The Homeowner Equity Report (HER) for the second quarter of 2024 has been made available by CoreLogic. According to the report, since Q2 of 2023, home equity for U.S. homeowners with mortgages—who own roughly 62% of all properties—has increased by 8.0% annually. This represents a cumulative gain of $1.3 trillion and an average increase of $25,000 per borrower. As a result, the total net homeowner equity as of Q2 of 2024 was over $17.6 trillion.

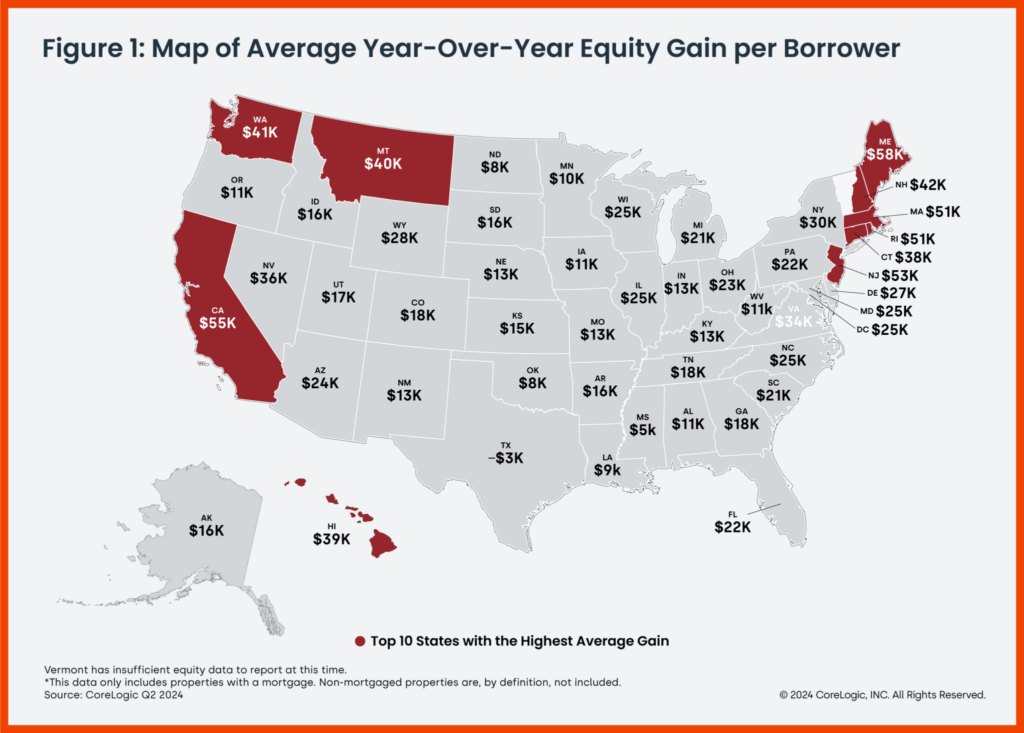

The Northeast states with the biggest gains in equity had the strongest yearly growth in home prices during the second quarter. Maine ($57,500) was the state with the highest average national equity increase, followed by New Jersey ($52,600) and California ($55,300). North Dakota (-$8,400), Oklahoma (-$7,700), and Texas (-$2,600) were the three states that reported yearly equity losses.

“Persistent home price growth has continued to fuel home equity gains for existing homeowners who now average about $315,000 in equity and almost $129,000 more than at the onset of the pandemic.” said Dr. Selma Hepp, Chief Economist for CoreLogic. “The substantial accumulation of home equity for existing homeowners has served as an important financial buffer in times of uncertainty, as some homeowners facing higher costs of homeowners’ insurance and taxes and have had to tap into their equity to prevent falling behind on their mortgages. As a result, mortgage delinquency rates have remained at historical lows despite the inflationary pressures and higher costs of almost all non-mortgage homeownership-related expenses.”

Equity Gains Remain Strong in the Northeast and California

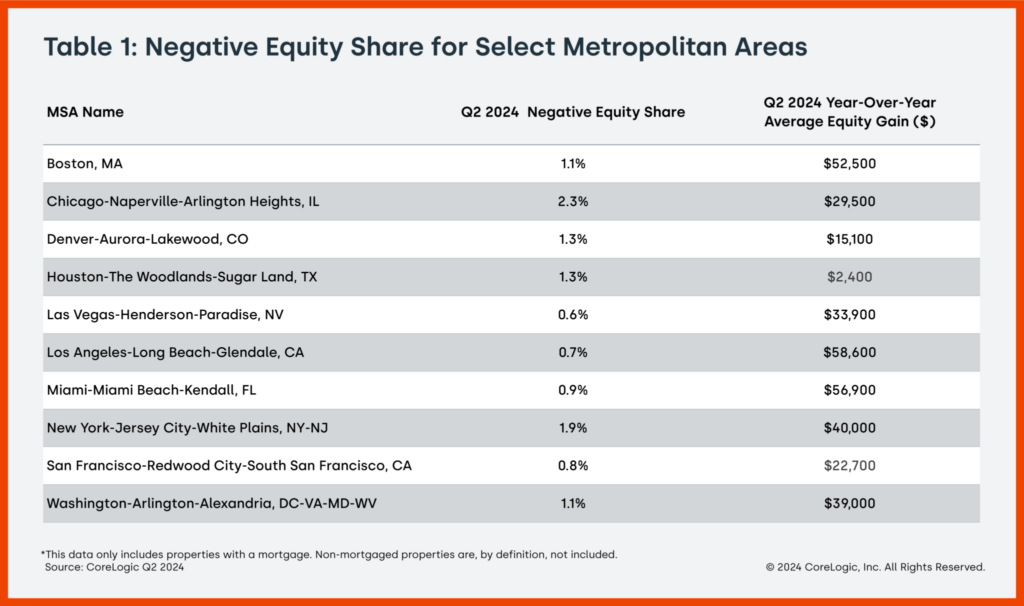

Mortgages with negative equity, sometimes called underwater or upside-down mortgages, are held by borrowers whose loan balance exceeds the current value of their residences. Across the nation, negative equity has been declining recently. The least difficult cities are Los Angeles and Las Vegas, where 0.7% and 0.6%, respectively, of all mortgages have negative equity shares.

As of Q2, the quarterly and annual changes in negative equity were:

- Quarterly change: From the second quarter of 2023 to the second quarter of 2024, the total number of mortgaged homes in negative equity decreased by 4.2%, to 1 million homes or 1.7% of all mortgaged properties.

- Annual change: From the second quarter of 2023 to the first second of 2024, the total number of homes in negative equity decreased by 15%, to 1.1 million homes or 2.0% of all mortgaged properties.

Due to the fact that home prices have an impact on home equity, borrowers with equity levels close to the negative equity threshold (about +/- 5%) are more likely to enter or exit negative equity when prices fluctuate. Considering the first quarter of the 2024 book of mortgages, 105,000 homes would regain equity if home prices increased by 5%, whereas 139,000 homes would become underwater if home values declined by 5%. According to the CoreLogic HPI Forecast, between June 2024 and June 2025, home prices will rise by 2.3%.

The next CoreLogic Homeowner Equity Report will be released in December 2024, featuring data for Q3 2024.

To read the full report, including more data, charts, and methodology, click here.