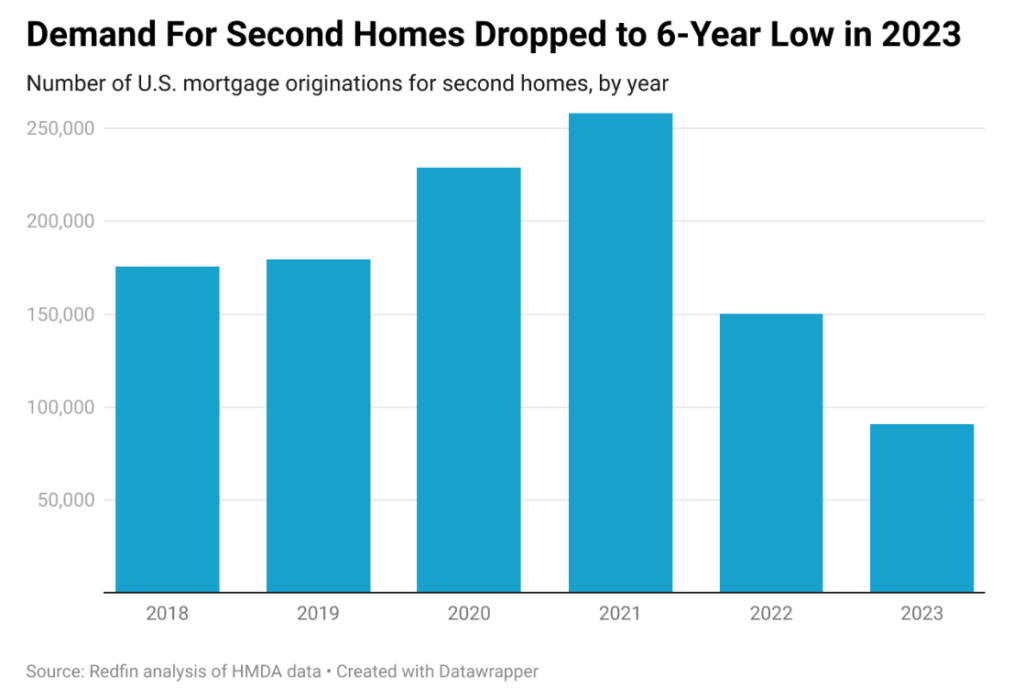

A new examination of U.S. home buyer trends in 2023 by Redfin found that 90,772 mortgages were taken out for second homes and vacation homes in, a total that was 40% lower year-over-year, and down 65% from the height of the pandemic housing boom in 2021. Meanwhile, mortgages for primary homes fell at half that rate—down 20% year-over-year in 2023, and down 35% from 2021.

For the report, Redfin analyzed Home Mortgage Disclosure Act (HMDA) data covering the purchase of second homes, primary homes, and investment properties from a five-year span of 2018-2023.

Forces forcing a decline

With the nation’s housing shortage and high rates pushing down home purchases last year, 2023 was the least affordable year on record, and affordability has yet to improve to date in 2024.

According to a new survey from Clever Real Estate, the median-priced home in the U.S. now costs $332,494, requiring prospective homebuyers to have an annual salary of at least $119,769 to afford it with a 10% down payment. That is over $45,000 more than the average household makes annually, which an estimated $74,755. Even with a 20% down payment, homebuyers would need to earn at least $98,202, which is still significantly higher than the average earnings.

In addition, Redfin’s recent analysis of housing costs found that during the four weeks ending May 5, the median monthly housing payment in the U.S. hit an all-time high of $2,894, up 14% from the previous year.

Mortgages for second homes dropped more than mortgages for primary homes for a number of reasons:

- It’s more expensive to buy a second home: The typical second home was worth $475,000 in 2023, versus $375,000 for primary homes. Additionally, the federal government increased loan fees for second homes in 2022, upping the total cost of buying one.

- Vacation homes aren’t a necessity the way primary homes are: In this case, when housing costs skyrocket, many prospective second-home buyers back off.

- Return to work scenarios: Purchasing a second home for your own use is a less attractive proposition than it was a few years ago because many companies are now requiring their employees to return to the office, meaning there’s less time to spend in vacation homes.

- A cooling rental market: Purchasing a second home to rent it out has become a less attractive proposition than it once was because the rental market has cooled from its pandemic peak, and owners of short-term rentals on sites like Airbnb are generally earning less revenue.

“Soaring prices pushed down demand for vacation homes last year, both for cash buyers and those getting a mortgage—but the latter pulled back even more because high rates exacerbated high prices,” said Phoenix-based Redfin Premier Agent Heather Mahmood-Corley. “There has been a small uptick in interest in second homes this year, mostly from cash buyers who plan to eventually move in full time. People who would need a mortgage are still sitting on the sidelines, waiting for rates to come down—especially because rates are typically even higher for second homes than primary homes.”

Who is buying vacation homes?

The share of total mortgages that went to second home buyers also dropped last year, with 2.8% of all mortgage originations in 2023 marked for second homes, down from 3.6% in 2022, and 5.1% in 2021.

The vast majority of mortgages go to buyers of primary homes, as they took out nearly nine in 10 (88.6%) mortgages in 2023, 87.2% in 2022 and 89.2% in 2020. The remainder goes to those buying investment properties, with 8.6% of all mortgages taken out in 2023 used for investment properties, compared with 9.2% in 2022 and 5.9% in 2020.

The vast majority of people who took out mortgages for vacation homes in 2023 were—unsurprisingly—high earners. Nearly nine in 10 (86%) second-home mortgages issued last year went to high-income buyers. Just under 3% went to low-income buyers. According to HMDA data, the nationwide median household income of home purchasers was $178,000 for high-income buyers, and $65,000 for low-income buyers.

Nearly four in five (79%) vacation-home mortgages went to white homebuyers in 2023. Asian and Hispanic homebuyers came in second and a slight third, with 6.4% and 6.2% of new vacation-home mortgages, respectively. Buyers who identify as more than one race took out 5.4% of second-home mortgages, and Black buyers took out 2.7%.

Gen Xers (55- to 64-year-olds) purchased 29.5% of vacation-home mortgages in 2023, and another 28.6% went to 45- to 54-year-olds (Gen Xers were 43- to 58-year-olds in 2023). Next came 35- to 44-year-olds (21%), 65- to 74-year-olds (11.4%), and people under 35 (6.9%).

Target markets

Originations for second homes fell in all major U.S. metros last year, taking the biggest drop in Austin, Texas, with a 62.5% year-over-year drop in 2023. Austin’s housing market slowed substantially across the board last year as the pandemic migration boom waned, and housing costs climbed too high for many locals. The next-biggest declines for second-home mortgages were mostly in expensive coastal cities:

- San Francisco, down 57.6% year-over-year

- New York, down 53.9% year-over-year

- Seattle, Washington, down 53% year-over-year

- Nashville, Tennessee, down 51.3% year-over-year

The smallest declines in second-home mortgages were in relatively affordable metros in the middle of the country and on the East Coast:

- St. Louis, down 25.2% year-over-year

- Kansas City, Missouri, down 31.1% year-over-year

- Providence, Rhode Island, down 31.1% year-over-year

- Montgomery County, Pennsylvania, down 32.1% year-over-year

- Warren, Michigan, down 32.1% year-over-year

Second-home mortgages made up the largest share of all mortgage originations in West Palm Beach, Florida, a popular destination for snowbirds and vacationers. Just under 7% of all mortgage originations in the West Palm Beach metro last year were for second homes. Raking next were:

- Orlando, Florida (4.1%)

- Riverside, California (4%)

- New Brunswick, New Jersey (3.9%)

- Tampa, Florida (3.6%)

Even though the share of second-home mortgages was largest in those places of all the major U.S. metros, they were still down at least 37% year-over-year.

Click here to read more about Redfin’s report on second mortgages and vacation homes.