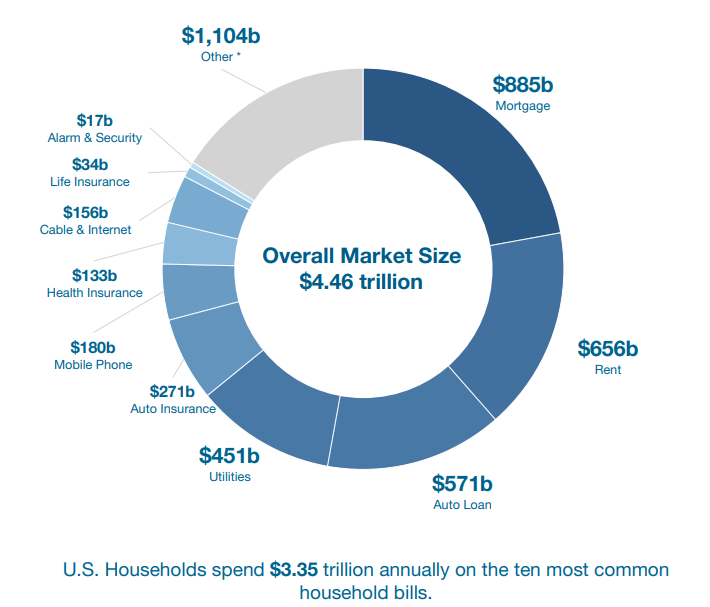

The average U.S. household spends $25,512 annually on essential household bills—an annual bill spend of roughly $2,126 per month, over one-third (34%) of the U.S. household median income ($74,755).

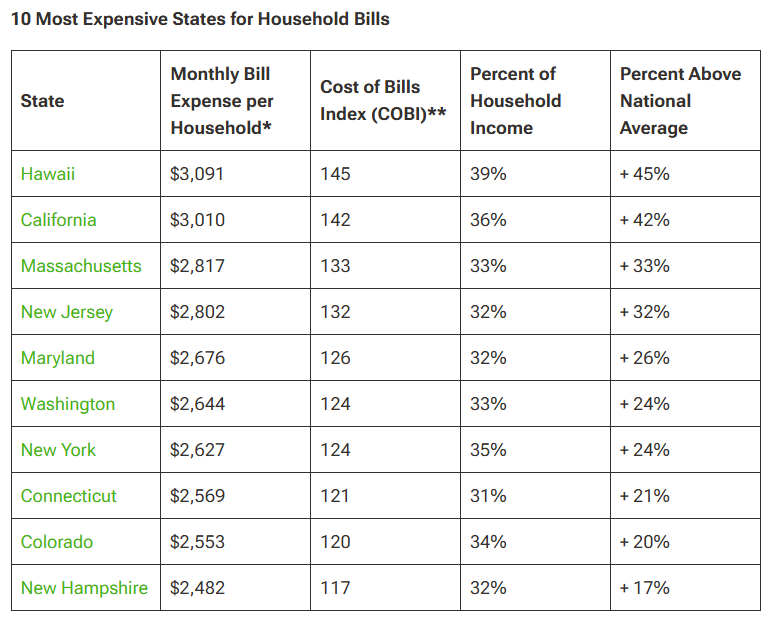

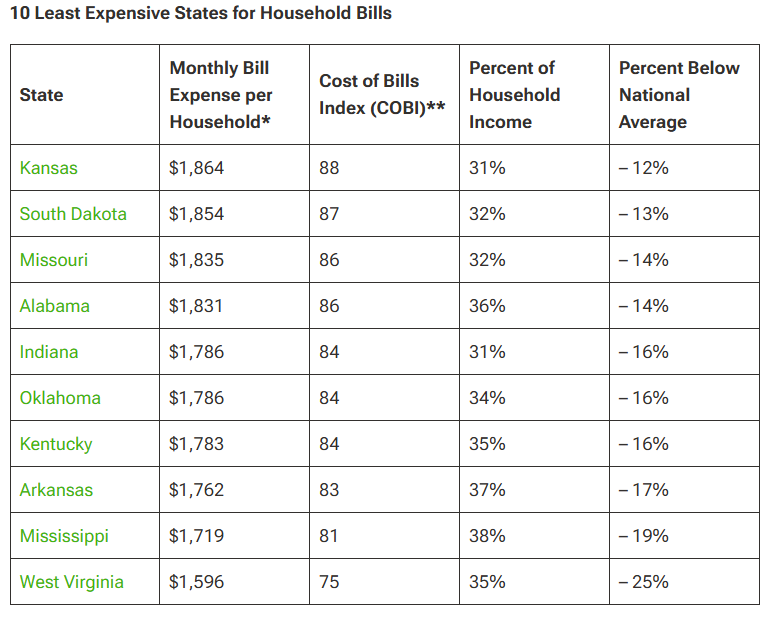

This news, from a report by doxo, shows that many states rank well above or below the national average. It’s no surprise that the most expensive states to live in are Hawaii, California, Massachusetts, and New Jersey, nor that West Virginia, Mississippi, Arkansas, and Kentucky lead the list of most affordable states to live in.

This breakdown of household bill expenses provides more detail on how bills contribute to the overall cost of living in all 50 states. The proprietary dataset provided by doxo, based on actual bill payments across 97% of U.S. zip codes and 45 bill pay service categories, was introduced earlier this year. Their Cost of Bills Index provides a standardized basis of comparison for any location in the country, and the 2024 State by State Bill Pay Market report looks at the state level, going wide and deep on The Bill Pay Economy in the U.S.

And there’s lots to consider. Americans are feeling the financial squeeze: 85% are worried about their ability to pay their bills, and nearly three-quarters (74%) have made changes to their spending and savings habits this year.

“With ongoing economic uncertainty, Americans continue to feel the pressure on their household budgets, especially as these bills eat up more than a third of the average median income,” said Liz Powell, Senior Director of INSIGHTS at doxo. “With doxoINSIGHTS, we’re arming Americans with the data transparency needed to make more informed decisions about their budgets and expenses, providing the broadest data available on actual household spending for critical bills. Offering clear and concise data through our recurring doxoINSIGHTS reports, including our annual State by State reports, doxo is proud to be shaping more informed bill payers across the nation.”

The report lists the total monthly bill expenditure for each state, breaking out the ten most common household bills. These include mortgage/rent, auto loan, utilities, cable/internet, cell phone, alarm/security, and three types of insurance (auto, life, and the consumer-paid part of health insurance).

Not surprisingly, Hawaii holds the top spot as the most expensive state in the union. Hawaiians spend $3,091 a month on household bills, 45% above the national average. The most affordable state goes to West Virginia, with an average monthly bill spend almost half of Hawaii’s—only $1,596, making them 25% below the national average.

The 10 most expensive and least expensive states to live in include:

Click here for more on doxo’s 2024 State by State Bill Pay Market report.