A breakdown of data from Redfin found that real estate investors purchased approximately 44,000 U.S. homes in Q1 of 2024, up 0.5% year-over-year—the first increase reported since Q2 of 2022.

Redfin reports that investor activity in the housing market is stabilizing following several years of dramatic ups and downs. Investor home purchases more than doubled during the pandemic homebuying boom in 2021, and then plunged nearly 50% at the start of last year, as declining rents and home values ate into potential profits. But now, with home prices and rents back on the rise and the initial shock of elevated mortgage rates in the rearview mirror, investors are easing their foot off the brake pedal.

Investors showing profits

Investors are reaping bigger profits than they were a year ago, as the typical home sold by an investor in March went for 55.2% more ($174,616) than the investor bought it for—up from 46.3% ($146,586) a year earlier. Just 5.3% of homes sold by investors sold for a loss, down from 13.7% in March 2023.

Investor purchases also hit a low point in Q1 of 2023—part of the reason they’re now rising on a year-over-year basis.

“Investor activity is steady,” said Dallas Redfin Premier Agent Connie Durnal. “When home prices got crazy high during the pandemic, investors sold out. But several months ago, they started to ramp back up. I’m not seeing a lot of home flippers in our market, but there are a lot of investors looking for single-family homes to rent out, which are in short supply.”

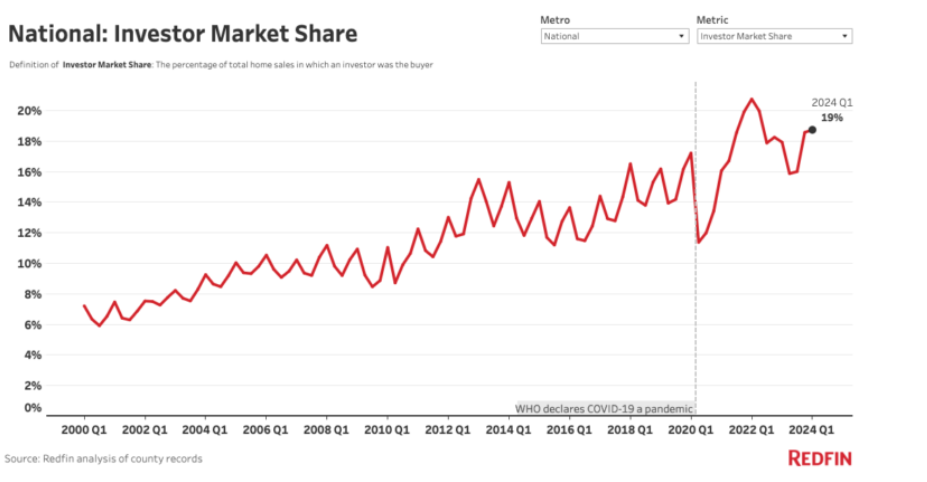

While investors are purchasing fewer homes than they were before and during the pandemic housing frenzy—a result of today’s relatively slow market—they’re still purchasing a fairly high share of the homes. They bought 18.7% of U.S. homes that sold in Q1, up from 17.9% a year earlier, marking the highest percentage in almost two years.

Investors have seen their market share tick up because they’ve come off the sidelines faster than individual buyers; overall U.S. home purchases fell 3.9% from a year earlier in Q1 as elevated mortgage rates deterred buyers (though it’s worth noting that’s the smallest growth in two years). Investors are less sensitive to mortgage rate fluctuations than regular buyers because most of them (69%) pay in cash, though they’re still somewhat sensitive because they often take out different loans to cover home flipping and other expenses.

What are investors targeting?

In terms of the types of real estate investments being targeted, investor purchases of single-family homes rose 3.9% year-over-year in Q1, the first increase in nearly two years. Meanwhile, investor purchases of townhouses, condos/co-ops and multifamily properties fell 8.6%, 6.4% and 2.5%, respectively. Investors are likely keen on single-family properties because that segment has posted relatively strong rent growth, return-on-investment (ROI) potential, and has lower tenant turnover.

“The balance of power between investors and regular buyers is changing,” said Amira Elgoneimy, a Redfin Premier Real Estate Agent in New Jersey. “When there’s a bidding war for a home, it has become more common for the winner to be the person who actually plans to live in the home. Individual buyers are sitting on a lot of cash from the sale of their previous house and pandemic savings, so they’re willing to pay a little more upfront than investors, who have to be mindful of margins.”

Single-family homes represented 68.9% of investor purchases Q1—the highest percentage since mid-2022. Meanwhile, condos/co-ops represented 18.7%, townhouses made up 7.2%, and multifamily properties made up 5.3%—all down from a year earlier.

Investors have also gained market share in the single-family segment, with 18.4% of single-family homes that sold in Q1 purchased by investors—the highest share reported since mid-2022. Meanwhile, the share of other property types bought by investors fell from a year earlier, to 31.9% for multifamily properties and 18.1% for both condos/co-ops and townhouses. Investors have a relatively large market share in the multifamily segment because those buildings are typically too expensive and not feasible for regular homebuyers, and apartments offer the potential for large returns from rental income.

Investors are snatching up luxury homes

Investor purchases of high-priced homes jumped 10.5% year-over-year in Q1—the first increase in nearly two years. Meanwhile, investor purchases of mid-priced homes rose 4.7% (also the first increase in nearly two years), and investor purchases of low-priced homes fell 6.5%.

An analysis of Q1 2024 luxury home sales by Redfin found that the median-priced U.S. luxury home sold for a record $1,225,000 in Q1, up 8.7% from a year earlier. Prices of non-luxury homes rose at roughly half the pace—up 4.6% to a median of $345,000, also a record high. Redfin classifies luxury homes as those estimated to be in the top 5% of their respective metro area based on market value, and non-luxury homes as those estimated to be in the 35th-65th percentile based on market value.

The typical home bought by investors in Q1 cost $464,560, up 9.2% from a year earlier. Investors purchased $31.3 billion worth of homes in Q1, up 6.6% year-over-year.

And while high-priced homes made up the biggest increase in investor purchases in Q1, low-priced homes were still the preferred property type. Low-priced homes represented 47.5% of investor purchases in Q1, while high-priced homes represented 28.5% and mid-priced homes represented 24%. Investors also have a relatively high market share in the affordable market. They bought a record 26.1% of low-priced U.S. homes that sold in Q1, compared to 16.4% of high-priced homes, and 13.4% of mid-priced homes.

“Any home that is entry-level is immediately pounced on,” said Brian Connelly, a Redfin Premier Agent in Boston. “There’s a mix of first-time homebuyers, investors and second-home buyers all fighting for homes.”

Where are investors targeting?

In the San Jose, California metro, investor home purchases jumped 27.8% year-over-year in Q1—the biggest increase among the metros Redfin analyzed, followed by Oakland, California at 22%; Minneapolis at 21.6%; Sacramento, California at 20.1%; and San Francisco at 18.5%. The Bay Area’s housing market has been bouncing back after slowing substantially during the pandemic. People aren’t moving out at the pace they were before, and California is now seeing some of the steepest increases in home prices and sales in the country, which investors may see as an opportunity.

Investor home purchases fell fastest in relatively affordable markets in the Midwest and on the East Coast. In Cincinnati, they declined 22.1% from a year earlier—the biggest drop among the metros Redfin analyzed. Next came Baltimore, down 22%; Providence, Rhode Island, down 20.2%; Virginia Beach, Virginia, down 15.1%; and Chicago, down 14.6%.

Additional Q1 metro-highlights

The highest share where investors purchased the largest share of investment home was reported in Miami, where investors bought 30.6% of homes that sold, followed by Cleveland (24.6%); Jacksonville, Florida (24.5%); San Diego (23.6%); and San Francisco (23.4%).

Investor sales were reported the lowest in Q1 in Providence, Rhode Island (10.5%); followed by Montgomery County, Pennsylvania (10.8%); Warren, Michigan (11.3%); Washington, D.C. (11.7%); and Seattle (11.7%).

Redfin reported the share of homes bought by investors in Q1 increased the most in Oakland, where investors bought 16.9% of homes that sold, up 2.9 percentage points from a year earlier. Next came Las Vegas (up 2.7 percentage points); Tampa, Florida (up 2.6 percentage points); Phoenix (up 2.5 percentage points); and Riverside, California (up 2.4 percentage points).

The biggest Q1 decreases were found in Cincinnati, down 3.1 percentage points; Baltimore, down 2.6 percentage points; Chicago, down 1.6 percentage points; Providence, down 1.1 percentage points; and Seattle, down 1.1 percentage points.

Where did investors yield the most profit?

According to Redfin, in Philadelphia, the typical home sold by an investor sold for 136.2% more than the investor bought it for in March 2024, followed by Cincinnati (120%); Virginia Beach, Virginia (97%); Newark, New Jersey (96.6%); and Columbus, Ohio (94.3%).

In San Francisco, the typical home sold by an investor sold for 28.7% more than the investor bought it for, followed by Phoenix (34.4%); Las Vegas (37%); Sacramento, California (39.5%); and Denver (42.5%).