Paying a million dollars for a home might seem like a dream for most Americans. Yet every year, more people are spending seven figures on a new house, with San Jose and San Francisco the meccas of high-cost living in the US. In their new report analyzing U.S. Census Bureau data, LendingTree discovered that the share of million-dollar homes is increasing, and that some parts of the nation are becoming magnets for these high-priced houses.

Key Findings

- Million-dollar homes are more common, but they’re not everywhere … yet. Across the nation’s 50 largest metros, 10.57% of owner-occupied homes were valued at $1 million or more in 2023, up from 7.71% in 2022. That’s a year-over-year increase of 2.86 percentage points (1.32 million housing units).

- San Jose and San Francisco have the largest share of million-dollar homes. Respectively, 71.57% and 56.57% of owner-occupied homes in these metros are worth $1 million or more, up from 66.28% and 52.91%. These are the only two cities in the study where a majority of homes are worth $1 million or more.

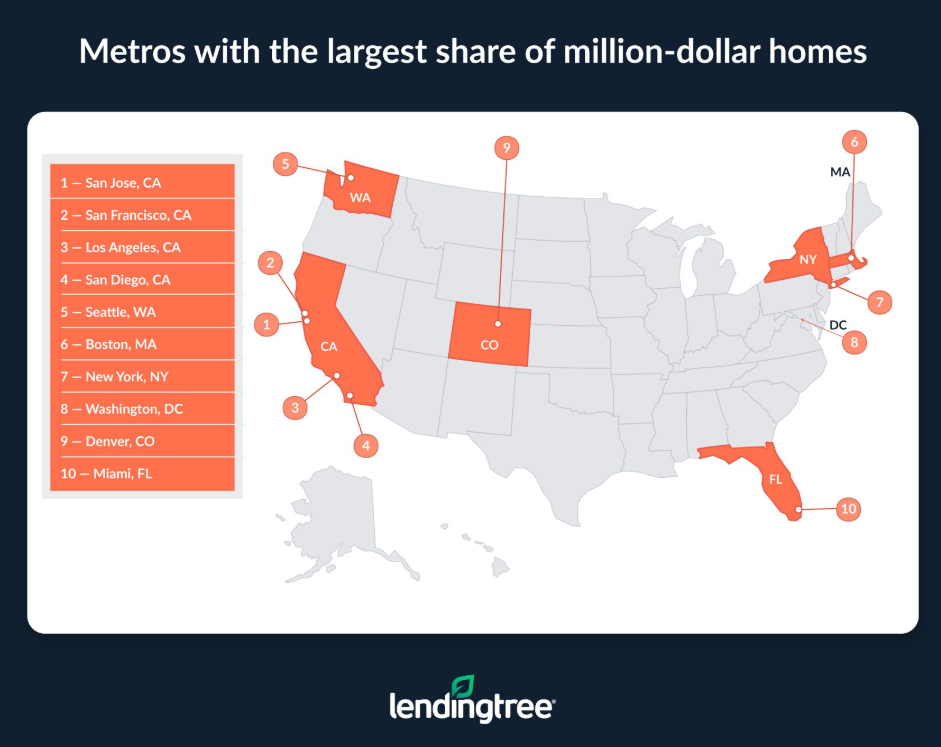

- The four metros with the highest percentage of million-dollar homes are, no surprise, all in California. Limited housing supplies and wealth generated by the tech and entertainment industries are just two factors that feed into the 44.02% of owner-occupied homes across San Jose, San Francisco, Los Angeles, and San Diego that are valued at $1 million or more.

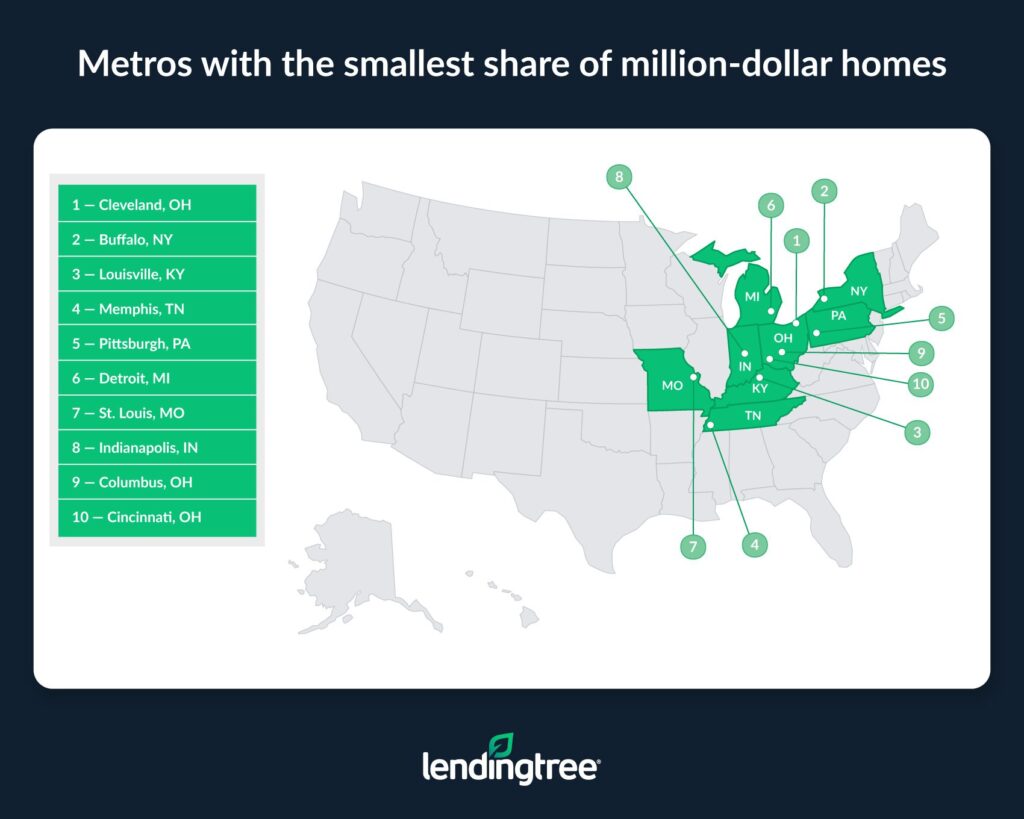

- Head east for metros with the lowest percentage of million-dollar homes. Cleveland leads the modest-home crowd, with 1.09% of owner-occupied homes valued at $1 million or more, with Buffalo (1.16%) and Louisville (1.44%) close behind. That said, although million-dollar houses aren’t common in these three metros, their numbers are growing, with a year-over-year increase of nearly 5,800 housing units valued at $1 million or more.

Metros With the Highest Share of Million-Dollar Homes

- San Jose, California

- Owner-occupied housing units: 374,116

- Owner-occupied units valued at $1 million or more: 267,751

- Owner-occupied units valued at $1 million or more (%): 71.57%

- Median value of owner-occupied housing units: $1,393,400

- San Francisco

- Owner-occupied housing units: 9705,016

- Owner-occupied units valued at $1 million or more: 551,606

- Owner-occupied units valued at $1 mil

- Median value of owner-occupied housing units: $1,105,100

- Los Angeles

- Owner-occupied housing units: 2,189,902

- Owner-occupied units valued at $1 million or more: 797,553

- Owner-occupied units valued at $1 million or more (%): 36.42%

- Median value of owner-occupied housing units: $867,200

Metros With the Lowest Share of Million-Dollar Homes

- Cleveland

- Owner-occupied housing units: 633,722

- Owner-occupied units valued at $1 million or more: 6,925

- Owner-occupied units valued at $1 million or more (%): 1.09%

- Median value of owner-occupied housing units: $217,300

- Buffalo, New York

- Owner-occupied housing units: 332,076

- Owner-occupied units valued at $1 million or more: 3,856

- Owner-occupied units valued at $1 million or more (%): 1.16%

- Median value of owner-occupied housing units: $233,300

- Louisville, Kentucky

- Owner-occupied housing units: 392,931

- Owner-occupied units valued at $1 million or more: 5,654

- Owner-occupied units valued at $1 million or more (%): 1.44%

- Median value of owner-occupied housing units: $253,600

Why Are Million-Dollar Homes Becoming More Common?

While homes worth $1 million or more are actually relatively rare in most metros, it’s a fact that home prices are generally increasing. Dwindling supply has pushed the price point of “middle-class” housing higher and higher. In some metros, such as San Jose or San Francisco, $1 million may not buy much more than a relatively basic home.

Experts generally agree the U.S. is short millions of housing units, and in the land of supply and demand, fewer homes equals higher prices. These steep prices are often felt the most in large metros, where strict zoning laws can make new construction difficult and exacerbate supply issues. This can make prices once reserved for only the most luxurious homes more common for, well, more common homes.

And even if the housing supply suddenly increased dramatically and prices declined, there would be numerous expensive properties nationwide. Wealthy buyers who buy these high-end properties aren’t going away, nor are the developers who create them.

For the study, LendingTree ranked the nation’s 50 largest metropolitan statistical areas (MSAs) by the share of owner-occupied homes, with or without a mortgage, valued at $1 million or more, using data from the U.S. Census Bureau 2023 American Community Survey with one-year estimates (the latest available at this study’s writing). To determine the share of million-dollar homes in a metro, LendingTree divided the number of owner-occupied housing units priced at $1 million or more by the overall number of owner-occupied housing units in the area.

Click here for more on LendingTree’s study on million dollar homes.