So far this year, permits have been received by builders to build 13 multifamily housing units for every 10,000 residents in the U.S.; this is a roughly 30% decrease from the average of 18 for the same periods in 2021–2023. That’s according to a new report from Redfin.

The study is based on a Redfin examination of data from the United States Census Bureau that covers the first five months of 2024 and the same periods in 2021–2023 for building permits for multifamily units in buildings with five or more units. While the metro sections below cover the 79 U.S. metros with populations of at least 750,000, national data encompass the whole country.

The decline in multifamily building permits is not due to a lack of demand, but rather a decrease in the number of home builders pursuing these permits.

Two reasons builders are seeking fewer permits are: Elevated interest rates have made it more expensive to borrow money for construction projects, AND there’s already a near-record number of new multifamily units hitting the market due to a building boom in recent years, making it difficult for some property owners to find tenants. Less than half (47%) of new apartments that were completed at the end of last year were rented within three months—the lowest share since 2020.

The number of multifamily units completed is still at record highs, despite the fact that multifamily building permits and starts have drastically decreased and are below their 10-year historical norm. The reason for this is that many of the projects that were started during the pandemic are just now being completed.

The amount that rent prices in the U.S. can rise is limited because of the glut of newly constructed apartments, which puts landlords in many locations in competition with one another for renters. Although they are currently at their highest point since 2022, asking rents have increased by less than 1% from a year ago—a far cry from the 18% spike observed during the pandemic.

“Prospective renters should be aware that now may be a better time to sign a lease than later,” said Sheharyar Bokhari, Senior Economist at Redfin. “Property owners might start jacking up rents again once all of the new apartments hitting the market fill up with tenants and there’s no longer so much supply, which could be the case in a year or two.”

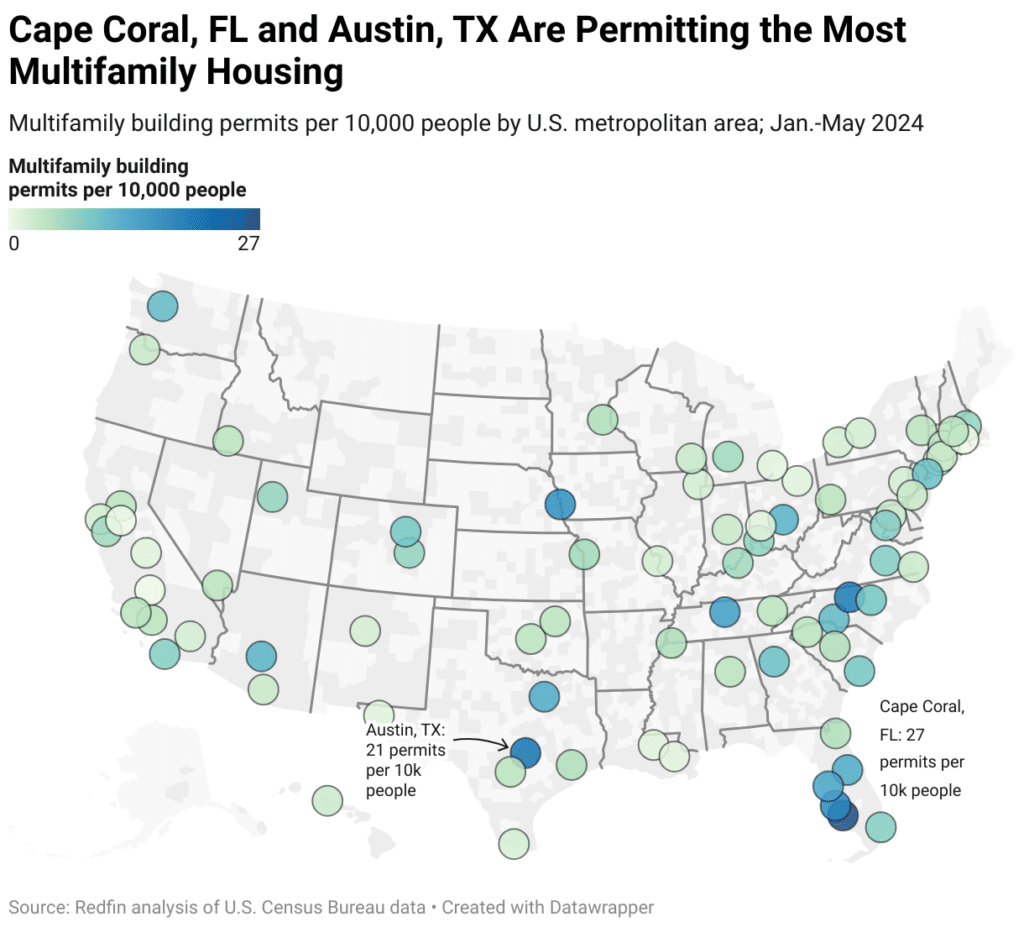

Cape Coral and Austin Permitting More Multifamily Housing Than Anywhere Else in the U.S.

In Cape Coral, FL builders got permits to construct 27 multifamily units per 10,000 people this year—the highest level among the 79 metros Redfin analyzed. Next came Austin, TX (21), Greensboro, NC (20), North Port, FL (18), Omaha, NE (17), Nashville, TN (15), Tampa, FL (14), Orlando, FL (13), Dallas (13) and Columbus, OH (12).

The Sun Belt, which saw a spike in popularity during the epidemic and subsequent building boom, is home to many of these metropolises. Four of the ten metro areas mentioned above are in Florida.

Florida is the hub of the house insurance issue and is at great risk for storms, flooding, and sea level rise. However, developers continue to construct because there is still a market for their products—partially because of the flood of displaced residents during the pandemic. As homeowners in Florida continue to rebuild following Hurricane Ian in late 2022, permits may also be increasing there.

California has the two metro areas with the lowest number of multifamily permits per 10,000 residents. During the first five months of the year, zero permits were issued in Stockton, CA. Bakersfield, CA (0), Providence, RI (0), El Paso, Texas (1), Baton Rouge, LA (1), Cleveland (1), Fresno, CA (1), Detroit (1), Dayton, Ohio (1), and New Orleans (1) are the next cities in order of precedence.

Multifamily Construction Slowed in Most Areas Since the Pandemic, But Permitting Has Increased in Some U.S. Metros

Since the pandemic, multifamily development permits have decreased in most metro areas; despite being the second-largest permitter in the US, Austin has witnessed the highest loss. As previously noted, this year there were 21 permits issued to builders per 10,000 residents in the Texas capital—a decrease from the average of 40 in 2021–2023. The second-biggest decrease was in Jacksonville (5 permits per 10,000 people in 2024 compared to 23 permits per 10,000 people in 2021–2023). Boise, ID (4 vs. 17), Colorado Springs, CO (7 vs. 24), and Raleigh, NC (9 vs. 21) followed.

Due in part to the fact that many people have been priced out, the aforementioned property markets have lost some of their recent surge in popularity that occurred during the pandemic.

Conversely, 25 metro areas are allowing more permits than they did during the pandemic. Greensboro saw the most rise among the metro areas Redfin examined, with builders obtaining 20 multifamily permits for every 10,000 residents this year, compared to an average of just four in 2021–2023. Cape Coral (27 vs. 16), Omaha (17 vs. 10), Columbus (12 vs. 7), and Tampa (14 vs. 9) complete the top five. For complete metro-level data, please refer to the study that is posted at the bottom of this press release.

Rents Drop in Metros Where Building Boomed During the Pandemic

In 16 of the 33 metro areas for which Redfin has rent-price data, the median asking rent has decreased from a year ago. Due to the surge in multifamily construction and the resulting competition among building owners for tenants, rents are declining in many of those metro areas.

In 2021–2023, there will be an average of 14 multifamily units per 10,000 persons in the 16 metro areas where rents are declining. In contrast, an average of only seven units per 10,000 inhabitants were allowed in the metro areas where rents are growing.

Among the metro areas for which Redfin has rent data, Jacksonville had the largest decline in median asking rent, with a 10% year-over-year decline in May. In 2021–2023, Jacksonville ranked among the top permitters in the nation, with an average of 23 multifamily units per 10,000 residents. Similar circumstances may be found in Austin, which had a 7% reduction in asking rent in May—the third-steepest decline among the metro areas for which Redfin has rent-price data—despite being the top permitter in the country during the outbreak.

To read the full report, including more data, charts, and methodology, click here.