David Wharton, Editor-in-Chief at Five Star, gave the opening remarks in the ever-educational MTech Forum at this year’s Five Star Conference & Expo. Numerous technology and subject-matter experts went deeply into how technology is advancing the industry while also addressing the posing risks that need to be recognized and taken into consideration going forward. Panelists took a deep dive into subjects including cybersecurity, artificial intelligence, and technological advancements in mortgage servicing from speakers and panel experts.

Leah Price, Senior Financial Technology and Innovation Specialist for the Federal Housing Finance Agency (FHFA) gave the keynote address, sharing insights into FHFA’s approach to Responsible Innovation, what the Office of Financial Technology is working on, the new Chief AI Office, and takeaways from FHFA’s first Tech Sprint.

Guarding the Gates: The Critical Role of Cybersecurity

Safeguarding confidential financial information and making sure regulations are followed are critical in a time when digital revolution is changing the business landscape. Panel experts talked about new threats, data security, and how technology might strengthen mortgage servicing operations with this panel of cybersecurity experts and thought leaders in the field.

Panelists included:

- Angel Hernandez, Chief Strategy Officer at Stavvy

- Heather L. Beach, VP of Enterprise Risk & Compliance at Xome

- David Callahan, EVP and CIO of LoanCare

- James Vinci, Chief Technology Officer for Selene Finance

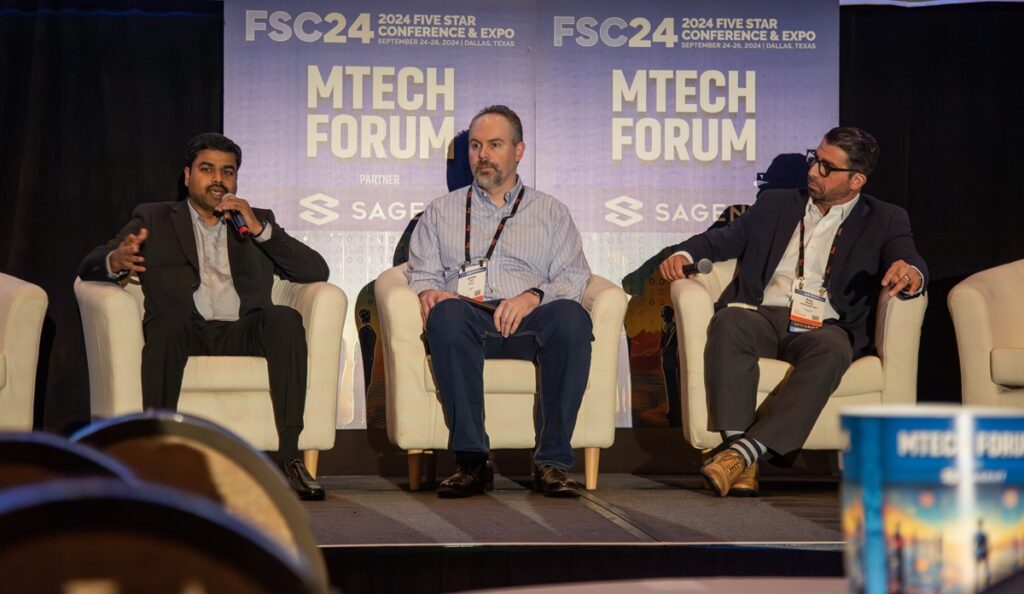

Innovations in Mortgage Servicing Technology

The second group of panelists revealed their insight on how new technologies are transforming the way that mortgage servicing is done. Our panel of forward-thinking business experts will go over the newest developments, obstacles, and chances to advance mortgage servicing operations. Whether you’re a lender, servicer, or tech supplier, the course offered crucial information about the changing landscape of the industry.

Experts included commentary from:

- Kevin Hamilton, CEO of Bron

- Cyril Arokiadoss, Senior VP of Digital Engineering at LoanCare

- James Curl, CTO of Xome

- Rida Sharaf, Chief Strategy Officer for USRES/RES.NET

Implementing AI Solutions in Servicing

Wrapping up the Forum with their takes on the transformative potential of Artificial Intelligence (AI) within mortgage servicing were:

- Rodney Cadwell, CEO of Quandis, Inc.

- Alec Crawford, Founder & CEO of Artificial Intelligence Risk, Inc.

- Omer Farooque, CTO for Sagent

- Bhupinder Mehta, SVP, Chief Transformation Officer and Operations Lead at BSI Financial Services

- Mang-Git Ng, CEO of Anvil

- Ramesh Sarukkai, CPTO and Founder of Rate Inc. & Prajna Inc.

From underwriting and risk assessment to customer service and operational efficiency, our panel of experts will explore real-world applications and ethical considerations as they break down how the landscape is already being impacted by this technology—and where it’s headed in the years to come.

For more information on the MTech Forum and the 2024 Five Star Conference & Expo, click here.