During the second quarter of 2024, the demand for distressed properties at auction displayed strong performance initially but showed signs of decline in June, even as the supply of available auction properties continued to contract, according to Auction.com’s latest Auction Market Dispatch report.

“The demand slippage in late Q2 could be an early indication that local community developers buying at auction are becoming increasingly wary of rising retail inventory, which represents competition for the renovated homes they sell or rent back into the retail market—typically within six months of buying at auction,” said Daren Blomquist, VP of Market Economics at Auction.com and author of the report. “If the demand pullback continues into Q3, it would also foreshadow a slowdown in retail home price appreciation.”

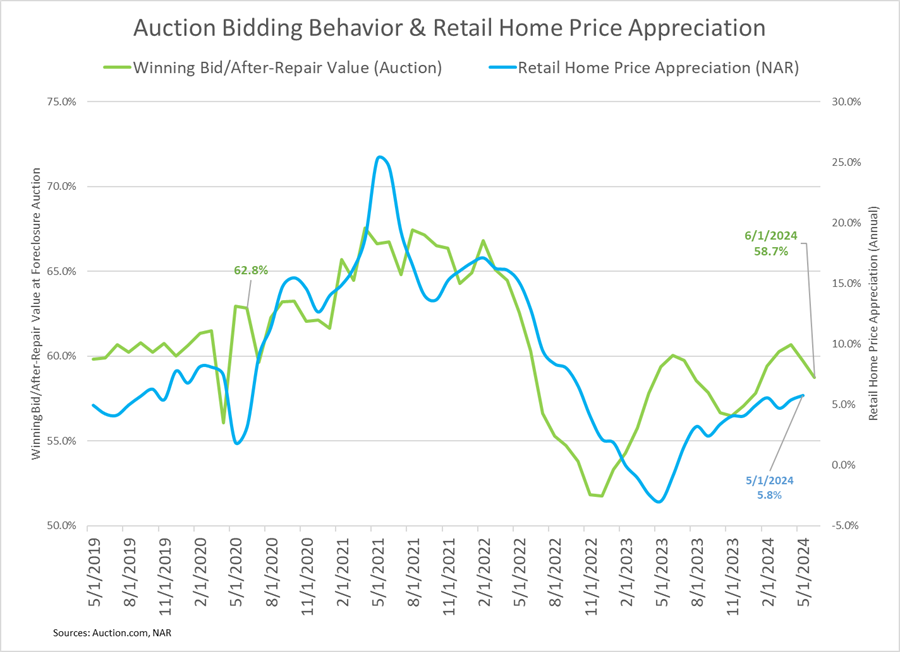

According to Auction.com, because buyers at distressed market auctions are anticipating retail market conditions three to six months into the future, bidding behavior at those auctions provides a reliable forward-looking indicator of trends in retail home price appreciation.

“I do feel like the retail market has softened,” said Tony Tritt, a Local Community Developer in Northwest Georgia. “I would expect a longer time horizon to get my renovated properties sold because they aren’t flying off the shelves like they used to.”

Demand slips from multi-year highs in late Q2

Despite strong demand metrics in April and May, data from June reveals a downshift in key indicators such as bidders per property, sales rates, and winning bid-to-value ratios.

The average number of bidders for each property sold at bank-owned (REO) auction in the second quarter was down 2% from the previous quarter but up 3% from a year ago. However, June saw a 17% drop in bidders-per-property from May and a 3% decline year-over-year.

The sales rate at foreclosure auction increased by 5% quarterly and 4% annually but decreased by 4% in June from a 25-month high in May. The June sales rate was still up 3% from a year ago.

Winning bidders at foreclosure auctions in June were willing to pay 58.7% of a property’s estimated after-repair value on average, down from a 25-month high of 60.7% in April. Similarly, winning bidders at REO auctions in June paid 58.6%, down from 61.7% in April.

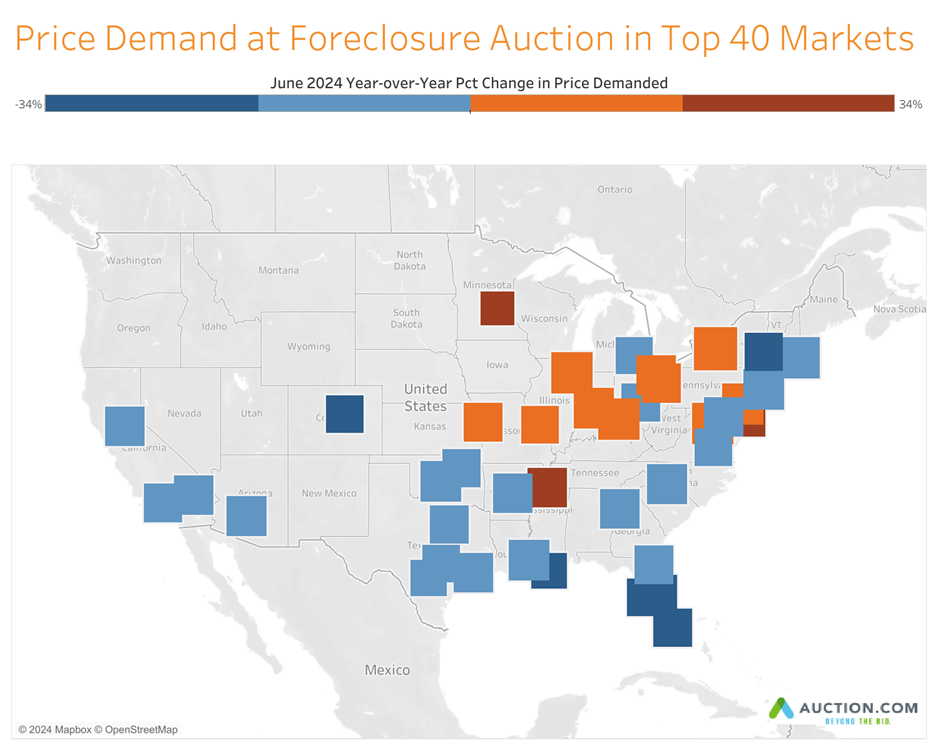

Price demand by market

Major markets with rising retail inventory saw significant declines in the price demanded by distressed property auction buyers in June. The winning bid-to-value ratio at foreclosure auctions decreased by double-digit percentages in Miami, New Orleans, Tampa Bay, Orlando, and Denver. Retail inventory in May 2024 rose above May 2019 levels in four out of five of these metro areas, with Miami being the exception, according to data from ResiClub. Miami had the highest share of “stale” listings—those unsold for at least 30 days—in the country in May, according to Redfin.

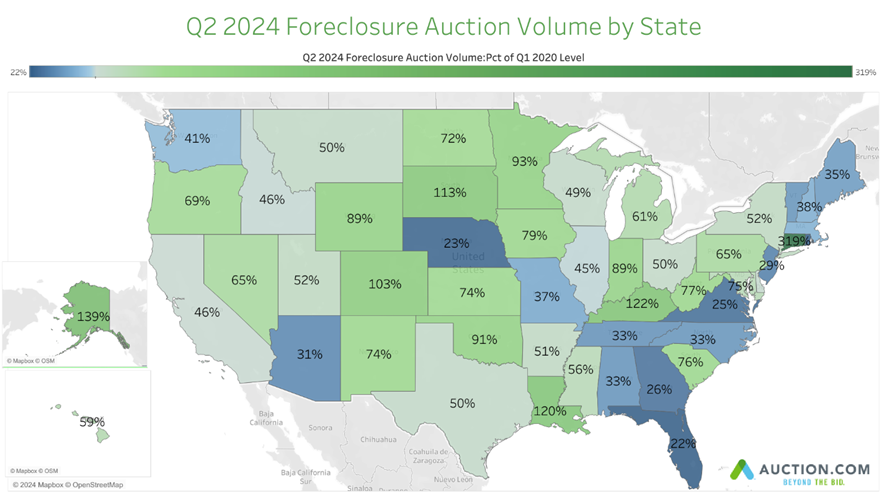

Continued contraction in supply

The supply of properties available for auction continued to shrink in Q2 2024. The number of properties brought to foreclosure auction was 46% of the pre-pandemic level in Q1 2020, down from 49% in the previous quarter and 57% in Q2 2023. REO auction supply was even more restricted, at 36% of the Q1 2020 level, down from 38% in the previous quarter and 40% in Q2 2023.

Supply by state

States with the highest supply of properties brought to foreclosure auction relative to pre-pandemic levels in Q2 2024 included Connecticut (319%), Alaska (139%), Kentucky (122%), Louisiana (120%), South Dakota (113%), and Colorado (103%). States with the lowest supply included Florida (22%), Rhode Island (22%), Nebraska (23%), Virginia (25%), and Georgia (26%).

Auction bid-ask spread widens

The bid-ask spread for distressed properties at auction widened noticeably in June. For foreclosure auctions, the spread was 6 percentage points, up from 3 points in April and May, marking a 16-month high. For REO auctions, the spread was 11 percentage points in June, up from a 25-month low of 8 points in April.

This widening was primarily due to a decline in the price demanded by buyers, with prices down 3% at foreclosure auctions and 5% at REO auctions from April to June. Sellers, however, kept pricing relatively steady, contributing to the increased spread.

The data from Q2 2024 suggests a potential softening in the retail housing market, with demand at distressed property auctions serving as a critical indicator of future trends.

Click here for more information directly from Auction.com.