While supply has inched up in some parts of the country, August experienced a decline in existing-home sales, according to the National Association of REALTORS (NAR). The Midwest had no change in sales, but the other three of the four major U.S. regions reported declines. Sales decreased in three regions from the previous year, while they held steady in the Northeast.

Completed transactions involving single-family homes, townhomes, condominiums, and cooperatives make up the total existing-home sales, which fell 2.5% from July to a seasonally adjusted annual rate of 3.86 million in August. Sales decreased 4.2% from the previous year (from 4.03 million in August 2023).

“Existing home sales were likely little changed in August,” said Danielle Hale, Chief Economist at Realtor.com. “Although home buyers had more for-sale homes to choose from and increased buying power from easing mortgage rates, it seems that many are waiting for additional improvements. The median home sales price likely continued to climb from one year ago, but dropped from July as is typical at this time of year.”

Key Findings:

- Existing-home sales retreated 2.5% in August to a seasonally adjusted annual rate of 3.86 million. Sales slid 4.2% from one year ago.

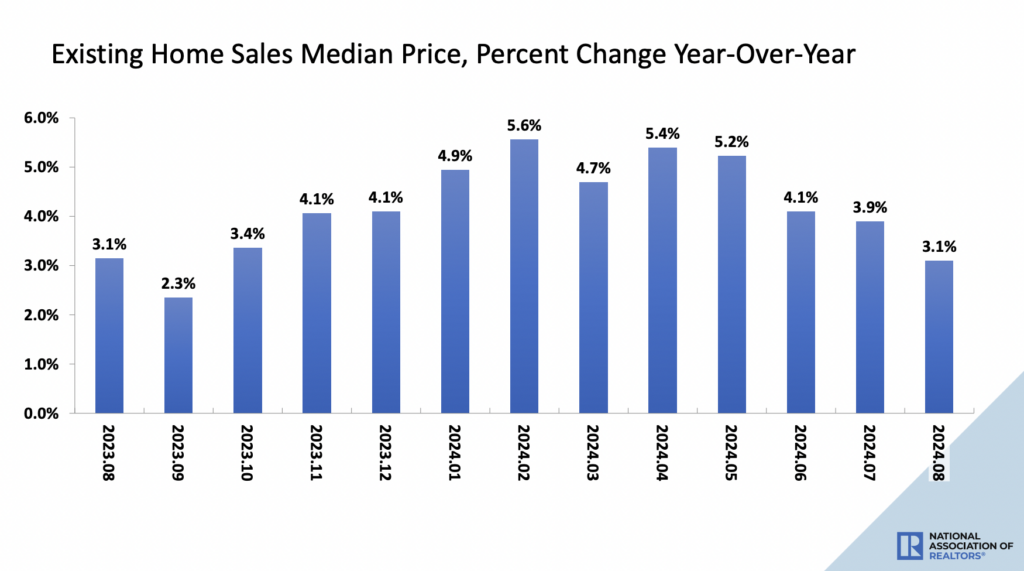

- The median existing-home sales price rose 3.1% from August 2023 to $416,700, the 14th consecutive month of year-over-year price increases.

- The inventory of unsold existing homes improved by 0.7% from the previous month to 1.35 million at the end of August, or the equivalent of 4.2 months’ supply at the current monthly sales pace.

“So far, those buyers who waited, may be glad that they did,” Hale said. “Not only have mortgage rates continued to fall into early September, but we’re also nearing a seasonal sweet spot for homebuyers, when competition usually wanes, home prices ease, and time on market tends to grow. A key question for housing consumers is whether to continue to wait or go ahead and move forward. Surveys show that consumers expect additional mortgage rate declines in the next year. Now that the Fed’s long awaited cut has arrived, however, the improvements may be more modest than we’ve seen to-date. Buyers thinking through the decision can take advantage of affordability calculators to see how their purchasing power has changed, and weigh the pros and cons of shopping in a seasonal slow period or preparing to compete in what could be a busier spring season in 2025.”

Moreover, the recent trend of falling mortgage rates combined with rising inventory, according to Lawrence Yun, NAR Chief Economist, is a strong mix that will create the conditions for stronger sales in the upcoming months.

“Home sales were disappointing again in August, but the recent development of lower mortgage rates coupled with increasing inventory is a powerful combination that will provide the environment for sales to move higher in future months,” Yun said. “The home-buying process, from the initial search to getting the house keys, typically takes several months.”

Some 1.35 million units made up the total housing inventory as of the end of August, up 0.7% from July and 22.7% from 1.1 million units a year earlier. At the current sales pace, unsold inventory is sitting at a 4.2-month supply, up from 4.1 months in July and 3.3 months in August 2023. August’s median existing-home price for all dwelling types was $416,700, a 3.1% increase over the same month last year ($404,200). Price rises were reported in all four US regions.

“The rise in inventory—and, more technically, the accompanying months’ supply—implies home buyers are in a much-improved position to find the right home and at more favorable prices,” Yun said. “However, in areas where supply remains limited, like many markets in the Northeast, sellers still appear to hold the upper hand.”

To read the full report, including more data, charts, and methodology, click here.