According to a new Bank of America Homebuyer Insights Report (HBIR) conducted in collaboration with the Bank of America Institute, many prospective homebuyers are concerned about the long-term consequences of renting. Approximately 70% believe they are not making a long-term investment in their future, while some 72% remain concerned that rent increases will affect their current and long-term finances.

However, when interest rates and property prices rise, confusion over whether to continue renting or buy a home in the current market grows. An estimated 57% of respondents remain unsure whether this is a good time to buy, up from 48% this time last year. This trend is most widespread among first-time homebuyers, with 62% saying they’re confused what to do.

“Given the highly competitive homebuying market, renters are unsure whether now is the right time to buy,” said Matt Vernon, Head of Consumer Lending at Bank of America. “That said, our research continues to show that the vast majority of prospective homebuyers overwhelmingly feel buying a home, now or in the future, is the best decision for them in the long run.”

The report found that these decisions are exacerbated further by the ongoing population migration across the U.S. According to the Bank of America Institute’s quarterly On the Move publication, cities in the South continued to experience large inflows of people as of Q1 of 2024, driven primarily by younger generations.

The Institute found that, while housing supply has expanded in response to population growth, the availability of rental homes in some areas may be insufficient to accommodate expanding populations. While 37% of HBIR respondents believe renting is the best option right now, many intend to make efforts toward buying a home in the future. Prospective homebuyers reported that some 81% believe renting is temporary and appropriate for their current stage of life, and 76% intend to buy a home within the next five years.

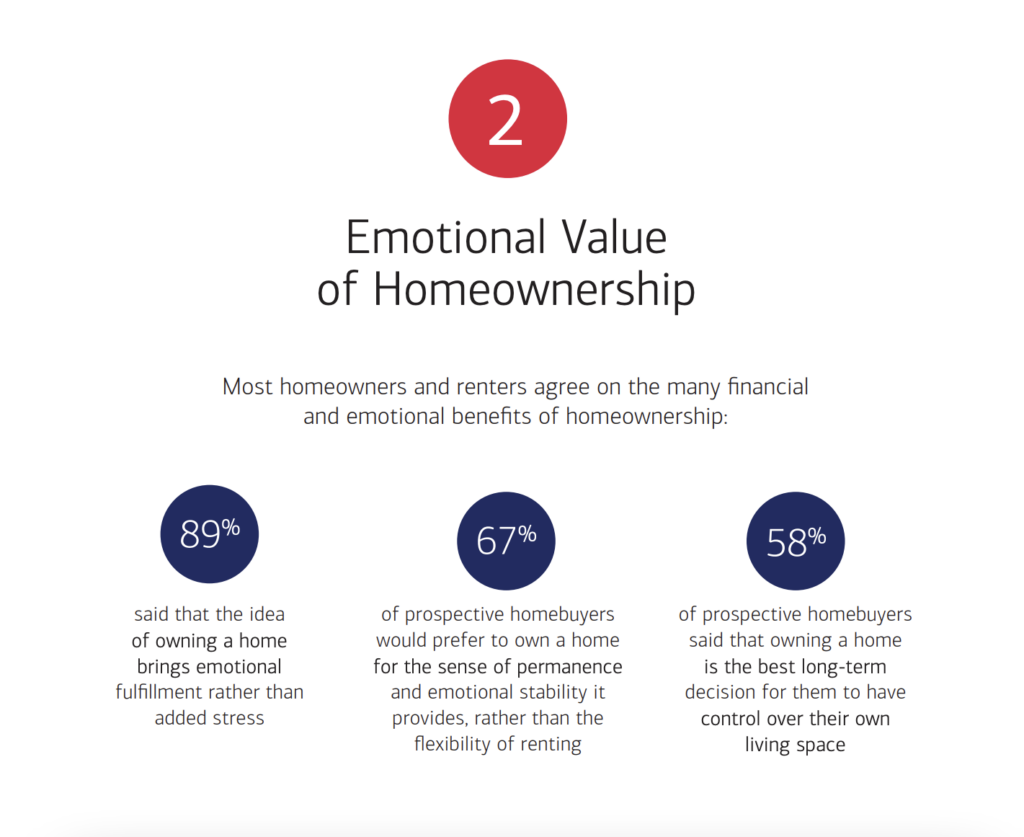

Buyers Weigh in On the Emotional Value of Owning vs. Renting

New findings from the study show that most homeowners and prospective homebuyers agree on the numerous financial and emotional benefits of homeownership—benefits that two-thirds (66%) of renters believe they are missing out on.

Key Findings:

- 89% of homeowners said that the idea of owning a home brings emotional fulfillment rather than added stress.

- 67% of prospective homebuyers would prefer to own a home for the sense of permanence and emotional stability it provides, rather than the flexibility of renting.

- 58% of prospective homebuyers said that owning a home is the best long-term decision for them to have control over their own living space.

However, the report also showed that baby boomers are an oddity. Today, some 80% of senior boomer renters say that renting is preferable to buying a property in the current market, up from 63% a year earlier. This can be ascribed in part to the fact that baby boomers believe:

- They appreciate the freedom from property maintenance and repair work that renting offers (90%).

- They prefer to avoid the financial responsibilities and stresses associated with homeownership (87%).

- And 83% value the sense of freedom to move when and where they want to that comes with renting instead of owning a home.

Worsening the challenges posed by increased mortgage rates and home prices, many prospective purchasers believe they lack the confidence required to begin their homebuying journey and do not want to make a mistake. Some 41% of homebuyers are not confident in their understanding of how to finance or secure a mortgage, while 41% are not confident in their understanding of interest rates. Nearly 40% are not confident they understand homebuying terminology and more than half (53%) are not confident in their understanding of homebuying grant programs.

“Grants are a valuable resource to help bridge the gap between your savings and a downpayment,” Vernon said. “Meeting with a lending specialist can be a great first step to see if you qualify for assistance programs, such as Bank of America’s down payment and closing cost grants.”

To read the full report, including more data, charts, and methodology, click here.