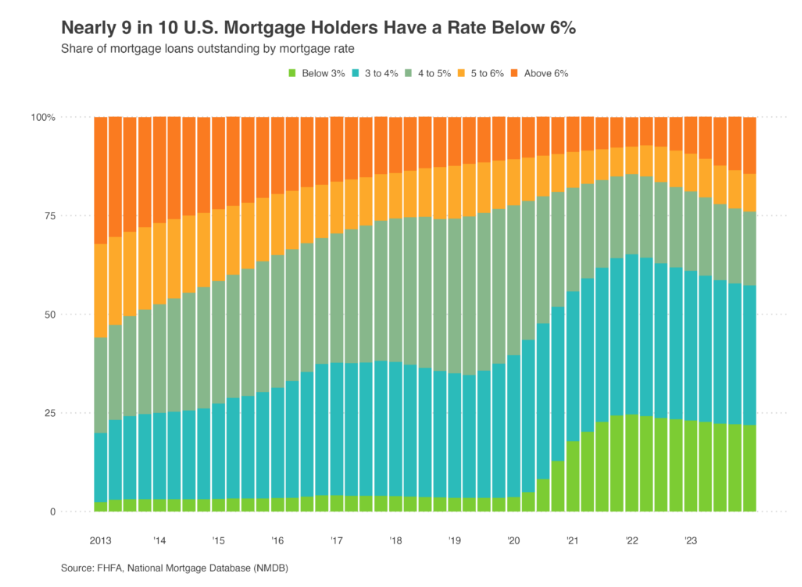

In a new analysis by Redfin, 85.7% of U.S. homeowners with mortgages have an interest rate below 6%, down from 90.6% at the start of last year, and a record high of 92.8% in mid-2022. This means even more than 85.7% of homeowners with mortgages have a rate below the current weekly average of 6.46%, prompting many to stay put instead of selling and buying another home at a higher rate—a phenomenon called the “lock-in effect.”

To determine the percentage of rate holders, Redfin analyzed data from the Federal Housing Finance Agency’s National Mortgage Database as of the first quarter of 2024, the most recent period for which data is available, which found:

- Below 6%:7% of mortgaged U.S. homeowners have a rate below 6%, down from a record 92.8% in the second quarter of 2022.

- Below 5%:1% have a rate below 5%, down from a record 85.6% in the first quarter of 2022.

- Below 4%:4% have a rate below 4%, down from a record 65.3% in the first quarter of 2022.

- Below 3%: 22% have a rate below 3%, down from a record 24.7% in the first quarter of 2022.

“I have a dozen or so homeowners who would like to sell, but aren’t willing to give up their 3% interest rate for one that’s more than twice as high,” said Blakely Minton, a Redfin Premier Real Estate Agent in Philadelphia. “Many of those sellers will list if rates get back down to 5%.”

The lock-in effect is fueling a shortage of homes for sale; new listings were at the lowest level in a year last month. But for most people, it’s not realistic to stay put forever, which is why the share of homeowners with rates below 6% is inching down. Some homeowners are opting to bite the bullet and give up their low rate in order to move. Many are selling because a major life event like a job change or divorce has given them no other choice.

Another reason the share of locked-in homeowners has dipped is that everyone who purchased a home in the last year was entering the market at a time when the average mortgage rate was above 6%.

For some homeowners, the pandemic surge in home values means they have enough equity to justify selling and taking on a higher rate—especially if they’re downsizing or moving somewhere more affordable. It’s also worth noting that while many homeowners remain locked into their low mortgage rates, a rising share of Americans are mortgage-free.

Mortgage rates have declined in recent weeks, causing homebuyer mortgage payments to fall for the first time since 2020. Freddie Mac in its latest Primary Mortgage Market Survey (PMMS), shows the 30-year fixed-rate mortgage (FRM) at 6.46%, lower than the 7.23% average of a year ago, but still significantly higher than the 2.65% record low hit during the pandemic.

With inflation on the decline, the Federal Reserve is now expected to start cutting interest rates at its next Federal Open Market Committee (FOMC) meeting on September 18. But the size and pace will depend on incoming economic data, particularly labor market data. Markets have now priced in aggressive expectations for how quickly the Fed will cut. If the Fed ends up cutting slower than markets anticipate, mortgage rates may rise a bit.