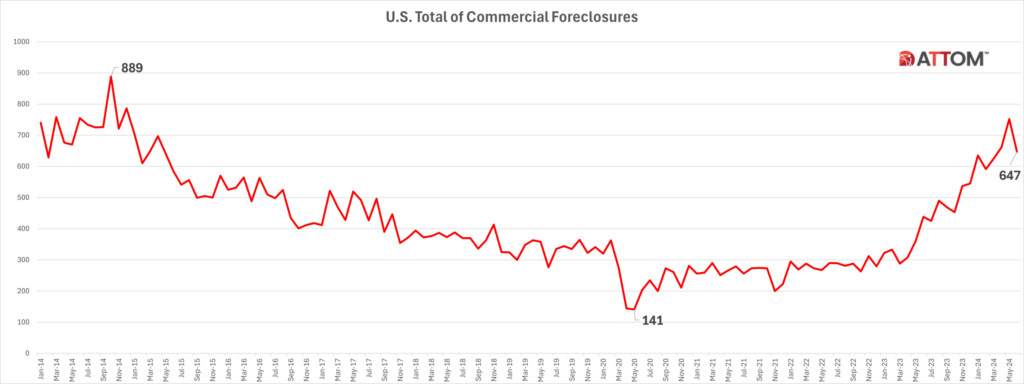

ATTOM has released its updated monthly report on U.S. Commercial Foreclosures, revealing a continued increase in commercial foreclosures over the years, from a low of 141 in May 2020, to the current figure of 647 in June 2024.

Since January 2014, ATTOM has been analyzing data, a period marked by the nation’s emergence from economic uncertainty, with commercial foreclosures numbering 740 nationwide. Over the following years, ATTOM monitored fluctuations, observing a peak in October 2014 with 889 commercial foreclosures, indicating ongoing market corrections.

Despite challenges like the COVID-19 pandemic and evolving economic policies, the market demonstrated remarkable adaptability, as initial pandemic-related foreclosures were followed by stabilization as businesses adjusted to new realities.

Launching an upward trend

In June 2020, the U.S. observed the onset of a consistent upward trend in commercial foreclosures following an almost seven-year phase of continuous declines. June 2020 marked the first rise, from a notable low of 141 in May 2020, that persisted with steady increases through June 2024. By June 2024, commercial foreclosures had increased to 647, reflecting a 219% year-over-year increase compared to the 2020 low.

Regionally, in June 2024, California reported the highest number of commercial foreclosures for the month, at 214, a 10% decrease month-over-month, but a 289% increase year-over-year. This marks California’s first monthly decline following a notable rise in commercial foreclosures over the past seven months, which began in November 2023. During this period, cases exceeded 100 and continued to escalate.

Following California, Texas, New York, New Jersey, and Florida all reported the highest number of commercial foreclosures in June 2024. While these states experienced decreases this quarter, they exhibited significant fluctuations over the past decade, with each state showing a continuous overall increase.

- Texas reported a total of 70 commercial foreclosures in June 2024, a 1% decrease month-over-month, and a 100% increase year-over-year.

- New York reported an 8% decrease in June 2024 month-over-month, and a 21% decrease in commercial foreclosures year-over-year.

- New Jersey saw a 35% decrease month-over-month in June, and a 34% increase year-over-year.

- Florida reported a 45% decrease month-over-month in June, and a 10% increase year-over-year.

The state of office space

The office space market has been one in flux ever since the pandemic gave rise to remote work situations.

According to Commercial Edge’s national office report, office utilization has plateaued, while values have fallen. Office defaults and delinquencies are on the rise in 2024, and hundreds of billions in office loans are set to mature over the next few years. The report found that more than $260 billion in office loans have recently matured, or are maturing by the end of 2026. This represents 30% of all office loans, covering 12,000-plus properties. However, the risk posed by maturing loans is not distributed equally across markets. Among top markets, Atlanta has the highest concentration of maturing loans, with 48.3% of its office loan volume either having recently matured or due to mature through the end of 2026—followed by Denver (41.8%), Nashville (41.7%), Chicago (40.7%), and the Twin Cities (39.2%), making them the only top markets crossing a 35% threshold.

For larger industrial spaces, Commercial Edge’s national office report that national in-place rents for industrial spaces averaged $8.00 per square foot in May 2024, an increase of four cents month-over-month, and up 7.5% year-over-year.

Regionally, it was California’s Inland Empire that reported the highest industrial rent growth once again, with in-place rents increasing by an average of 12.6% over the last 12 months—followed by Los Angeles (11.6%), Miami (11.4%), and New Jersey (9.6%).

Commercial Edge found that Phoenix was the fastest-growing industrial market not adjacent to a shipping port, with an 8.7% rent growth year-over-year. The Phoenix metro has been a booming industrial market in recent years, driven mostly by its population growth and proximity to key ports. The Phoenix region offers a compelling alternative for companies seeking a less crowded option than Southern California for their industrial spaces.

A ripple effect

The reverberation of commercial foreclosures can do great damage to a financial ecosystem, and as a recent Marketplace article notes, small banks are bearing the brunt of the rise in commercial foreclosures. The article noted that KeyCorp, Comerica, and Ally all reported that their net income fell in Q1, as did larger banks like U.S. Bancorp and Citizens Financial, with the one thing weighing on the sector being commercial real estate. These banks have a great deal of CRE loans on their books, loans that may continue to mount should the rate of commercial real estate foreclosure turn upward.