Kiavi, along with John Burns Research & Consulting and Sundae, have jointly released the findings of its Q1 Fix-and-Flip Survey for 2024, which found that the overall Fix-and-Flip Market Index rose to 66 in the first quarter of 2024, up from 64 in in the fourth quarter of 2023, and 62 in first quarter of 2023.

The company notes that an Index value greater than 50 represents market expansion, while a value lower than 50 indicates a market contraction.

With more than $16B in funded loans, Kiavi, formerly known as LendingHome, is one of the nation’s largest private lenders to residential real state investors (REIs).

“Looking back at the Q1 fix-and-flip market, we saw strong resilience from investors despite the high interest rate environment. As we’ve observed by our growth in loan volume, real estate investors are finding a way to navigate this ‘higher for longer’ rate environment. Move-in ready homes sold very quickly in most markets. It speaks partially to how millennials, a huge demographic, strongly desire move-in ready homes over ones that need work,” said Charles Goodwin, Senior Director of Sales at Kiavi. “In H2, we can likely expect continued strength in this market. Of course, this is subject to what happens with the Fed’s decisions on interest rates, and whether or not the strength of the economy continues. If inflation reports slowly come down, and economic indicators like unemployment, GDP, and wage growth remain similar to where they are, I expect to see continued strong investor activity.”

Areas of fix-and-flip interest

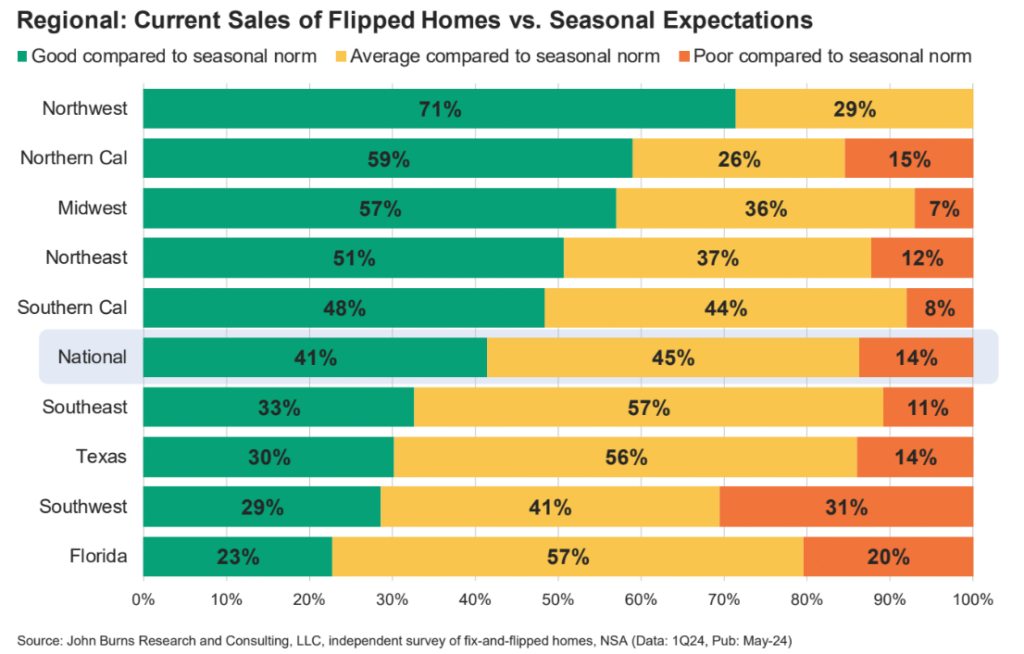

The strongest markets Kiavi reported for flips in the first quarter of 2024 included regions where homes are generally older and more in need of repair, where competition from new homebuilders is minimal, and where overall inventory remains low. Leaders were found in the Northeast, Midwest, California, and Northwest.

The weakest markets for flips in 1Q24 included regions where resale inventory is rising, and where homebuilders are more active and outcompete the resale market via incentives, and where holding costs (especially taxes and insurance) have accelerated recently. Markets that were the weakest were found in Florida, Texas, the Southwest, and Southeast.

The state of rates

As of April 2024, Fannie Mae predicted that the average 30-year fixed rate mortgage (FRM) in the U.S. would be 6.7% during the first quarter of 2024, and 6.4% by the end of the year.

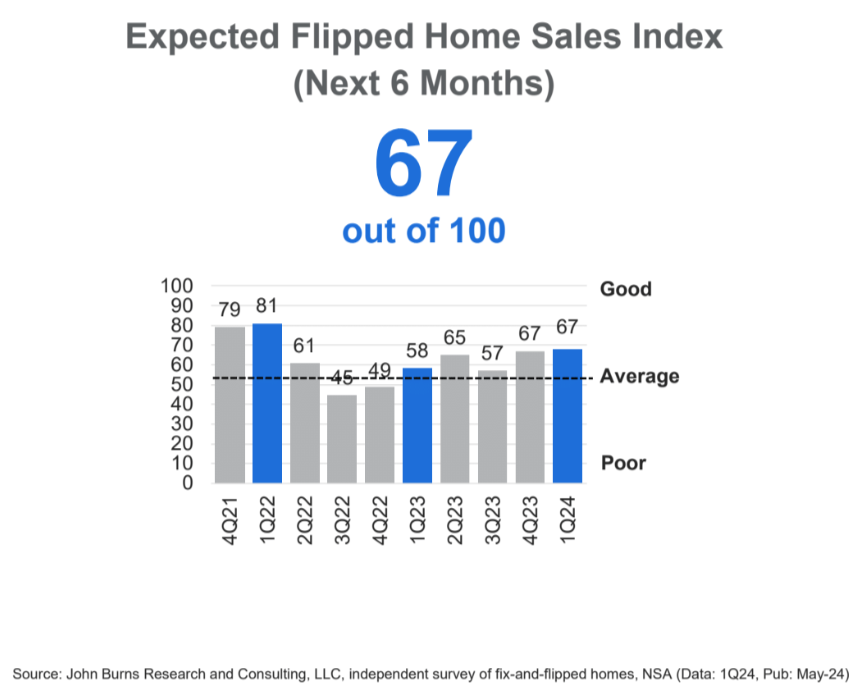

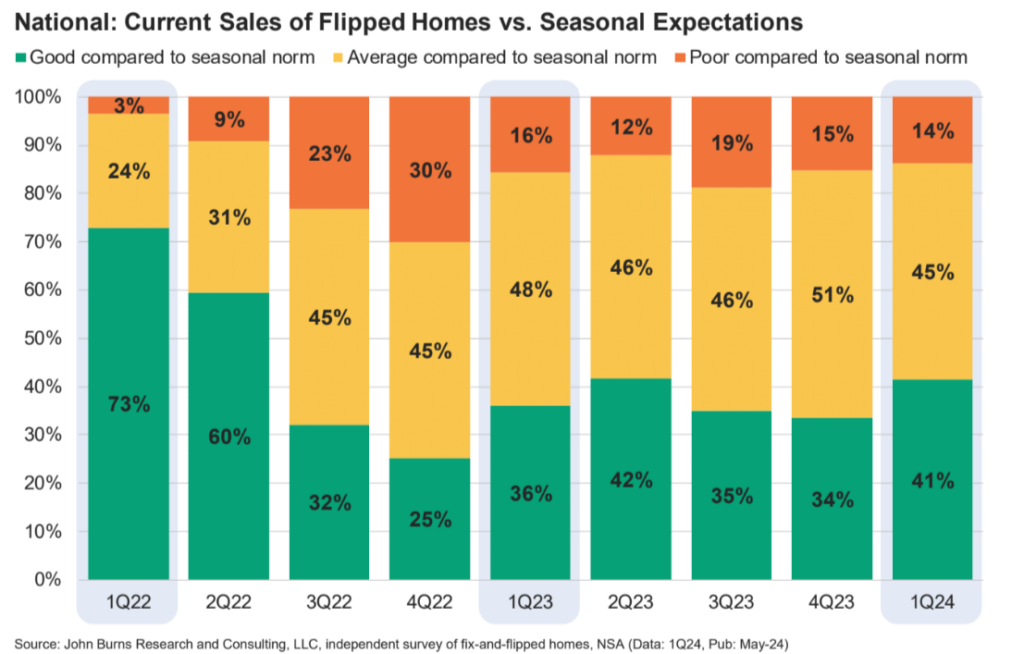

Those flippers polled by Kiavi remain optimistic about sales over the next six months, though feel their expectations are very market-dependent. Overall, respondents felt that recent “higher for longer” interest rate messaging from the Fed has not dampened flipper optimism, with 47% of flippers nationally expecting “Good Sales” relative to seasonal norms over the next six months, the highest share since the first quarter of 2022 when mortgage rates were a low of 3%-4%.

Flippers also expect a 3% price appreciation for flipped homes over the next six months, as low inventory (particularly for move-in ready homes) supports pricing. As of the end of May, Zillow reports the average U.S. home value at $358,734, up 4.3% year-over-year.

However, flipper price expectations are more muted in Florida, the Southwest, and Texas, given the aforementioned inventory, competition, and cost challenges in these regions.

Flippers also expect that eventual rate cuts by the Fed will induce significant demand for flipped homes. The New Home Trend Institute’s latest consumer research finds that “waiting for mortgage rates to decline” was the top obstacle holding consumers back from purchasing, the first time in the history of the study that anything has beaten out “Waiting for a Life Stage Change” for the top spot.

Property usage

Of those flippers polled, 43% expected to keep more of their homes as rentals this year. In supply-constrained regions like the Northeast and Southern California, single-family rent growth and home price appreciation are both strong, which incentivizes long-term investing and buy-and-hold strategies over quick flips.

Of those flippers polled, 62% in the Northeast and 53% of flippers in Southern California expect to keep more of their homes as rentals this year, marking the highest share of all U.S. regions.

However, fewer flippers are turning to rentals in markets across Texas and Florida, where single-family rents are weakest and holding costs have risen recently, as 86% of Texas flippers and 66% of Florida flippers intend to keep the same or fewer homes as rentals in 2024 relative to 2023.

“In the report, many flippers indicated that they would be keeping more of their homes as rentals in the coming year,” added Goodwin. “We’re seeing this in markets where rental properties still ‘pencil’ despite higher rates. Markets, primarily in the South, can often enable an investor to find positive cash flow, especially an investor that added value by renovating. Certain markets like Texas and Southern Florida have rising resale supply, so if a flipper is having trouble reselling a property, then holding as a rental might be a viable option. Rent growth is still strong or normal in many areas in the South.”

Flipping as a solution to affordability?

According to a recent analysis of homebuyers from Redfin, nearly two of every five (38%) homeowners don’t believe they could afford to buy their own home if they were purchasing it today. Nearly three in five (59%) homeowners who answered this question have lived in their home for at least 10 years, and another 21% have lived in their home for at least five years. That means the majority of respondents have seen housing prices in their neighborhood skyrocket since they purchased their home, as the median U.S. home-sale price has doubled in the last 10 years, and has shot up nearly 50% in the last five years alone.

“Ultimately, the fix and flip market can help with housing affordability,” said Goodwin. “Flippers tend to focus on starter homes and are one of the main sources of supply in supply constrained markets like California, Pacific Northwest, and the Northeast. Though affordability is still stretched, if flippers weren’t doing their part to take a distressed situation and turn it into a move-in ready home, you would likely see affordability worsen.”

Click here to access the full Q1 Fix-and-Flip Survey.