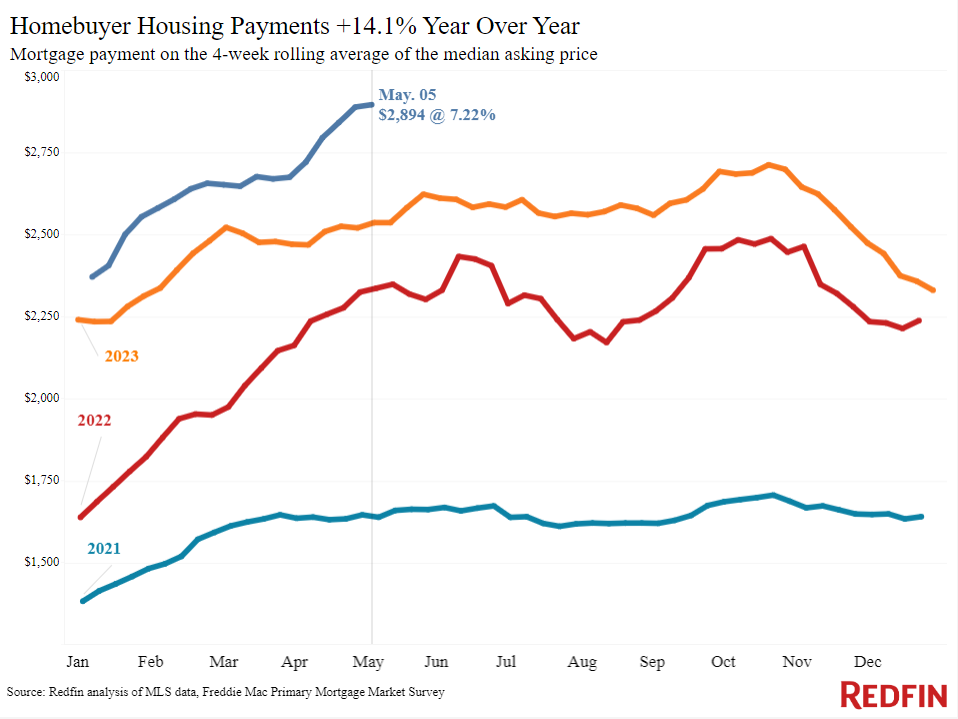

During the four weeks ending May 5, the median monthly housing payment in the U.S. hit an all-time high of $2,894, up 14% from the previous year, while home prices grew 4.5% to their own record high. This is according to a recent study from Redfin.

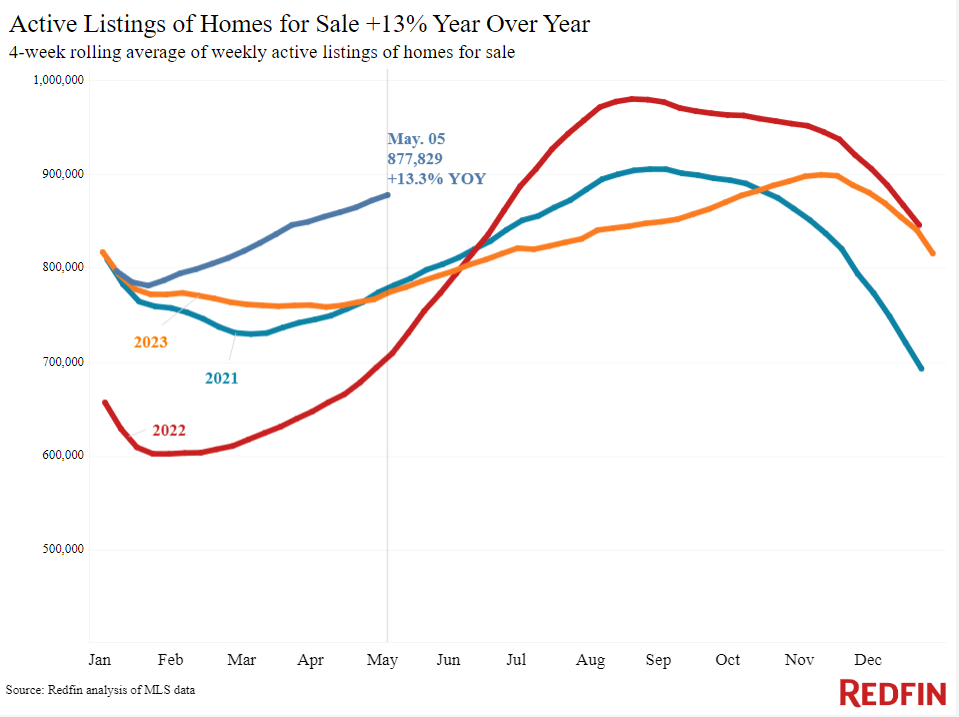

Many prospective sellers remain apprehensive of high interest rates, therefore the overall supply of homes for sale slowed. New listings increased 9% year over year, the smallest gain in three months (with the exception of the four weeks ending March 31, which had an artificially slight fall owing to Easter).

Except for 2020 and 2023, the four-week period ending May 5 saw the fewest new listings of any similar time on record. Many would-be sellers pulled out when interest rates climbed in April, preferring to stay put and keep their cheap mortgage rate.

“The market is a mixed bag, with high mortgage rates causing some listings to sit longer than I would expect in the springtime and high prices holding steady,” said David Palmer, a Redfin Premier agent in Seattle. “Sellers can rest assured that there are plenty of motivated buyers who are jumping into the market now; they finally understand that rates aren’t going to plummet anytime soon. Those buyers are the people who are moving because they need to: They’re relocating for a new job, going through a divorce, or growing their family. So even though some of my listings are taking longer to sell than they would in a typical spring market, they are selling eventually.”

Home sales declined as a result of rising interest rates and a scarcity of inventory. Pending home sales fell 3% from a year ago, marking the largest drop in two months. There is further evidence that competition for homes is reducing during a time of year when it usually accelerates: 30% of properties sold above asking price, unchanged from a week before and down from 32% a year ago and more than 50% two years ago.

And 6.2% of home sellers reduced their asking price, the largest percentage since November and up from 4.3% a year earlier. However, there is one indication that demand is beginning to rise: Mortgage applications increased by 2% week-over-week.

Per the report, recent economic news has pulled rates down from their peak. Encouraging economic data pulled daily average mortgage rates down from a five-month high of 7.5% on April 30 to around 7.2% at the end of last week and early this week, giving buyers some comfort. At their May 1 meeting, the Fed held interest rates stable while leaving the door open for a rate decrease later this year, and last Friday’s soft jobs data was another step in the right direction.

To read the full report, including more data, charts, and methodology, click here.