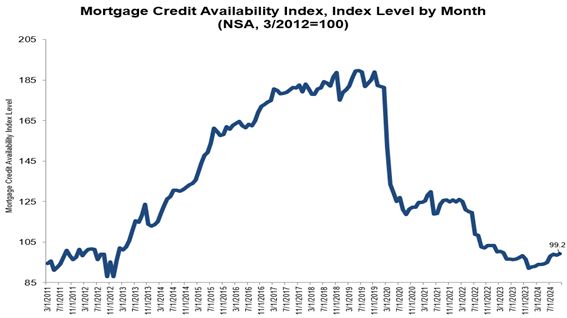

Mortgage credit availability increased in October according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

The MCAI rose by 0.7 percent to 99.2 in October. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The index was benchmarked to 100 in March 2012. The Conventional MCAI increased 1.0 percent, while the Government MCAI increased by 0.4 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.2 percent, and the Conforming MCAI rose by 0.9 percent.

“Mortgage credit availability increased to its highest level since April 2023, driven by gains across all loan categories. However, despite the across-the-board increases, overall credit supply remains tight, with the index still near the very low levels of 2011-2013,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Notably, while credit availability was higher over the month, it was for a specific segment of borrowers. Credit supply improved in loan programs for cash-out refinances and those that require lower-LTV and higher credit scores. Additionally, there was greater availability of jumbo loan programs, which pushed the jumbo index up over the month.”

The MCAI rose by 0.7 percent to 99.2 in October. The Conventional MCAI increased 1.0 percent, while the Government MCAI increased by 0.4 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.2 percent, and the Conforming MCAI rose by 0.9 percent.

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI and are designed to show relative credit risk/availability for their respective index. The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

The Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100), while the Conventional and Government indices have adjusted “base levels” in March 2012. MBA calibrated the Conventional and Government indices to better represent where each index might fall in March 2012 (the “base period”) relative to the Total=100 benchmark.

The Total MCAI has an expanded historical series that gives perspective on credit availability going back approximately 10-years (expanded historical series does not include Conventional, Government, Conforming, or Jumbo MCAI). The expanded historical series covers 2004 through 2010 and was created to provide historical context to the current series by showing how credit availability has changed over the last 10 years – including the housing crisis and ensuing recession. Data prior to March 31, 2011 was generated using less frequent and less complete data measured at 6-month intervals and interpolated in the months between for charting purposes. Methodology on the expanded historical series from 2004 to 2010 has not been updated.

Data prior to 3/31/2011 was generated using less frequent and less complete data measured at 6-month intervals interpolated in the months between for charting purposes.

To see the full report, click here.