For the third consecutive year, the U.S. is expected to set new records for apartment construction. By the end of 2024, developers plan to have completed an astounding 518,108 rental units, a startling 30% more than in 2022 and 9% more than in 2023. This is according to a new study from RentCafe.

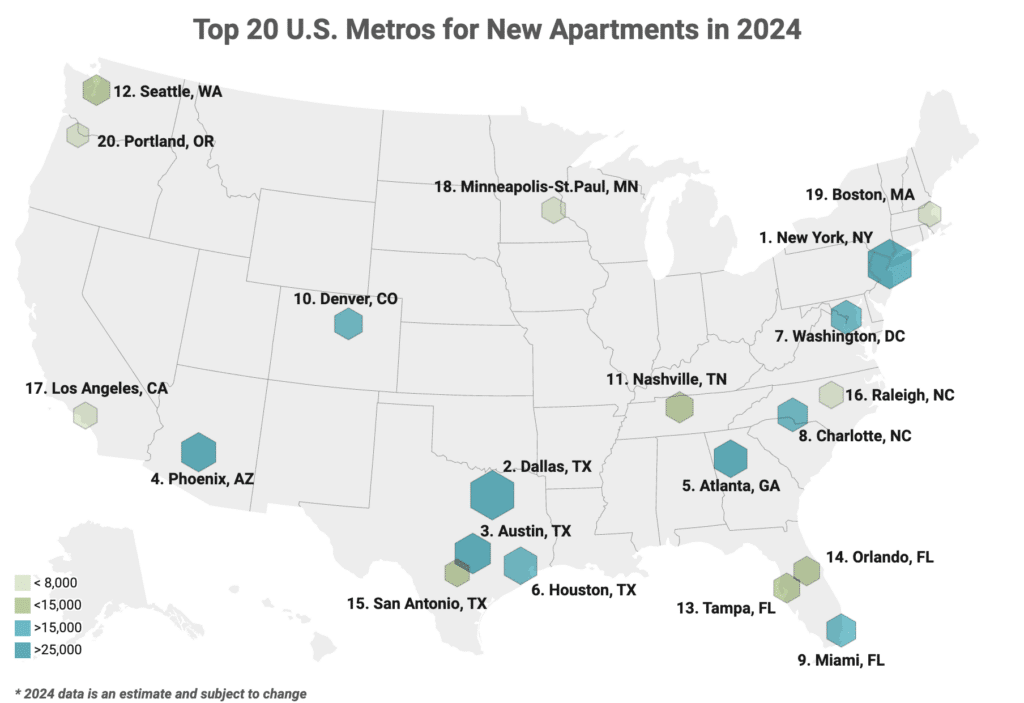

Furthermore, 2024 will mark the first time in the history of apartment building in the U.S. that the total number of completed units will exceed the 500,000-unit mark. For the third year running, the New York metro area is in the lead, followed by the Popular Texas metros of Dallas and Austin. Notably, by the end of December, the combined metro areas of Dallas and Austin are predicted to welcome about 10% of all newly constructed apartments countrywide.

“The supply wave has brought 50-year high deliveries to certain metros … but the increased competition is slowing rent growth, especially in booming Sun Belt markets,” said Doug Ressler, Senior Analyst and Manager of Business Intelligence at Yardi Matrix.

Further, and even despite falling rents in the Sun Belt, demand for apartments has remained strong.

Looking ahead, despite market uncertainties that are preventing many new projects from commencing, 2 million units are scheduled to open by 2028. Moreover, 47% of the 369 metro areas under study are probably going to develop more in the upcoming five years than they did in the years between 2019 and 2023.

Due to a significant increase in the number of renters over the past 50 years, demand for rental apartments in the U.S. remains higher than supply, even with recent construction efforts following the building boom of the early 1970s, when a comparable number of rentals entered the market as Baby Boomers were coming of age.

Regional variations in apartment development can be attributed to a number of variables, including demand, local laws, climate, and economic conditions. Nevertheless, the top 20 metro areas according to our rating are home to roughly 60% of the new apartments anticipated to hit the market in 2024. This indicates that it is anticipated that the remaining places’ current supply will not rise significantly this year.

The majority of apartments that have been built in the past five years are high-end and primarily target upper-middle-class and upper-class renters. Renters in smaller regions may still have few inexpensive options due to the concentration of new apartments in the main U.S. metro areas and the emphasis on high-end residences.

Per the report, even if the number of apartments built reaches a record high in 2024, the multifamily market is being negatively impacted by rising borrowing prices, which has forced many developers to modify their plans for the upcoming years. As a result, they may concentrate on initiatives with lesser risk or move toward industries with high demand and employment growth.

“The overall impact on the number of developers might vary by region,” Ressler said. “In places like Texas, for instance, the demand for apartments remains robust due to factors like corporate migration and high home prices. On the other hand, some markets are seeing a slowdown in new construction starts due to the economic environment.”

Remarkably, a few developers are observing a change in the market, where land sellers are now more willing to bargain. This, combined with lower labor costs, is opening doors for long-term thinkers, especially in regions where there is now an excess of supply. Over the course of the next year and a half, these markets should see a major improvement in their outlook.

In 2025 and beyond, the landscape of apartment building is taking on a slightly different form. Ressler stated that most markets won’t notice how quickly declining starts translate to reduced completion levels until the second half of 2025, and most likely in 2026. “All things considered, this significant decline in starts in every region paves the way for a significantly altered industry trajectory by 2026 and 2027.”

Developers anticipate completing a record-breaking 518,108 apartments this year, and in 2025, they will supply 440,478 new units—a 15% decrease from 2024 levels. Then, through 2027, when deliveries are anticipated to hit a 10-year low with 319,000 rentals opening nationally, the rate of building is predicted to drop down even more. Following that, a large increase is anticipated in 2028 when over 391,000 apartments are scheduled to go online, representing a nearly 23% increase over the previous year.

New York Metro to Open Nearly 33,000 Apartments in 2024

The New York metropolitan area is “well-positioned” to expand upon the exceptional apartment building feat of the previous year. More specifically, with 32,935 additional rental units anticipated by the end of December 2024.

Nearly 30% (9,379 units) of the total number of new units in the New York metro will be located in Brooklyn. Manhattan, which will receive 2,979 new rentals, will follow far behind. Also, 2,412 units from local developers are scheduled to be completed in Jersey City, NJ.

The ongoing housing crisis in the Northeast is the primary driver of the apartment building boom in the New York metro area. This being the case, Boston, which debuted at #19 in our ranking with 8,022 brand-new rentals scheduled to open in the area this year, is the only other Northeastern metro to make it into our top 20 for new apartment completions in 2024.

The Boston metro area’s thriving life science sector is mostly to blame for the increase in new apartment construction because it is increasing demand for housing, according to RentCafe findings. For example, the combined cities of Cambridge and Boston are home to over 1,000 biotech businesses, both large and small, making the Boston metro area a top biotech cluster in the U.S. Apartment demand has increased as a result of the area’s continued draw for professionals, students, and their families.

developers there plan to finish 32,932 units by 2024. It is noteworthy that the majority of anticipated completions (5,267 units) of new apartments are anticipated to occur in Dallas proper. Fort Worth and Frisco are scheduled to open 2,020 new flats and 4,608 rentals, respectively, in close proximity.

Dallas continues to draw businesses and building projects due to its steady population growth (the metro added more than 150,000 new residents between July 2022 and July 2023 alone), business-friendly atmosphere, affordability when compared to other metros of a similar size, and excellent infrastructure. Naturally, corporate relocations increase wages and create positions across the metroplex, so promoting economic growth and drawing in housing-dependent immigrants.

Specifically, Austin, Texas, is slated to get an incredible 12,157 new units by the end of the year, accounting for over 56% of all anticipated deliveries in the metro area. It’s understandable why: Driven by a robust job market, prospects in the technology, healthcare, and hospitality sectors, as well as the influx of major tech businesses drawn by Texas’s income tax exemption, Austin is expanding and changing. Furthermore, even though housing costs are growing, people from more costly coastal towns have constantly moved to remote employment locations.

With a projected 20,141 new units anticipated to build throughout the metro region before the end of 2024, Phoenix takes fourth place. The majority of this building is happening in Phoenix proper, and developers want to complete 7,389 units, or over one-third of all the residences in the area, by the end of the current development phase.

At last, Atlanta completes the top five, with 18,520 new residences anticipated by the end of the year. Here as well, Atlanta proper is forecast to lead construction in 2024 with 7,184 units scheduled for completion, or almost half of all anticipated new apartments in the metro area.

To read the full report, including more data, charts, and methodology, click here.