According to a new research from Redfin, the median home sale price in the U.S. increased 6.2% year-over-year in April to $433,558, representing the highest level on record. Today’s housing market is much slower than it was during the previous homebuying boom, but prices continue to rise because there simply aren’t enough homes available.

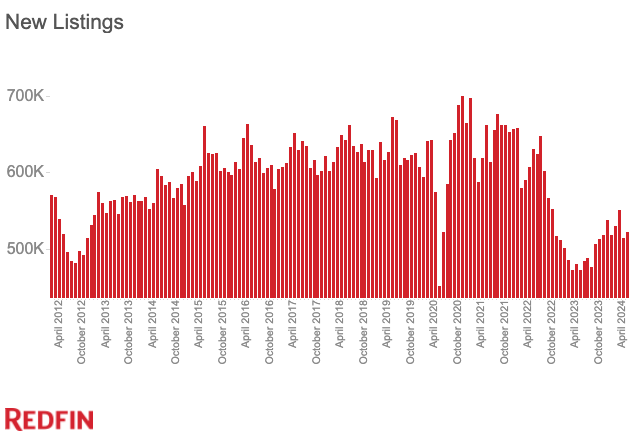

New listings rose 1.7% month-over-month in April on a seasonally adjusted basis, and 10.8% year over year. Nonetheless, they were around 20% lower than pre-epidemic levels, owing in large part to many homeowners’ reluctance to sell since they feel “locked in” by the low mortgage rate they received during the pandemic. New listings were at their lowest level on record in April, aside from the onset of the epidemic, which explains why they’re currently up so much year-over-year.

On a seasonally adjusted basis, home sales in April were unchanged from the previous month (0.2%) but down 1.4% from the previous year. Homebuyers are being smacked with a one-two punch of high prices and rising mortgage rates. The average 30-year fixed mortgage rate in April was 6.99%. This is up from 6.82% in March and 6.34% in April 2023, and more than doubles the all-time low of 2.65% during the pandemic.

“It’s not all bad news for homebuyers. Mortgage rates are already inching lower in response to this week’s inflation report, which signaled that the Fed may cut interest rates this summer—a possibility that just weeks ago many thought was off the table,” said Redfin Economics Research Lead Chen Zhao. “In certain parts of the country, buyers also have room to negotiate as homes linger on the market, prompting sellers to slash their asking prices and provide concessions.”

Metro-Level Highlights: April 2024

- Prices: Median sale prices rose most from a year earlier in Buffalo, NY (24.3%), Anaheim, CA (22.8%) and Rochester (15%). They fell in just five metros: San Antonio (-1.6%), Memphis, TN (-0.7%), Birmingham, AL (-0.7%), North Port, FL (-0.2%) and Austin, TX (-0.1%).

- New listings: New listings rose most in San Jose (46.9%), Tacoma, WA (38.3%) and Oakland (38%). They fell in one metro Redfin analyzed: Greensboro, NC (-1.6%).

- Active listings: Active listings rose most in Cape Coral, FL (50.6%), North Port (49.1%) and Fort Lauderdale, FL (42.2%). They fell most in Raleigh, NC (-12.3%), New Brunswick, NJ (-8.7%) and Lake County, IL (-7.4%).

- Closed home sales: Home sales rose most in San Jose (38.2%), San Francisco (30.4%) and Stockton, CA (23.2%). They fell most in Fresno, CA (-3.5%), Jacksonville, FL (-3%) and Albany, NY (-2.6%).

- Sold above list price: In San Jose, 75.8% of homes sold above their final list price, the highest share among the metros Redfin analyzed. Next came Rochester (72.8%) and Oakland (69.7%). The shares were lowest in North Port (6.8%) West Palm Beach, FL (7.1%) and Cape Coral (9.3%).

- Off market in two weeks: In Rochester, 84.6% of homes that went under contract did so within two weeks—the highest share among the metros Redfin analyzed. Next came Seattle (75.9%) and Buffalo (74.5%). The lowest shares were in Honolulu (7.4%), Tucson, AZ (16.6%) and Chicago (16.9%).

Housing Supply Hits Four-Year High in April

Active listings reached their highest level since December 2020 in April. On a seasonally adjusted basis, they were up 0.3% from a month earlier and 7.5% from a year earlier, although they remained far lower than pre-pandemic levels.

New listings indicate the number of properties listed for sale in a given month, whereas active listings represent the total number of homes for sale in that month. This means that the latter metric includes residences that have been on the market for a long.In April, 43.9% of homes sold within two weeks of being listed, a decrease from 46.9% the previous year.

Some 18% of Home Sellers Are Cutting Their Asking Prices

Almost one in every five (17.6%) homes for sale in April had a price reduction, which means the seller reduced the asking price after putting their home on the market. That’s up 5.6 percentage points from 12.1% a year ago, the largest increase in almost a year.

“Most sellers in Las Vegas are willing to negotiate—anywhere from 5% to 10% off their list price,” said local Redfin Premier real estate agent Fernanda Kriese. “Sellers are offering buyers money for mortgage-rate buydowns, along with other concessions. Homes that are listed below market value get multiple offers and are snatched up in two to four days, but homes that are priced $5,000 to $10,000 over market value are sitting for 30 to 60 days longer.”

Las Vegas, like many epidemic boomtowns, has seen its housing market calm after the homebuying frenzy of 2021 and 2022. However, other markets have not cooled as quickly, and some are experiencing significant competition among homebuyers. In San Jose, CA, for example, 75.8% of properties that sold in April received more than their asking price. That’s up from 61.6% a year ago and the greatest share among the metros Redfin examined. Rochester, NY was next at 72.8%, followed by Oakland, CA at 69.7%. In April, one-third (33.5%) of properties sold for more than their asking price.

Redfin recently surveyed its agents, and the majority (74.4%) believe the 2024 housing market will be more advantageous for sellers than buyers. This is most likely due in part to sellers receiving record-high prices for their properties. Qualtrics performed the study from April to May 2024, with approximately 300 Redfin Premier agents participating.

To read the full report, including more data, charts, and methodology, click here.