Less than one-third (32.1%) of renter households pay under $1,000 in monthly rent—the lowest share on record, according to a new report from Redfin. That total is down nearly 10% from 2022’s reported share of 35.2%, and nearly 20% since 2012 (50.4%).

Most (47.9%) renter households pay between $1,000 and $1,999 per month, while nearly 15% (14.4%) pay $2,000-$2,999, and 5.7% pay $3,000 or more.

Redfin’s report is based on Census Bureau data covering U.S. apartments in buildings with five units or more, in 2023, the most recent year for which the Census has data. Historical rents are inflation-adjusted to represent 2023 dollars.

Skyrocketing pandemic rents which stabilized near their record high created the shrinking share of rental listings under $1,000. The median apartment asking rent is now $1,634, nearly the same as last year but up roughly 20% from pre-pandemic prices.

“Rising rents have made it increasingly difficult for people to find housing in America,” said Redfin Senior Economist Sheharyar Bokhari. “Low-income workers, college students, immigrants, and people on the fringes of homelessness have had to come up with new ways to be resourceful, with some taking on multiple roommates and others receiving financial support from family or friends.”

Many Renters Are Simply Staying Put

While about one of every three renter households pays less than $1,000 in monthly rent, roughly one of every 13 (7.5%) apartments on the market is priced below $1,000. The majority (63.7%) are in the next bracket up, costing between $1,000 and $1,999, with about one-fifth (22%) listed for $2,000-$2,999, and 6.9% listed for $3,000 or more. This is based on listing data from Redfin.com and Rent.com covering the three months ending Sept. 30, 2024; the remainder of the report uses Census data through 2023.

Not surprisingly, some renters in apartments under $1,000 a month aren’t moving because they simply can’t afford to. Many signed their leases years ago, when housing was more affordable, and while property owners will raise rents for existing tenants, those increases are usually smaller than the price bump they add when listing an empty apartment on the market.

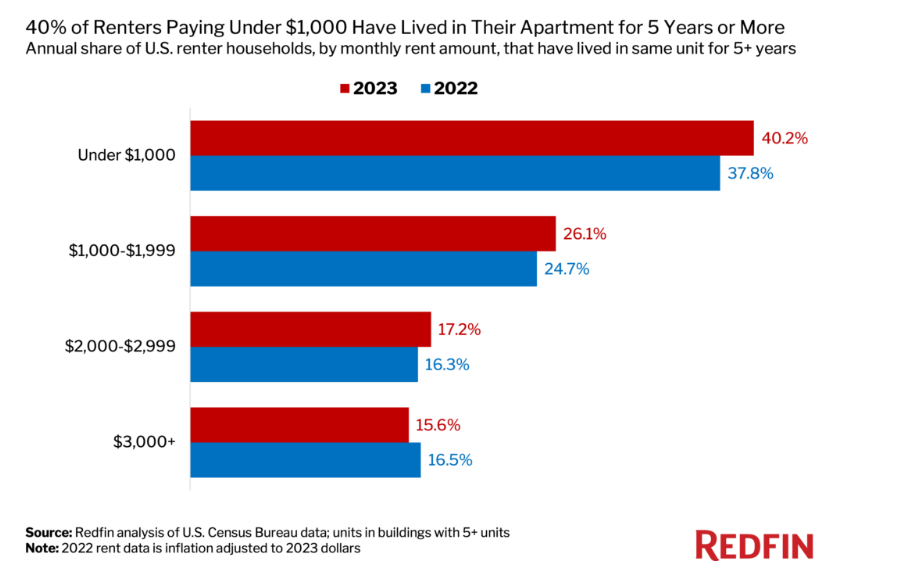

In this case, staying put means being in an apartment for over five years for two out of every five (40.2%) renter households. That’s compared with 26.1% of renters paying $1,000-$1,999, 17.2% of renters paying $2,000-$2,999 and 15.6% of renters paying $3,000 or more.

Oklahoma City, New Orleans, and Cleveland Ranked Most Rent-Friendly Cities

Out of the 50 most populous core-based statistical areas in America, nearly two-thirds (64.3%) of renter households in Oklahoma City pay less than $1,000 in monthly rent, with New Orleans (63.5%) coming in second; followed by Cleveland (63.4%); Louisville, Kentucky (57.6%); and Pittsburgh (55.8%). The four other metros where the majority of renters pay under $1,000 are Buffalo, New York (55.2%); Cincinnati (54.9%); St. Louis (53.9%); and Memphis, Tennessee (53.5%).

While these metro areas are among the lowest asking rents in the country, some have seen large increases lately—likely because low rents fueled an increase in demand. The median asking rent in Cleveland, for example, rose 11.1% year-over-year last month, one of the largest jumps among the metros analyzed. Cincinnati and Louisville also saw sizable increases.

California Renters Are Least Likely to Pay Under $1,000

Not surprisingly, metros that were either already expensive or saw an explosion in popularity recently also saw a drop in affordable rents. In San Diego, just 7.1% of renter households pay less than $1,000 in monthly rent—the lowest share among the 50 most populous metros. Next came San Jose, California (7.8%); Washington, D.C. (8%); Denver (8.5%); and Austin, Texas (9.1%).

Four Metros Where Renters Are More Likely to Pay Under $1,000 a Month Than They Were Pre-Pandemic

First up is Baltimore, which has the biggest increase: one-quarter (25.1%) of renter households pay less than $1,000 in monthly rent now, up from 21.6% in 2019. The three other metros that saw increases were New Orleans (63.5%, up from 60.5%) and, surprisingly, New York (24.9%, from 23.7%) and Los Angeles (13%, from 12.3%).

And then there are those cities where renters are less likely to find a deal. Leading that group is Birmingham, Alabama, which had the largest decline of the areas analyzed. The Magic City has become slightly less magical for some: 61.7% of renter households paid under $1,000 in 2019, but that number has dropped to 44%. The runners-up also had huge drops: Phoenix (12.4%, down from 28.1%); Las Vegas (17.8%, from 32.5%); Charlotte, North Carolina (16.4%, from 30.8%); and Richmond, Virginia (18.6%, from 33%).

The drop in $1,000 or less apartments for many cities, such as Phoenix, can be explained as a combination of a surge in popularity during the pandemic, which created a higher demand for housing, and therefore higher rents.

Click here to access Redfin’s full report on rentals.