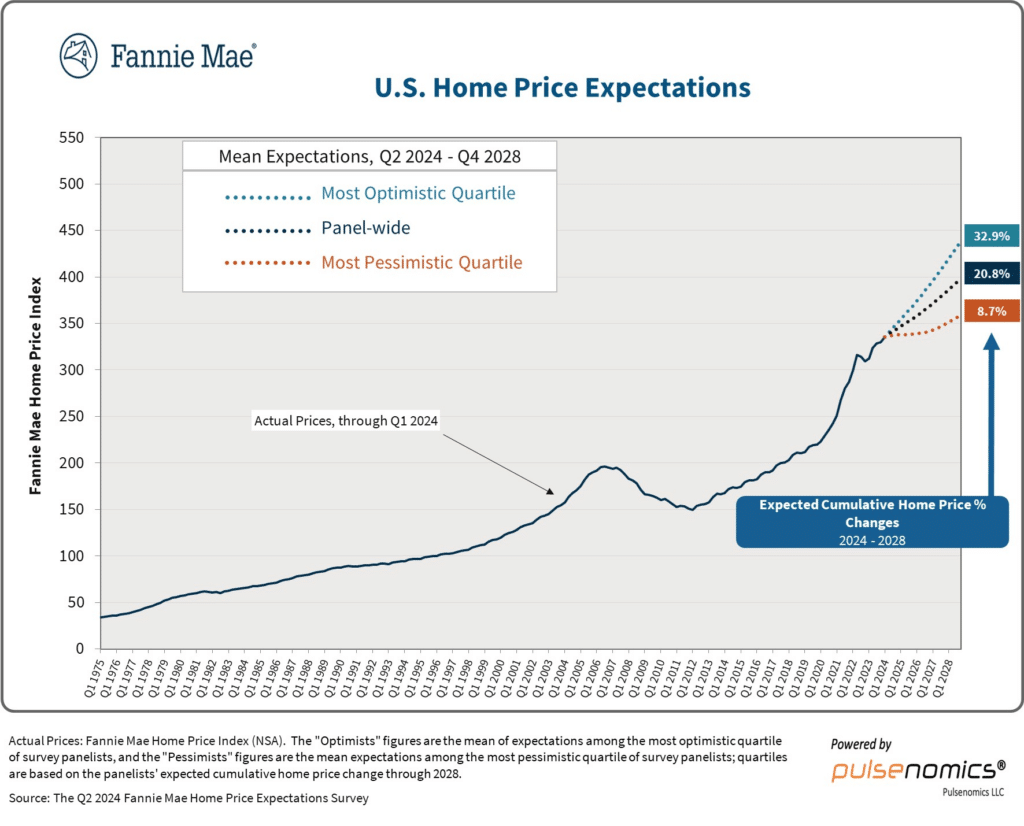

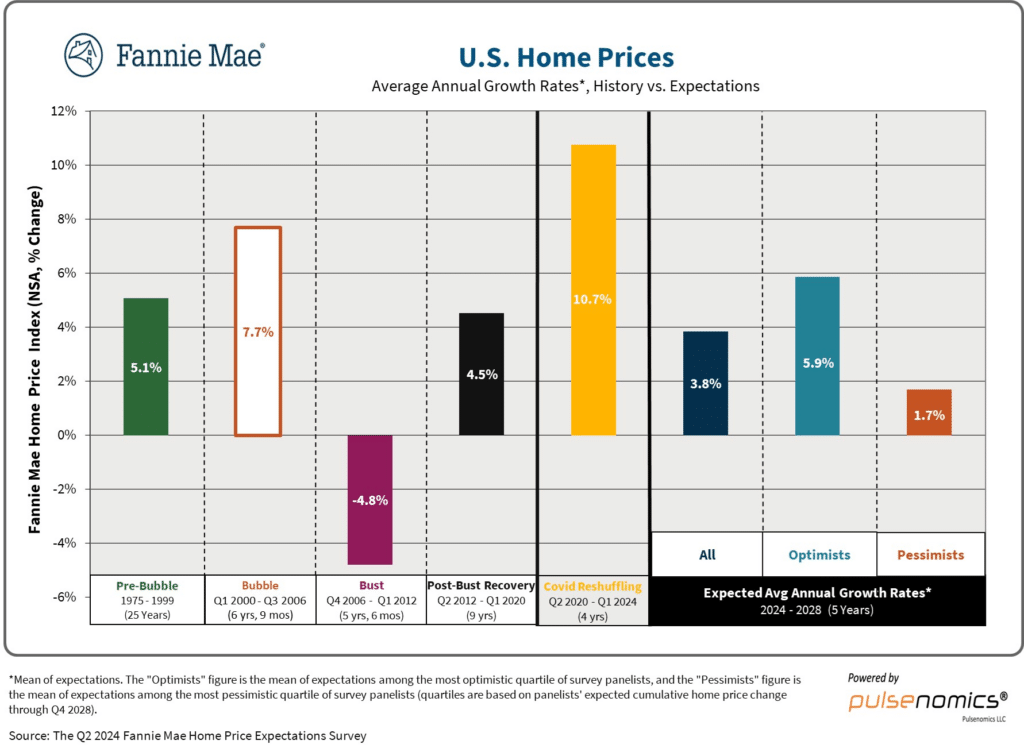

Following a 6.6% rise in 2023, a panel of housing experts predicts annual national home price growth of 4.3% in 2024 and 3.2% in 2025, according to the Q2 2024 Fannie Mae Home Price Expectations Survey (HPES)—conducted in collaboration with Pulsenomics, LLC.

The HPES polls more than 100 experts from the housing and mortgage industries, as well as academia, to estimate national home price percentage increases over the next five calendar years, as measured by the Fannie Mae Home Price Index (FNM-HPI).

“The rise in mortgage rates in 2024 and continued above-trend home price growth continue to strain home purchase affordability,” said Doug Duncan, Fannie Mae Senior VP and Chief Economist. “Listings have trended generally upward of late, suggesting to us that a rising number of current homeowners can no longer put off moving. However, we believe the ongoing affordability challenges are likely to weigh on how quickly these new listings convert to actual sales. On average, the expert panelists expect only a modest decline in mortgage rates through the rest of the year, and a majority also see the ‘lock-in effect’ weakening, which would likely lead to a gradual uptick in for-sale listings and continued moderation of home price growth over the forecast horizon.”

Home Price Forecast

The panel’s most recent forecasts of national home price rise are higher than last quarter’s 3.8% for 2024 but lower than the previous quarter’s 3.4% for 2025. On average, the panel expects the 30-year fixed mortgage rate to conclude 2024 at 6.6%, up considerably from the previous quarter’s 5.9% projection.

Despite rising mortgage rates, 84% of respondents say both consumer and home-seller sensitivity to the “lock-in effect” is decreasing, adding to the increase in listings. Furthermore, a majority expects any weakening of that impact to result in a “somewhat” or “significant” slowdown in home price increase.

“A slowdown in home price growth and easing mortgage rates offer a glimmer of hope that the peak of the housing affordability crisis may be behind us,” said Terry Loebs, Founder of Pulsenomics. “However, the price surge of over 50% nationwide since early 2020 has created a high hurdle that will, unfortunately, keep many aspiring homeowners on a slower path to achieving their dream.”

To read the full report, including more data, charts, and methodology, click here.