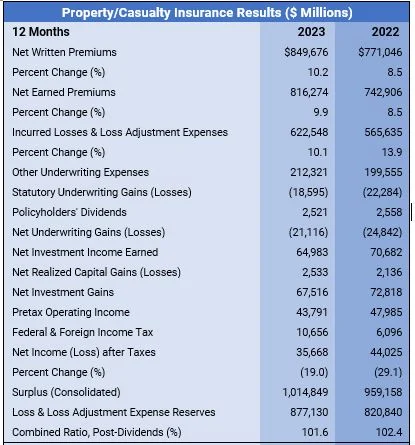

The main national trade organization for commercial, home, and auto insurers, The American Property Casualty Insurance Association (APCIA), and Verisk released a statement today regarding the insurance industry’s projected $21.1 billion in full-year 2023 losses. Important financial metrics for private U.S. property/casualty insurers show that underwriting losses in 2023 resembled those in a challenging 2022.

Net income is at its lowest point in over a decade, despite the industry’s expected net underwriting loss of $21.1 billion being less than the $24.8 billion recorded the year before. It dropped to $35.7 billion in 2023 from $44 billion the year before, a 19% reduction.

Earned premiums grew by 9.9% in 2023, but incurred losses and loss adjustment costs increased by 10.1 percent. A key indicator of insurer profitability, the combined ratio scarcely moved from 102.4 percent in 2022 to 101.6 percent in 2023.

The preliminary findings, which are displayed in the table below, are consolidated estimates that were obtained from the annual accounts that insurance companies sent to insurance authorities. Based on about 96.9% of all business underwritten by private property/casualty insurers in the U.S., these results have been calculated.

“Insurers experienced a second straight year of net underwriting losses with over $21 billion in red ink in 2023 following nearly $25 billion in 2022,” said Robert Gordon, Senior VP of Policy, Research, and International at APCIA. “While overall industry surplus—representing the supply capacity for insurance coverage—modestly increased in 2023 thanks to investment gains, it has still not recovered from the $72 billion contraction in 2022 and fell to a five-year low relative to premium revenue. Homeowners and auto insurance performed particularly poorly: in both 2022 and 2023, loss ratios exceeded levels not seen in more than 20 prior years. As insured losses skyrocket, many policyholders in the U.S. face rising insurance costs and availability challenges, which is why the insurance industry is analyzing these issues and advocating for solutions. However, the market won’t fully stabilize until insurers can close the gap between losses and rates.”

The policyholders’ surplus increased to $1,014.8 billion in 2023 from $950.8 billion in Q3; however, the insurers’ rate of return on average policyholders’ surplus, which is a critical factor in total profitability, fell to 3.6 percent in 2023 from 4.4 percent in 2022.

Premiums and combined ratios both saw year-over-year increases in the fourth quarter, which can be attributed to a significant drop in cat occurrences.

In Q4 of 2023, the industry’s net income increased to $18.8 billion, up from $10.6 billion in the same period of 2022.

Additional data:

- While the first half of the year experienced record-breaking catastrophe activity, activity in the second half was below-average, most notably in the fourth quarter. Catastrophe losses for Q4 of 2023 were the lowest quarterly cat losses since 2015 and the fewest quarterly catastrophe events since 2016. Net written premiums increased by $17.9 billion in the fourth quarter of 2023, representing a growth of 9.7 percent compared to the previous year.

- Net underwriting gains rose to $9.7 billion in the fourth quarter of 2023, rebounding from $3.7 billion in losses reported in the same quarter one year earlier.

- The combined ratio improved from 103.0 percent in the fourth quarter of 2022 to 96.8 in the same period this year.

“Despite only one U.S. landfalling hurricane in 2023, we saw elevated catastrophe activity. Severe convective storms were a key driver of underwriting results for the year, particularly in homeowners,” said Saurabh Khemka, Co-President of Underwriting Solutions at Verisk. “On the premium side, the hard market and steady exposure growth have eased some of the pressures in commercial lines. However, even with another year of double-digit rate increases, rate adequacy continues to be a major challenge for personal auto driven by inflation, supply chain shortages, and labor shortages.”

To read the full report, including more data, charts, and methodology, click here.