According to the Mortgage Bankers Association’s (MBA) Builder Application Survey (BAS) data for April 2024, mortgage applications for new home purchases jumped 22.1% over the previous year. Compared to March 2024, applications increased by 2%.

“New home purchase activity increased at a healthy pace in April 2024 after a slight pause in March. Applications to purchase newly constructed homes increased 22% over the year and have now shown annual gains for 15 consecutive months,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “There continues to be healthy demand for new homes, given greater availability and other benefits over existing home purchases such as builder concessions and customization options. First-time homebuyers account for a growing share of purchase applications with the FHA share of applications at 26.3% in April, higher than the survey average of 18% dating back to 2013. Our estimate of new home sales increased more than 13% to 699,000 units, the strongest pace in three months.”

New Home Purchase Mortgage Applications Increase in April

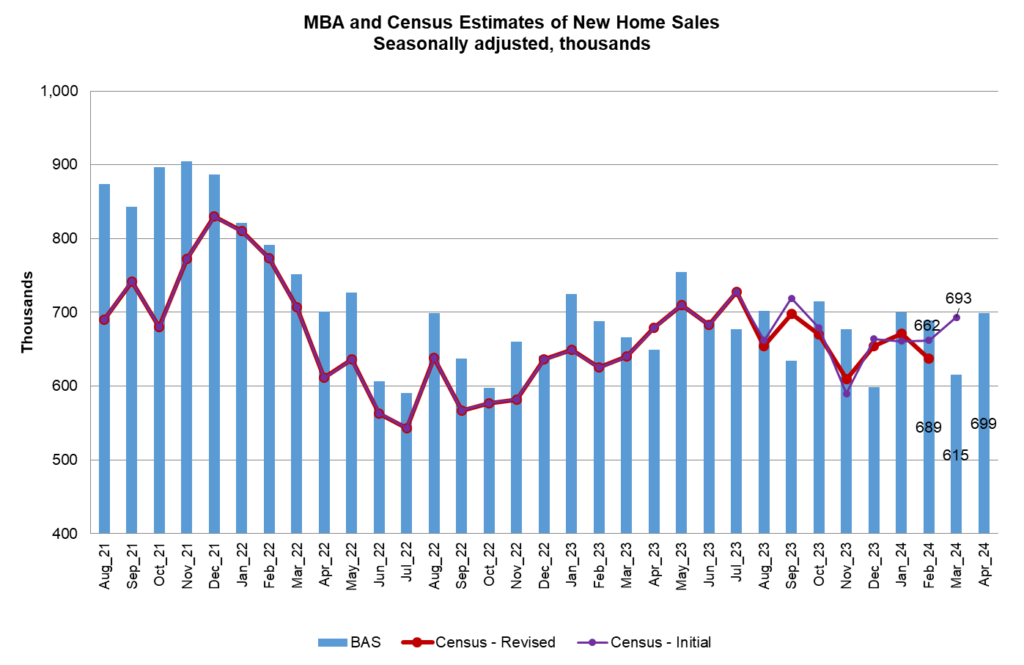

MBA believes that new single-family home sales, which have typically been a leading indication of the U.S. Census Bureau’s New Residential Sales report, will be at 699,000 units per year in April 2024 on a seasonally adjusted basis. The new home sales forecast is based on mortgage application data from the BAS, as well as assumptions about market coverage and other variables.

The seasonally adjusted estimate for April is a 13.7% rise over the March pace of 615,000 units. Unadjusted, MBA forecasts 62,000 new home sales in April 2024, up an estimated 3.3% from 60,000 in March. Conventional loans accounted for 62.8% of loan applications, followed by FHA loans (26.3%), RHS/USDA loans (0.3%), and VA loans (10.5%). The average loan size for new homes grew from $405,400 in March to $405,490 in April.

To read the full report, including more data, charts, and methodology, click here.