Mortgage credit availability increased in May, according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) based on data from ICE Mortgage Technology.

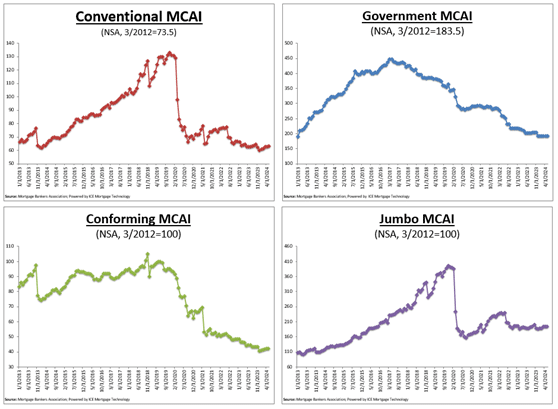

The MCAI increased by 0.1% to 94.1 in May. A decrease in the MCAI suggests tighter lending rules, whilst an increase in the index indicates looser credit. The index was benchmarked at 100 in March 2012. The Conventional MCAI climbed by 0.3%, while the Government MCAI fell by 0.1%. The Jumbo MCAI climbed by 0.1%, while the Conforming MCAI jumped by 0.5%.

“Mortgage credit availability rose gradually in May and has increased for five consecutive months. The overall supply of mortgage credit is still close to 2012 lows, but is slowly increasing,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The industry has reduced capacity over the past two years in response to extremely low unit volumes. Conventional, conforming, and jumbo credit availability have expanded slightly in recent months as lenders broaden loan offerings to reach more potential homebuyers in a tight purchase market.”

Conventional, Government, Conforming, And Jumbo Mcai Component Indices

The MCAI rose by 0.1% to 94.1 in May. The Conventional MCAI increased 0.3%, while the Government MCAI decreased by 0.1%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 0.1%, and the Conforming MCAI rose by 0.5%.

The Total MCAI contains an enhanced historical series that provides insight on credit availability for the past ten years (excluding Conventional, Government, Conforming, and Jumbo MCAI). The enlarged historical series, which covers 2004 to 2010, was designed to provide historical context to the current series by demonstrating how credit availability has changed over the last ten years, including the housing crisis and subsequent recession. Prior to March 31, 2011, data was prepared using less frequent and less complete data collected at 6-month intervals and interpolated in the intervening months for charting purposes.

To read the full report, including more data, charts, and methodology, click here.