Home sales dipped 1.7% month-over-month in May on a seasonally adjusted basis, and 2.9% year-over-year, according to a recent Redfin study. There have only been two months in the last decade with fewer home sales: October 2023, when mortgage rates reached a 23-year high, and May 2020, when the pandemic brought the housing market to a halt and home sales to an all-time low.

“Buyers today are facing many of the realities of a hot market even though few homes are changing hands,” said Elijah de la Campa, Senior Economist at Redfin. “Sales are sluggish because high homebuying costs are making both house hunters and prospective sellers skittish. And with so few homes for sale, buyers in some markets are getting into bidding wars, which is helping push home prices to record highs.”

Experts predict sales may increase later this year if mortgage rates gradually fall as projected.

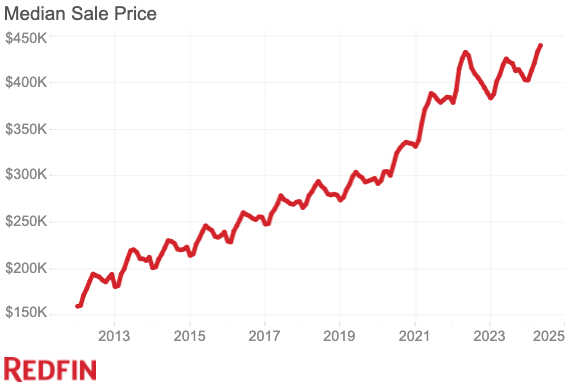

Home Prices Hit Another Record High in May as Mortgage Rates Continued Rising

In May, the median home sale price increased by 5.1% year-over-year to a record $439,716. The average 30-year fixed mortgage rate reached 7.06%. That’s up from 6.99% one month earlier and 6.43% a year ago, and it’s more than double the all-time low of 2.68% during the pandemic. Daily average mortgage rates fell to their lowest level in roughly three months this week after the latest CPI report revealed that inflation is still slowing.

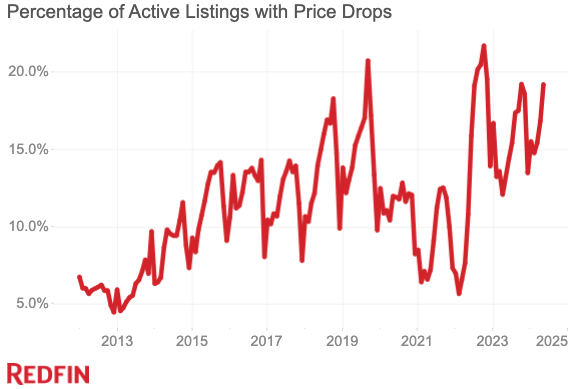

Even though homes are selling for higher prices than ever before, many sellers are still having to drop their list prices after putting their properties on the market—one positive sign for potential homebuyers.

Metro-Level Highlights: May 2024

- Prices: Median sale prices rose most from a year earlier in Anaheim, CA (17.6%) Cleveland (15.1%) and Nassau County, NY (14.2%). They fell most in Cape Coral, FL (-2.7%), Honolulu (-2.1%) and Austin, Texas (-1.1%).

- Price cuts: In Indianapolis, 48.1% of listings had a price drop—a higher share than any other metro Redfin analyzed. Next came Tampa, FL (45.2%) and Denver (44.8%). The lowest shares were in Newark, NJ (13.4%), Lake County, IL (15%) and Milwaukee (15.2%). Three of the 10 metros with the highest shares of price drops are in Florida and three are in Texas.

- New listings: New listings rose most in San Jose, CA (32.7%), Seattle (31.2%) and Denver (31.1%). They fell most in Atlanta (-7.7%), New Orleans (-4.4%) and Greensboro, NC (-4.3%).

- Active listings: Active listings rose most in North Port, FL (51.1%), Tampa (46%) and Cape Coral (45.1%). They fell most in New Brunswick, NJ (-8.1%), Chicago (-7.3%) and Raleigh, NC (-5.5%).

- Closed home sales: Home sales rose most in San Jose (16.6%), Minneapolis (11.7%) and San Francisco (10.5%). They fell most in Stockton, CA (-15.4%), Buffalo, NY (-15.3%) and San Antonio (-14.3%).

- Sold above list price: In Rochester, NY, 77.1% of homes sold above their final list price, the highest share among the metros Redfin analyzed. Next came San Jose (76.1%) and Oakland, CA (68.4%). The shares were lowest in North Port (5.9%), West Palm Beach, FL (8.1%) and Cape Coral (8.6%).

Nearly One of Every Five Homes for Sale Faced Price Cuts

In May, over one-fifth (19.2%) of properties for sale had their prices reduced, up from 13.2% the previous year and just short of the 21.7% record established in October 2022.

Some sellers are lowering their prices because they overpriced their home and it ended up sitting on the market. The average home for sale in May lasted 32 days on the market. While this is comparable to a year ago, it is the highest level seen in any May since the pandemic began.

Price drops are especially typical in locations where housing supply has increased rapidly, such as Florida and Texas. In some places, individual home sellers have faced stiff competition from homebuilders.

Ongoing U.S. Housing Shortage is Improving, But Remains Severe

On a seasonally adjusted basis, new listings increased 0.3% month over month in May, and by 8.8% year-over-year. Nonetheless, they were about 20% below pre-pandemic levels (May 2019). Many homeowners are hesitant to sell because they believe they are “locked in” by the cheap mortgage rate they obtained during the pandemic.

Active listings, or the total number of properties for sale, increased 0.4% month-over-month on a seasonally adjusted basis and 11.1% from the previous year, the highest yearly gain since the beginning of 2023. Still, active listings were around 25% lower than before the outbreak.

New listings indicate the number of homes listed for sale in a given month, whereas active listings represent the total number of homes for sale in that month. That means the latter metric includes unsold properties. One reason for the significant increase in active listings is that homes in some locations are sitting on the market and becoming stale.

Active listings have also increased in Florida’s southwest Gulf Coast. On an unadjusted basis, they increased by 51.1% in North Port, the most in the country. Tampa (46%), followed by Cape Coral (45.1%). A separate Redfin analysis revealed that these property markets are cooling quicker than any other in the country, owing to a new-construction boom, worsening natural disasters, and rising insurance rates.

Meanwhile, many of the markets that are performing well and witnessing price increases, such as Rochester, NY, are very inexpensive and have near-record low supply.

In the last decade, only two months have seen fewer home sales. High home prices, rising mortgage rates, and a continuous housing shortage are discouraging buyers.

To read the full report, including more data, charts, and methodology, click here.