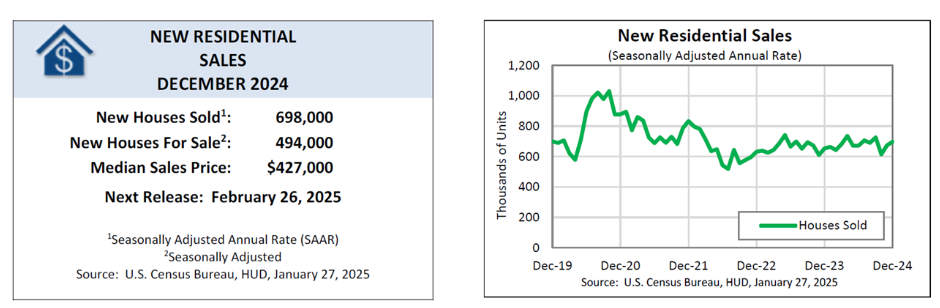

The U.S. Census Bureau and the U.S. Department of Housing & Urban Development (HUD) have released their new residential sales statistics for December 2024, which found that sales of new single-family homes were at a seasonally adjusted annual rate of 698,000—3.6% above the revised November rate of 674,000, and 6.7% above the December 2023 estimate of 654,000.

“New home sales are now 16% higher than the pre-pandemic average, but we are currently still only building about 10 per 1,000 households, which is about the same as in 1991,” said First American Chief Economist Mark Fleming. “New construction has struggled to keep up with demand. Rising construction costs, zoning restrictions, and a shortage of labor have all contributed to the inability to build enough homes.”

According to HUD and the Census Bureau, an estimated 683,000 new homes were sold in 2024, 2.5% above the 2023 total of 666,000.

“There are two main reasons the new home market was stronger in 2024,” added Bright MLS Chief Economist Lisa Sturtevant. “First, in many markets, there was simply more new home inventory and some buyers who might have wanted to purchase an existing home were instead looking at new construction. Second, home builders were able to offer prospective buyers concessions, including rate buydowns, to entice them to new home communities.”

In terms of affordability, the median sales price of new houses sold in December 2024 was $427,000, with the average sales price of $513,600.

“The balance between the new and existing home markets could change in 2025,” said Sturtevant. “The available supply of existing homes for sale is increasing as more current homeowners are deciding to sell. And while mortgage rates remain elevated and builders will still promote rate buydowns, those concessions get more difficult as profit margins narrow.”

Freddie Mac reported that the 30-year fixed-rate mortgage (FRM) averaged 6.96% as of January 23, 2025, down from the previous week when it averaged 7.04%. A year ago at this time, the 30-year FRM averaged 6.69%.

In terms of for sale inventory and supply, the seasonally-adjusted estimate of new houses for sale at the end of December was 494,000—a supply of 8.5 months at the current sales rate.

“To put this pace in perspective, in the late 1930s and early 1940s, we were building between 500,000 and 700,000 units a year, which equated to 15-20 units per 1,000 households,” explained Fleming. “Post-World War II that ramped up to over a million units, peaking at 1.9 million units per year in 1950, or 44 units per 1,000 households. We have never built at this rate since. The key to fixing the affordability crisis is to increase the amount of construction in this country to keep up with new demand every year as well as make up for the under-building that has now been occurring for decades.”

Click here for more on the HUD and U.S. Census Bureau report on new residential sales.