In a new study by BadCredit.org, researchers put a price tag on the formidable obstacles that minimum wage workers faced in order to afford a home across the U.S.

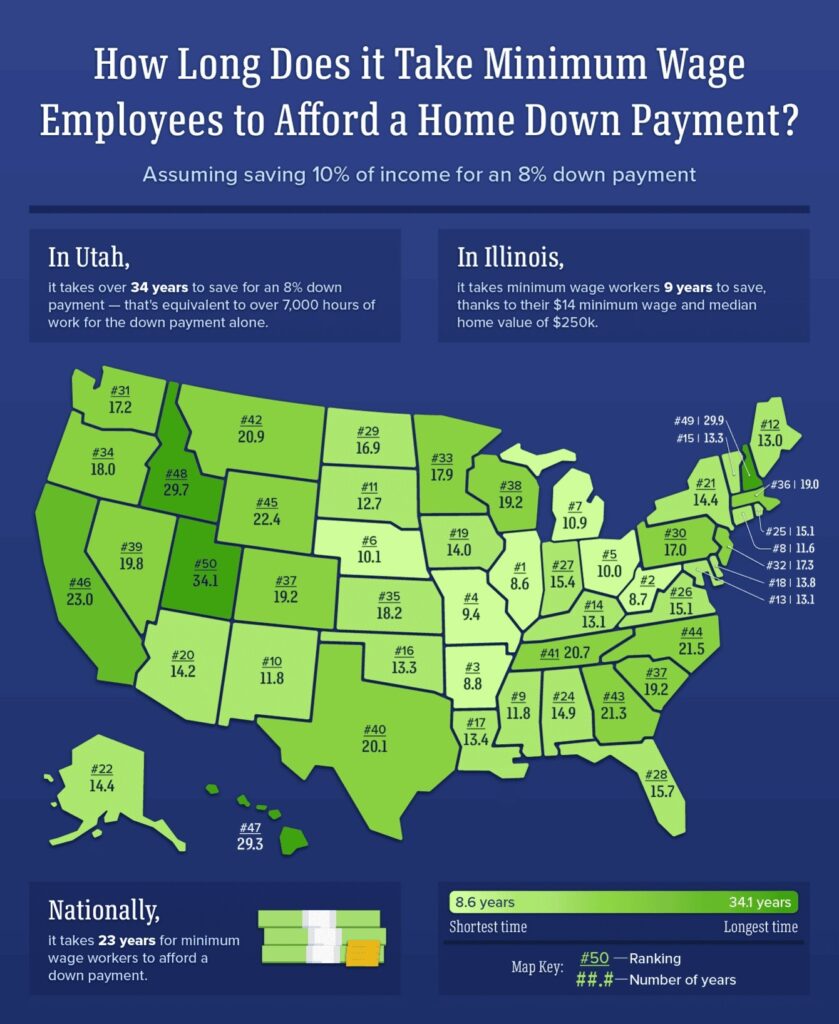

The study found that if they started saving 10% of their paycheck at the age of 18, minimum wage workers could afford an 8% down payment in roughly 23.1 years at the age of 41 (equating to 4,809 hours of work). Salaried workers making the U.S. median income can achieve the same milestone in just 5.1 years.

The analysis, conducted by BadCredit.org Senior Editor Jon McDonald, compared Zillow home prices over the past year to minimum wages in every state. To identify how long it took minimum-wage workers to afford a down payment on a single-family residence (SFR) and condo home values according to Zillow over the last 12 months (May 2023 to April 2024)—correlated that to the minimum wage in every U.S. state, according to the Department of Labor (DOL). For the study, an 8% down payment was used, and the number of years it took to save was determined by the amount someone needed to save, assumed saving 10% of total income while working 40 hours per week, 52 weeks per year.

“The findings are a sobering reminder of the financial hurdles that low-income earners face in achieving the American Dream of homeownership,” said McDonald. “While we’re seeing increases in minimum wage, such as the recent rise for California’s fast-food workers, these steps are often insufficient to bridge the gap in high-cost housing markets.”

States where affordability looms high

In the state of Utah, the study found that it would take approximately 34.1 years to afford a down payment, the longest time of any state. On their median income, the same goal is met in 6.5 years. Coming in at second, in the state of New Hampshire, it took minimum-wage workers 29.9 years to afford the average down payment, where the minimum-wage earners make just $7.25 per hour.

In nine other states, including California, Georgia, Hawaii, Idaho, Montana, North Carolina, Tennessee, Wyoming, and Texas, it would take minimum wage workers more than two decades to save for a down payment. Hawaii, Montana, and California are the only three to make this list with minimum wages above the federal wage ($7.25) due to their comparatively high housing costs.

Realizing the American dream

The state found the most feasible for minimum-wage workers to own a home was Illinois, where minimum-wage workers earning $14 per hour could save for a down payment of 8% at the average price of $250,979.50 for a home of in just 8.6 years.

Coming in second, minimum-wage workers in West Virginia earning $8.75 per hour would take 8.7 years to save for an 8% down payment on a home at the average price of $158,225.66.

Ranking third was the state of Arkansas, where those earning the minimum wage of $11 per hour would need to save for 8.8 years before being able to afford an 8% down payment on the average priced home (currently at $201,356.44).

Coming in at the number four spot, minimum wage workers in Missouri earning $12.30 per hour require 9.4 years to save for a down payment on a home priced $239,410.15.

Coming in at number five, in the Buckeye State of Ohio, those earning the minimum wage of $10.45 per hour would need 10 years to save for an average priced home of $217,604.88.

Rounding out the top 10 of states where the minimal amount of time was reported on saving for an 8% down payment on a minimum-wage salary were Nebraska (10.1 years), Michigan (10.9 years), Connecticut (11.6 years), Mississippi/New Mexico (11.8 years), and South Dakota (12.7 years).

Click here for more on BadCredit.org’s analysis of minim-wage earners and downpayments.