A recent study by Realtor.com took a closer look at the immediate and long-term impact that the wildfires in the Palisades and Eaton regions of Los Angeles County will have on the area’s housing market.

Into their second week, the fires continue to burn, fueled by lingering drought-like conditions and ongoing windy conditions. All the while, communities in the Los Angeles County region are faced with the decision to either stay and rebuild or pick up the pieces and relocate elsewhere.

Though the full damage of the fires has yet to be fully assessed, more than $40 billion worth of residential real estate is located within the boundaries of the impacted area. In measuring the impact on the housing space in the long- and near-term, Realtor.com matched up fire perimeters as reported by the National Interagency Fire Center on January 21, 2025 with its own database of residential properties and found the following:

- The 15,841 residential properties within the designated fire boundaries had a total value of $40.3 billion. This estimate includes single-family homes, town homes, condominiums, and cooperatives.

- The sizable total value of residences impacted by the fires stems from both the high number and the relatively high median value. The median home within the boundaries of the Eaton fire has an estimated $1.3 million value while the typical home in the Palisades fire boundary has an estimated value of $3.0 million.

- For comparison, the total value of residential real estate in Los Angeles County is $2.0 trillion, and the median value of the 1.7 million properties in Los Angeles County is somewhat lower ($870,500).

- The residences within the fire boundaries comprise 0.9% of Los Angeles County residential properties by number and account for 2.0% of the total value of properties in Los Angeles County.

- So far in 2025, about 100 homes have been listed for sale within the Eaton and Palisades fire boundaries. LA county as a whole has seen 8,426 active listings year-to-date, meaning these at-risk properties made up about 1.3% of active for-sale home listings so far this year.

- Rents have been stable to modestly down in the Los Angeles metro area in recent years as the rental vacancy rate has risen to a 10-year high. This will likely help the market better accommodate displaced households, but rental price increases are still expected.

- The typical property in the boundaries of the Palisades fire was worth $3 million, and the median value of a home in the Eaton region was $1.3 million. The Los Angeles County median home value currently stands at approximately $870,500.

The number of homes listed for sale in the impacted areas fell from 94 homes in the first week of the year (pre-fire), to 52 homes last week, as sellers either pulled listings off the market, or potential listings never hit the market. In this same period of time, the broader Los Angeles market saw the count of active listings rise from 6,089 to 6,743, an increase that is seasonally typical.

Realtor.com forecast that the Los Angeles area will likely see an uptick in local market home search activity, as displaced families hoping to remain local while assessing the damage to their property and as they begin the rebuilding process. This upward push in demand will impact the price of rentals in the area and drive them higher in the short-term.

According to Gregory Eubanks, a Redfin Premier Agent, this inventory shortage of rentals is creating bidding wars for the short supply available: “Tons of past clients are reaching out on behalf of friends, seeing if I know of any available rentals. There’s competition for nearly every rental, and it’s not just on price; a lot of people are taking on long leases to secure a place to live. A rental listed for $16,000 per month got bid up to $30,000, and the winners took on a two-year lease. On the buying and selling side, people are pulling back, waiting for the dust to settle. Two buyers have canceled deals because they don’t feel comfortable making such a big purchase with the catastrophe going on. Three clients have canceled their listings, with the homeowners opting to rent their homes out to people impacted by the fires instead.”

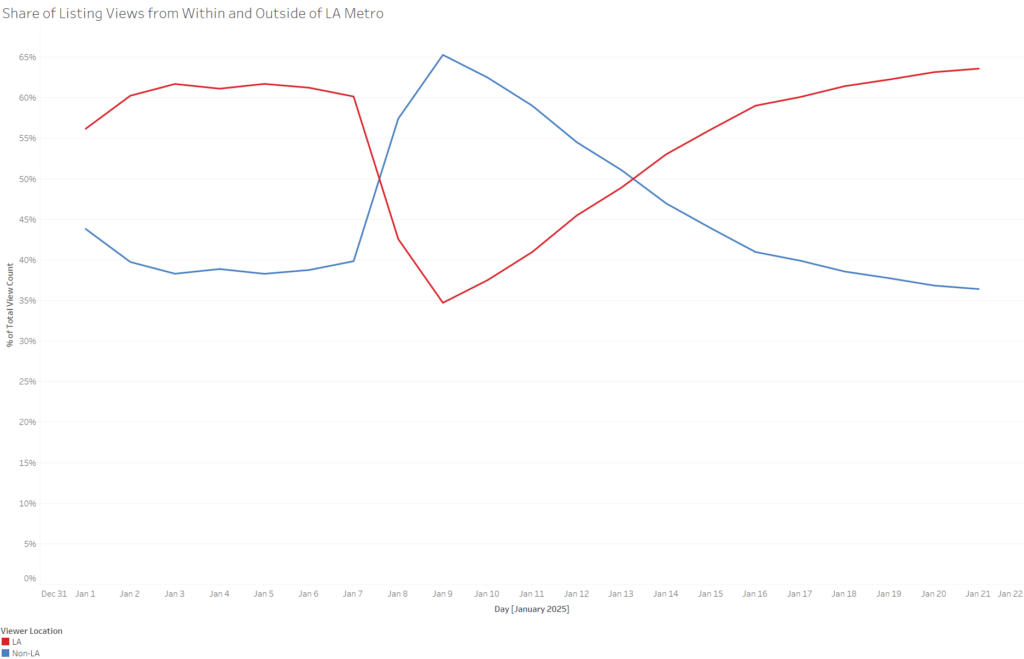

Realtor.com found that for-sale listing viewership from outside of LA surged starting on January 8, as the wildfires began escalating. Prior to January 8, less than 40% of listing viewership came from outside the LA metro area. By January 9th, the out-of-metro share of views reached 65%, peaking before falling slowly and reaching pre-fire share by January 18. Of note, in the last few days, out-of-metro viewer share has continued to fall, suggesting that within-LA viewership is picking up, perhaps as displaced residents look for living options. Though the pick-up in out-of-metro viewership is quite pronounced, the LA metro is very large, so the effect is likely somewhat muted compared to what we would see in the areas immediately adjacent to the areas affected by the wildfires.

Rents in the Los Angeles metro area in December were the fourth highest in the country behind New York, Boston, and San Jose. The median asking rent for a zero- to two-bedroom home was $2,750, a decline of 2.7% compared to the prior year. Asking rents in the Los Angeles metro have been relatively weak in recent years. The last time the metro saw rent growth above 1.5% year-over-year was in 2022, and in the last two months of 2024, rent declines grew somewhat larger.

And as Heidi Ludwig, a Redfin Premier Agent, noted, some are getting creative in their rental options as many Airbnbs are turning into long-term rentals: “People are getting creative; I’m seeing Airbnbs turn into regular rentals, and second-home owners offer up their empty homes as rentals. I’ve been all over Facebook, asking if anyone knows of open rentals, and then matchmaking with clients.”

Click here for more on Realtor.com’s examination of the Los Angeles housing market in the wake of the area’s wildfires.