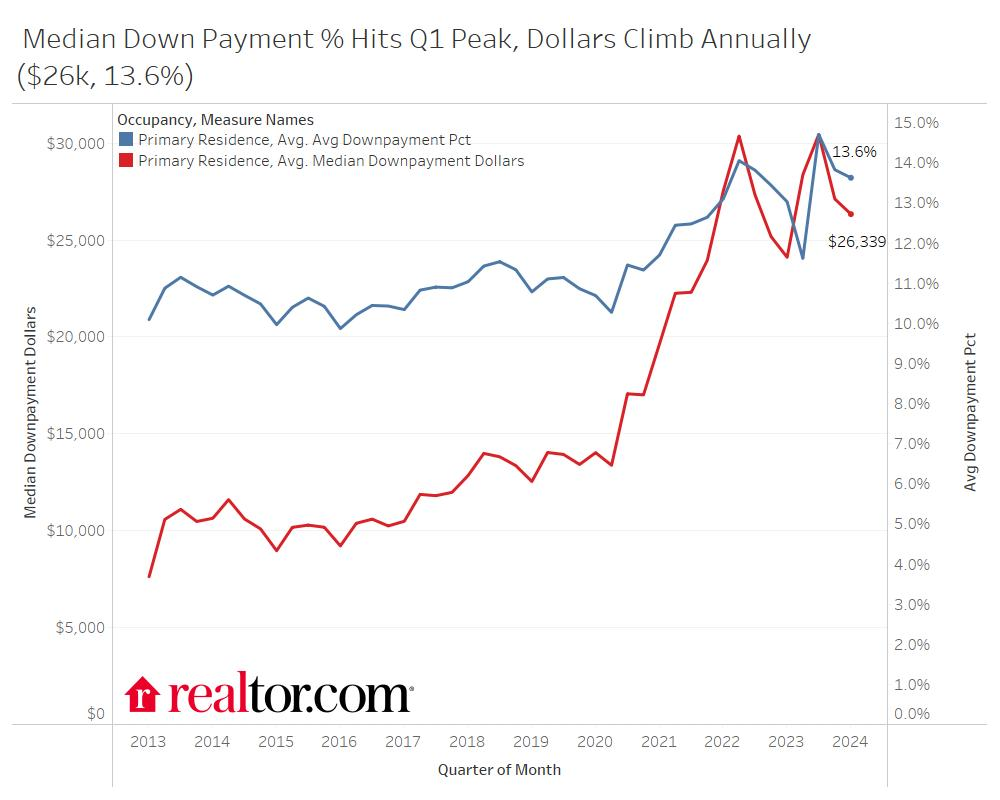

In general, homebuyers raised down payments in Q1 2024 compared to the previous year at the state, metro, and national levels. This is according to a new housing market update from Realtor.com. However, quarterly down payments have decreased starting Q3 2023. Down payments typically fall between the fourth and first quarters. In line with this seasonal tendency, the average down payment decreased from 14.7% in Q3 of 2023 to 13.6% in Q1 of this year. Down payments remain significantly higher than pre-pandemic levels, both as a percentage of the purchase price and as an absolute dollar amount.

Despite the red-hot pandemic market has cooling over the previous two years, buyers continue to spend more as a down payment than was customary before to the pandemic. This could be for a number of different causes. Limited property availability has increased buyer rivalry in many locations, prompting buyers to give more as a down payment, a frequent pandemic practice designed to assist a buyer win in a multiple-bid scenario. Furthermore, mortgage rates have risen dramatically since pre-pandemic levels, prompting purchasers to reduce their interest payments by putting more down and taking out a smaller loan.

Top Five States with Largest Down Payment Growth in 2024:

- New Hampshire (20.90%)

- Rhode Island (16.70%)

- Connecticut (15.70%)

- New Jersey (18%)

- Washington (17.20%)

Nationwide Down Payment Share Reaches Q1 High

In 2019 and 2020 (at the U.S.-level), homebuyers made an average down payment of 10.9% on main properties. Buyers made an average 13.6% down payment in 2022, up from 12.3% in 2021. By 2023, down payments had weakened slightly, falling to an average 13.3%, still significantly above pre-pandemic levels but lower than 2022. Despite the reduction in the average annual down payment amount, down payments reached a record high of 14.7% in Q3 of 2023. Similarly, while Q1 of 2024 witnessed fewer down payments than previous quarters, compared to Q1 of 2023—which is a fair correction for seasonality—there was a yearly rise in down payment as a percentage of purchase price as well as in cash amount.

In all states except eight, the average down payment grew annually as a percentage of the selling price in Q1 2024. In all but eight states, the average dollar amount for a down payment climbed. In Q1 2024, New Hampshire saw the greatest increase in payment as a proportion of price (3.4 percentage points), rising from 17.5% to 20.9%, followed by Rhode Island (+2.3 percentage points) and Connecticut (+1.8 percentage points). These states, the most of which are in the Northeast, have high prices and are more likely to attract purchasers with high incomes who can compete with a down payment.

Mortgage Rates Restrict Both Housing Supply and Housing Demand

Mortgage rates declined from multi-decade highs reached in Q3 of 2023, but remained in the 6.6% to 7% range through Q1 of the year. As interest rates fell, some buyers and sellers returned to the market, and listing activity increased year after year. Despite six months of yearly inventory expansion, the number of properties for sale in April remained roughly 40% lower than pre-pandemic levels.

Despite progress, many sellers remain hesitant to sell, which would require exchanging a low-rate mortgage for a new, higher-rate mortgage. In Q1 of the year, the average outstanding mortgage rate was 3.78%, or about three percentage points lower than the quarter’s going rate for mortgage originations. Similarly, in April, 26% of customers expected mortgage rates to fall this year, prompting some to wait for lower rates.

Even if buyer and seller activity remains restricted, many markets, particularly cheap markets, continue to experience buyer competition, which is spurred by limited for-sale home inventory. Climbing down payments indicate that purchasers in these locations may be making large down payments to compete, to cut the size of their mortgage in the face of rising interest rates, or to take advantage of high cash available following a home sale in a higher-priced area.

Down Payments Shrink in Pandemic Hotspots

In Q1 of 2024, down payments declined in eight states, including Montana, D.C., Wyoming, Oklahoma, and South Carolina. These states, along with Florida, had a yearly reduction in the size of down payments. Utah and Delaware had the percent down decrease annually but the dollar amount increase, as rising home prices pushed up dollar amounts, but Texas and North Dakota witnessed the opposite, with decreasing home prices dominating.

Additionally, during the pandemic, demand surged in Texas and Florida, resulting in low inventories and rising costs. However, since mortgage rates rose in mid-2022, demand for homes in these locations has decreased, resulting in an increase in inventory. Some locations, including Austin (+28.9%), San Antonio (+27.4%), and Denver (+15.2%), as well as four others, saw inventories return to or exceed pre-pandemic levels while national inventory remained low. The easing of the Texas and Florida property markets has resulted in halted home price increases, with purchasers presumably facing less competition and more options.

This impact can also be seen in down payment trends. Homebuyers seeking to navigate these trends may discover that relatively moderate markets provide the potential to achieve homeownership while limiting interest payments by utilizing their existing resources to place a greater down payment on a home.

To read the full report, including more data, charts, and methodology, click here.