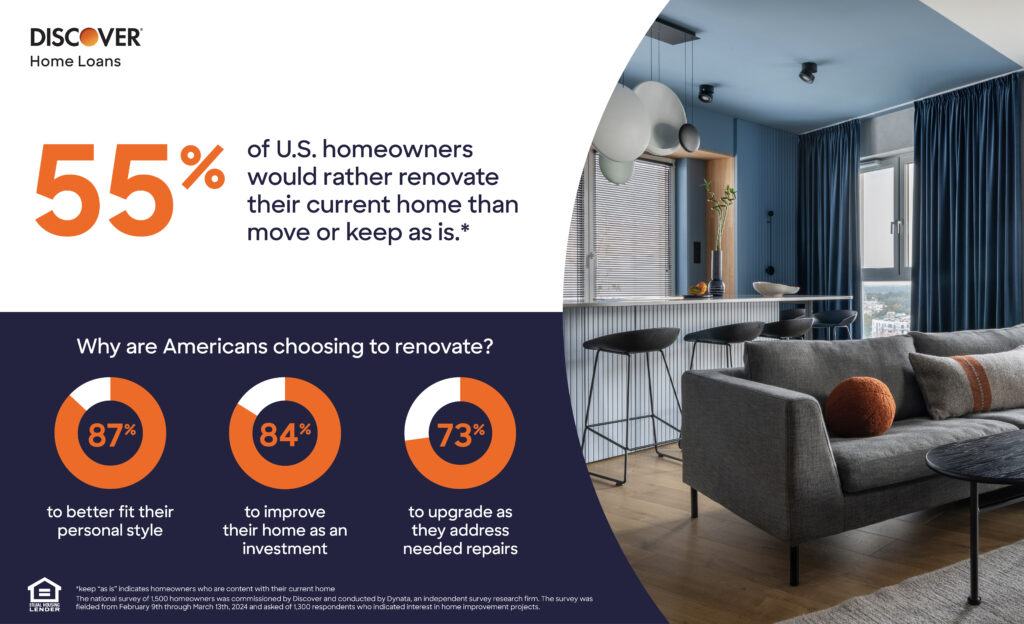

More than half (55%) of those polled would rather renovate their current home as opposed to move to a new home (24%) or keep their home “as is” (21%). Of those polled, 57% either have a home improvement project underway, or were planning a project within the next year. For those planning a home improvement project, 87% want to make cosmetic changes to reflect their personal style; 84% want to use home improvements as an investment opportunity; and 73% want to upgrade home features in need of repair.

Younger generations were generally more optimistic about their financial future this year with 48% of Gen Z and Millennial homeowners expecting their finances to improve over the next year—compared to only 31% of Gen X and Baby Boomers. Reasons for renovating a home also differ between generations. Gen Z and Millennial respondents are more likely to take on renovation projects that personalize their homes, while Gen X and Baby Boomers are taking on home renovations to feel a sense of accomplishment.

Spending and saving habits also differ between generations. Gen Z, Millennials and Gen X are more likely to expect their home improvement project to go over their anticipated budgets, while Baby Boomers are most likely to expect to stay consistent with their budget. Baby Boomers are less likely to budget for extra costs, while Gen Z is more likely to save between 11-15% when compared to other generations.

“As younger generations are building equity and looking to renovate, they appear to be willing to spend more to create a home that better reflects their personal aesthetic,” said Cook. “Meanwhile, older generations are willing to spend on improvements to keep up with the maintenance of their homes, but not embellish or completely overhaul.”