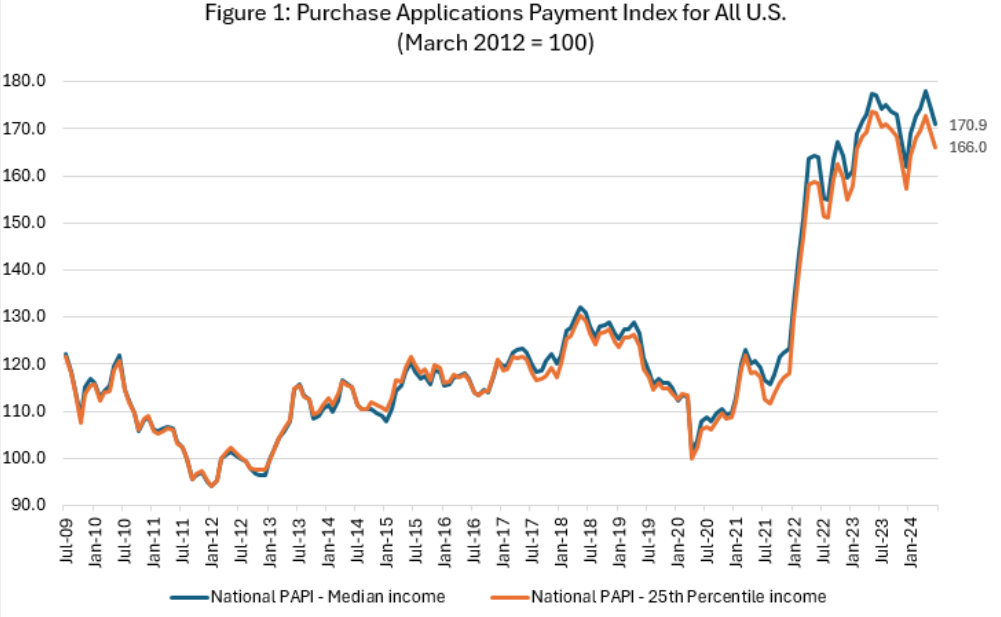

According to the Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI), homebuyer affordability improved in June, with the national median payment applied for by purchase applicants decreasing to $2,167 in June 2024 from $2,219 in May 2024, down $52. MBA’s PAPI measures how new monthly mortgage payments vary across time–relative to income–using data from MBA’s Weekly Applications Survey (WAS).

“Homebuyer affordability conditions improved for the second straight month, as declining mortgage rates continue to increase purchasing power and is enticing some borrowers back into the housing market,” said Edward Seiler, MBA’s VP, Housing Economics, and Executive Director, Research Institute for Housing America. “The median loan application amount fell to $320,512 in June, indicating that home-price growth is moderating, which should boost additional activity.”

Contributing factors

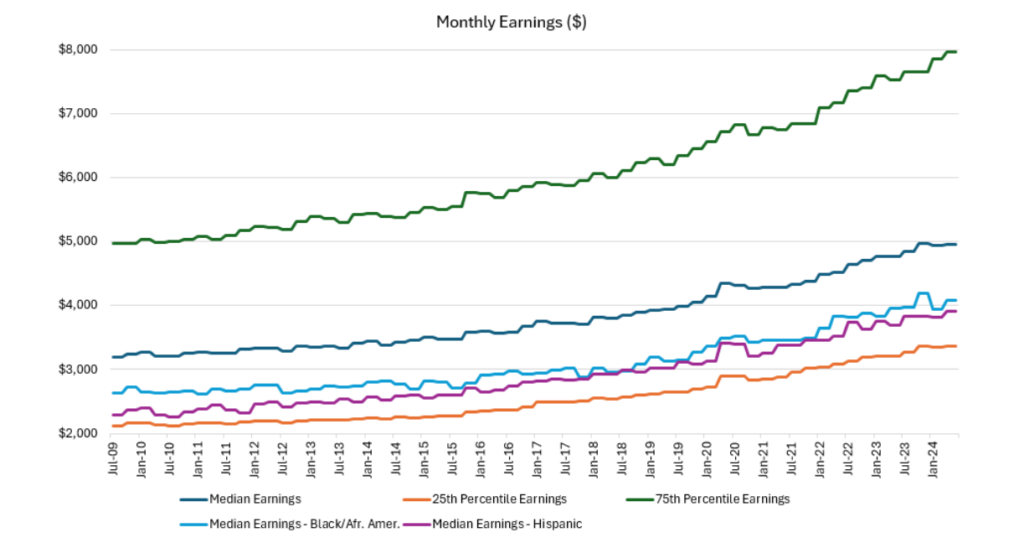

An increase in MBA’s PAPI–indicative of declining borrower affordability conditions–means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI–indicative of improving borrower affordability conditions–occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

The national PAPI decreased 2.4% to 170.9 in June from 175.0 in May. Median earnings were up 3.9% compared to one year ago, and while payments increased 0.2%, the strong earnings growth means that the PAPI is down 3.6% on an annual basis. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment decreased to $1,460 in June from $1,509 in May.

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey decreased to $2,510 in June from $2,522 in May.

Freddie Mac’s latest Primary Mortgage Market Survey (PMMS), shows the 30-year fixed-rate mortgage (FRM) averaging 6.78% as of July 25th, down after edging closer to the 7% mark.

“Mortgage rates essentially remained flat from last week but have decreased nearly half a percent from their peak earlier this year,” said Sam Khater, Freddie Mac’s Chief Economist. “Despite these lower rates, buyers continue to pause, as reflected in tumbling new and existing home sales data.”

By household, homebuyer affordability increased for Black households, with the national PAPI decreasing from 175.6 in May to 171.4 in June. Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 163.3 in May to 159.5 in June. Homebuyer affordability increased for White households, with the national PAPI decreasing from 176.8 in May to 172.6 in June.

Additional June PAPI findings

- The national median mortgage payment for FHA loan applicants was $1,907 in June, down from $1,924 in May and up from $1,854 in June 2023.

- The national median mortgage payment for conventional loan applicants was $2,180, down from $2,226 in May and down from $2,205 in June 2023.

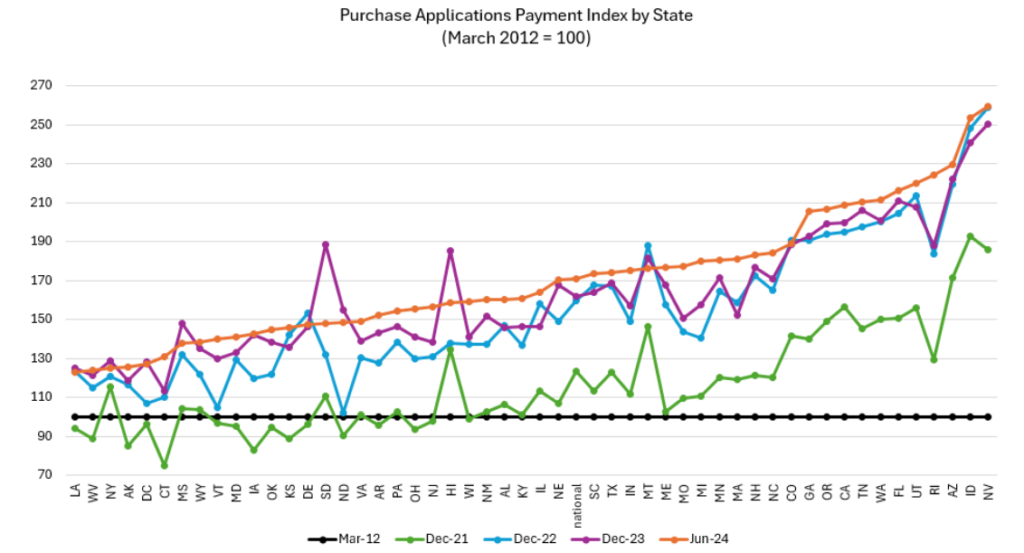

- The top five states reporting the highest PAPI were: Nevada (259.4), Idaho (253.4), Arizona (229.7), Rhode Island (224.1), and Utah (220.2).

- The top five states with the lowest PAPI were: Louisiana (122.9), West Virginia (124.2), New York (124.8), Alaska (125.4), and D.C. (127.0).

Click here for more information on MBA’s June 2024 PAPI report.