According to data from the Mortgage Bankers Association‘s (MBA) Builder Application Survey (BAS) for December 2024, mortgage applications for the purchase of new homes rose 8.9% over the previous year. The number of applications fell 3% from November 2024. Typical seasonal patterns have not been adjusted for in this update.

“Applications for newly built homes increased 9% compared to a year ago in December, while the FHA share of applications reached its second highest level in the survey’s history at 29%,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “First-time homebuyers remained active in the new home segment, as existing inventory for starter homes remains tight. The monthly decrease in applications was consistent with typical seasonal patterns. MBA’s estimate of seasonally adjusted new home sales fell in December but remained slightly above last year’s sales pace.”

December Home Sales Activity: In A Nutshell

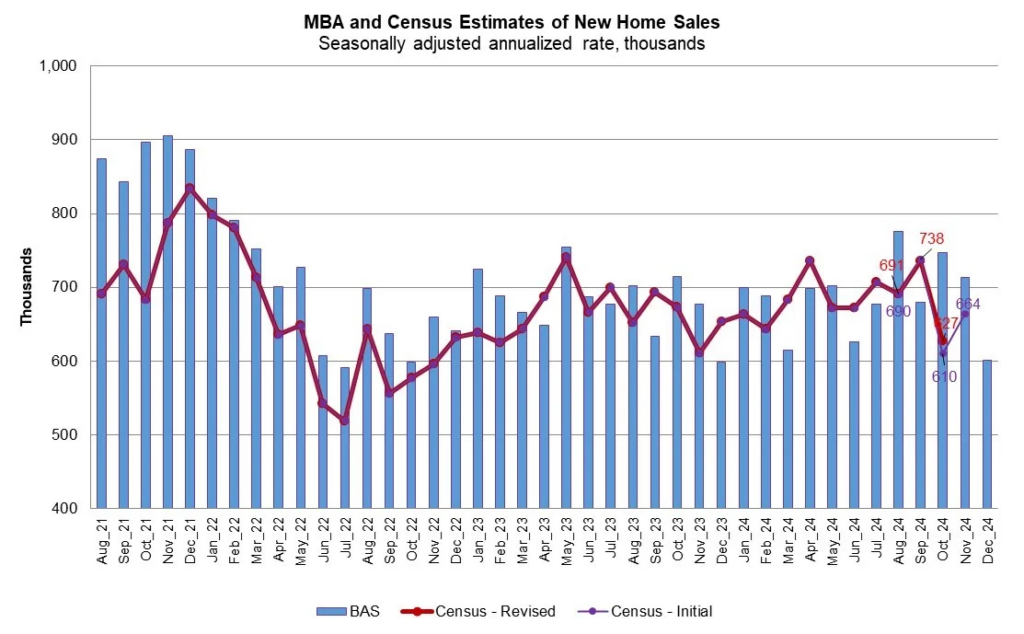

According to the MBA, the number of new single-family home sales in December 2024 was 601,000 units, a seasonally adjusted yearly rate that has been a leading indication of the U.S. Census Bureau‘s New Residential Sales report for years. The BAS’s mortgage application data, along with assumptions about market coverage and other variables, are used to calculate the new home sales estimate.

Compared to the pace of 713,000 units in November, the seasonally adjusted estimate for December represents a 15.7% decline. According to MBA, there were 46,000 new home sales in December 2024 on an unadjusted basis, which is 6.1% less than the 49,000 new home sales in November.

Conventional loans accounted for 60.1% of loan applications by product type, followed by FHA loans (29.5%), RHS/USDA loans (0.5%), and VA loans (9.9%). Between November and December, the average loan size for new homes dropped from $402,873 to $400,930.

The number of applications from mortgage subsidiaries of home builders nationwide is monitored by MBA’s Builder Application Survey. MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro levels by using this data along with data from other sources. Information about the kinds of loans taken out by first-time homebuyers is also included in this report.

Every month, the Census Bureau conducts official new home sales estimates. New house sales are included in that statistics at the time of contract signing, which usually occurs at the same time as the mortgage application.

To read the full report, including more data, charts, and methodology, click here.