Based on its industry-leading mortgage, real estate, and public records data sets, Intercontinental Exchange, Inc. (ICE) has published its July 2024 ICE Mortgage Monitor Report.

The dynamics underlying the active mortgage market’s gradual shift toward higher average rates are examined in this month’s Mortgage Monitor. Although there is still a significant bias in the market toward lower-rate mortgages, Andy Walden, VP of Research and Analysis at ICE, points out that this is shifting.

“As of May, 24% of homeowners with mortgages now have a current interest rate of 5% or higher,” Walden said. “As recently as two years ago an astonishing nine of every 10 mortgage holders were below that threshold. All in, there are 5.8M fewer sub-5% mortgages in the market today than there were at this time in 2022. This has been a slow-moving change, as borrowers with lower rates have sold their homes or, to a smaller degree, refinanced to withdraw equity.

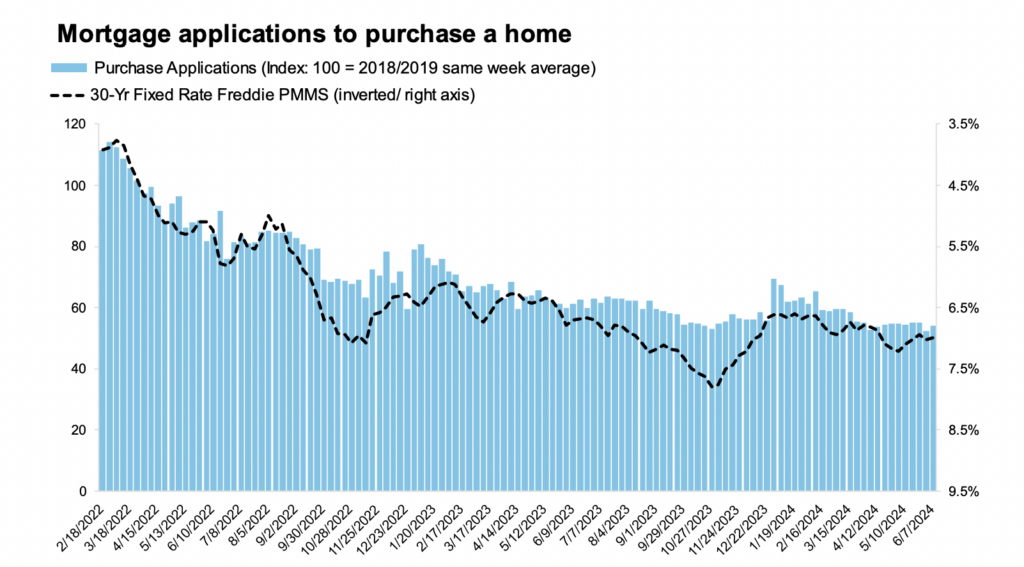

Walden added, “The entire market is acutely aware of how elevated rates have been constraining origination volumes. But seen from another angle, the same dynamic is also serving to gradually enlarge the population of folks with high-rate mortgages who are actively waiting for the moment a refinance makes sense. This would benefit both a growing number of homeowners and lenders.”

Mortgage Origination & Refi Activity: 2022-2024

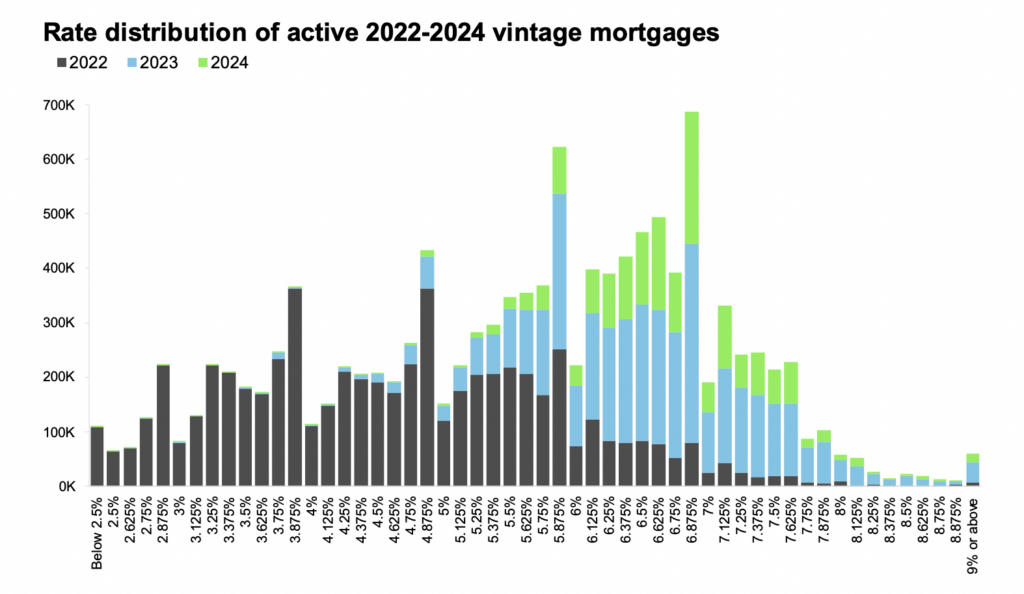

Approximately four million first lien mortgages originated since 2022 had 30-year rates above 6.5%, with 1.9 million having rates of 7% or above, according to the research. In the 7–7.225 percentile range, there are, on average, about 240K active mortgages; nevertheless, there is a discernible peak of 690K loans with rates just below 7%.

“The concentration of active loans just below 7% has more to do with borrower psychology than concrete savings,” Walden said. “There’s clearly something appealing in today’s market for a homeowner to see a 6-handle in front of their mortgage rate. From a rate/term refinance lending perspective, this group is worth watching as they represent a potential tipping point for a return to more meaningful, albeit historically modest, refi volumes.”

Refi volumes are still far below historical levels for the time being. Having said that, there have been some noticeable changes in the refinancing landscape of late. Take the recent increase in the VA market share, which, according to ICE origination statistics, went from less than 10% of rate/term refis a year ago to more than 30% in recent weeks.

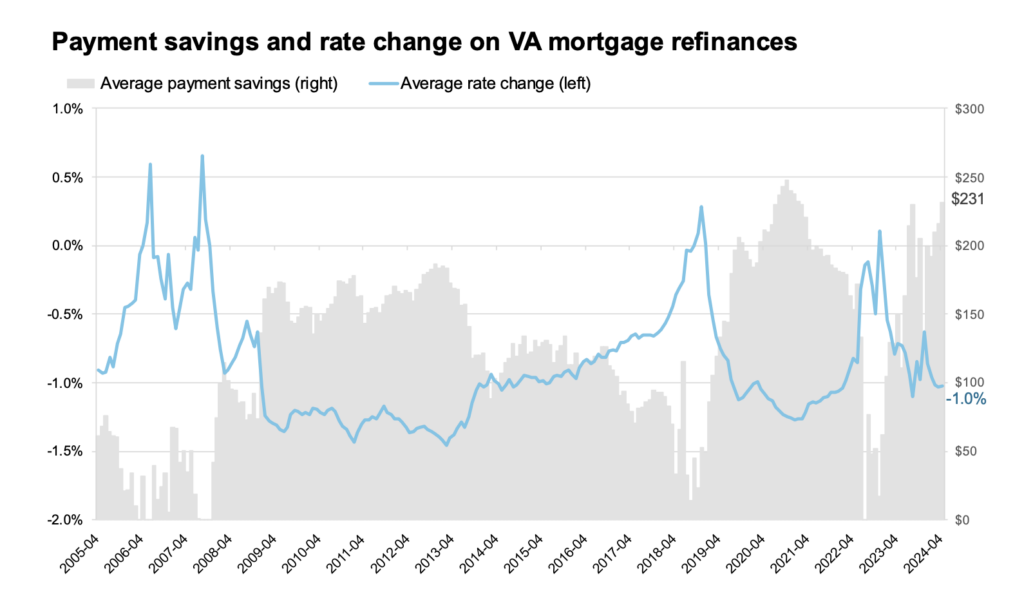

The rise in VA refinance share seems to be due, in large part, to streamline refinances. A before-and-after analysis of ICE McDash +Property data shows that some veterans, particularly those who had taken out mortgages within the previous year, took advantage of the streamlined refinancing program to lower their interest rate by more than a full percentage point, for an average monthly savings of $230 among April originations.

Highlighting Loan Activity on 30-Year Fixed Rate Mortgages

The average rate offered on these loans is far lower than that of their FHA and conforming mortgage counterparts, and the ICE U.S. VA 30-year fixed rate mortgage index is down over a full percentage point from its peak in late October. With the retention of FHA and VA refinances tripling from 15% in Q4 to 46% in Q1, VA refinances also contributed to the servicing retention rate in Q1 reaching its best level in 18 months.

However, the average borrower had to pay more for their loan balance in order to fund closing fees and/or buy down their rate, so those reduced payments came at a price. In addition to the rapid turnaround, the exceptionally high prepay speeds have the potential to harm investors in assets secured by VA loans.

The recent VA loan activity confirms the results of the recently published 2024 ICE Borrower Insights Survey, which indicated that, with a 20-point difference between the lowest mortgage rate and the next most popular choice, obtaining the lowest mortgage rate was the most important factor when selecting a lender. However, borrowers usually don’t weigh many possibilities even though they desire the lowest rate.

Actually, when choosing a loan, some 84% of borrowers questioned looked at either one (36%) or two (48%) options. This demonstrates how crucial it is for lenders to remain aware of their consumers’ needs and initiate contact as soon as a favorable refinancing opportunity presents itself, as does the effective proactive retention of FHA/VA borrowers in Q1.

To read the full report, including more data, charts, and methodology, click here.