The number of office-to-apartment (O-to-A) conversions is on the rise, and by 2025, there will be about 71,000 units planned, breaking new records. This increase coincides with fierce competition among tenants and a widespread lack of rental flats. A new RentCafe report revealed the share of future projects, anticipated growth, and which metros are set to lead in O-to-A conversions.

This movement goes beyond simply building new homes; it also represents a move toward sustainable, neighborhood-centered urban areas that meet the changing needs and preferences of contemporary American cities. Therefore, turning offices into homes is a sensible solution to the expanding housing need as remote work continues to change the nature of the workplace and a sizable portion of office space in the U.S. is still vacant.

There is a significant amount of carryover of unfinished projects from year to year, even while the number of office-to-apartments conversions is increasing, suggesting greater interest in this kind of retrofitting. This implies that other elements such as the viability of conversion, building expenses, and regional incentives are involved. Only 3,709 of the 55,339 office-to-apartments that were in some stage of development in January of last year were finished by December, meaning that 51,630 units remained unfinished until 2025. At the beginning of 2025, this, along with 19,021 additional proposed conversions, indicates a noteworthy 28% increase in the pipeline year-over-year.

Modern Buildings Being Reused, Conversions Rise Across U.S. Markets

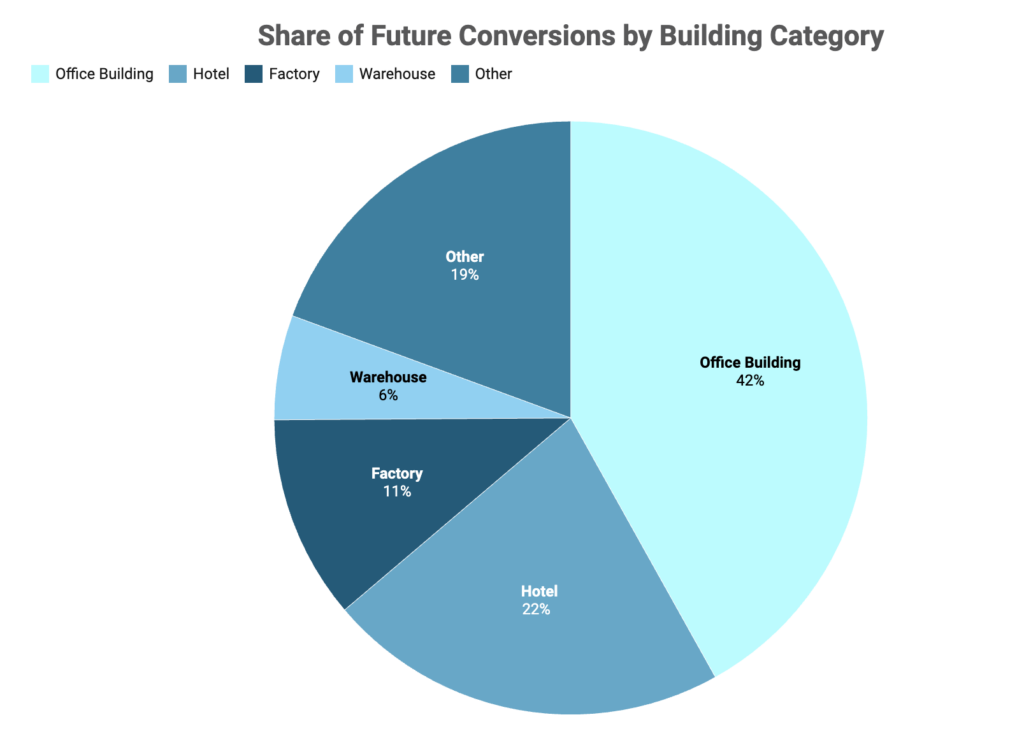

The most common adaptive reuse project type is notably creative office-to-apartment conversions, which make up about 42% of the 168,500 upcoming conversion projects. This is a significant increase from the previous year, when this category accounted for 38% of all conversions. This follows stagnating rents, falling commercial property values, and increasing vacancy rates in office buildings nationwide. All of this increases the financial viability of converting workplaces into distinctive living areas.

It’s interesting to note that this trend has grown significantly in recent years. The amount of planned office-to-apartment conversions, for example, was 23,100 units in 2022 and nearly doubled to 45,200 units in 2023. The pipeline then reached 55,300 future apartments in 2024, marking the continuation of the growth. As of 2025, the number of offices that need to be transformed has reached an all-time high of 70,700.

This notable growth demonstrates how America’s cities are changing due to changes in work patterns and living preferences. Therefore, it is evident that adaptive reuse is playing a significant role in changing urban landscapes as office spaces are redesigned to satisfy the demand for housing.

The rise in adaptive reuse projects incorporating newer structures built during the 1990s and 2010s suggests a significant change. Even while just 1.27% of finished projects made use of these more recent structures, the percentage rises to 7.03% for projects in the future. This rise indicates that people are becoming more interested in reusing contemporary buildings (perhaps because they are easier to modify for new purposes and fulfill modern standards). According to CommercialEdge’s Conversion Feasibility Index (CFI), over 1.2 billion square feet of office space nationwide—or 14.8% of the whole office inventory—are deemed eligible for conversion.

Which Metro Has the Largest O-to-A Conversion Pipeline?

The “Big Apple” seems to stay on some sort of list when it comes to the housing market, doesn’t it?

With 8,310 office buildings scheduled to be converted to residences, the New York metro area is leading the way. Washington, D.C., which led last year, now comes in second with 6,533 more apartments to be transformed. Los Angeles comes in third with 4,388 anticipated conversions, an astounding 80% rise over the previous year. Not to be outdone, major cities like Atlanta, Dallas, and Chicago are now adopting office-to-apartment conversions, following the national trend.

Many communities are simplifying the conversion procedure and providing financial incentives to encourage conversion projects even more. For example, in New York City, tax exemptions of up to 90% are available for renovated buildings that contain at least 25% affordable flats.

In a similar vein, the Housing in Downtown initiative in Washington, D.C., offers 20-year tax breaks for conversions from commercial to residential space. Additionally, the approval process is being intentionally made simpler by cities like San Francisco and Minneapolis. While San Francisco has updated construction rules, altered the Planning Code, and established a special financing area to enable these conversions, Minneapolis just eliminated the need for public hearings.

Future Office-to-Apartments by Metro Area:

| Metro Area | O-to-A Pipeline as of 2025 | Change of O-to-A Pipeline (YoY) | Total Conversions Pipeline (All Building Types) | Share of O-to-A as of 2025 |

|---|---|---|---|---|

| New York | 8,310 | 59% | 15,710 | 53% |

| Washington, D.C. | 6,533 | 12% | 10,527 | 62% |

| Los Angeles | 4,388 | 80% | 8,985 | 49% |

| Chicago | 3,606 | 28% | 6,669 | 54% |

| Dallas | 2,725 | −14% | 3,451 | 79% |

| Atlanta | 2,239 | 57% | 3,980 | 56% |

| Minneapolis | 1,873 | 40% | 2,404 | 78% |

| Charlotte, NC | 1,787 | 107% | 3,260 | 55% |

| Cincinnati | 1,753 | 12% | 2,768 | 63% |

| Kansas City, MO | 1,676 | 11% | 3,066 | 55% |

1. New York, NY

- Future office-to-apartment conversions as of 2025: 8,310 units

- Share of office-to-apartment conversions as of 2025: 53%

- Office space suitable for residential conversion: 305.4 million square feet

With 8,310 of these cutting-edge units presently under construction, the New York metro area tops the country in office-to-apartment conversions, up 59% over the previous year. In particular, NYC has the largest office market in North America, with around 730 million square feet of space. Additionally, almost 80% of the Big Apple’s office space is located in Manhattan alone.

Additionally, there is room for more office-to-apartment conversions—more than 305.4 million square feet, or nearly 46% of the metro’s total office inventory—out of the available office space in the area. One notable project is the renovation of Pfizer’s former global headquarters at 219 E 42nd St., which is anticipated to result in 536 rental units.

2. Washington, D.C.

- Future office-to-apartment conversions as of 2025: 6,533 units

- Share of office-to-apartment conversions as of 2025: 62%

- Office space suitable for residential conversion: 61.3 million square feet

After dropping out of the top slot since last year, Washington, D.C., now ranks second in terms of office-to-apartment conversions. Although only 14% of the metro’s 61.3 million square feet of office space inventory consists of eligible conversion candidates, its 2025 pipeline includes 6,533 future flats, representing a 12% year-over-year growth.

The Universal Buildings project, located at 1825-1875 Connecticut Ave. NW, is a significant conversion in the neighborhood. The land, which is more than one million square feet in size, will be developed into The Geneva, a residential complex with at least 69 affordable apartments among its 525 new units.

3. Los Angeles

- Future office-to-apartment conversions as of 2025: 4,388 units

- Share of office-to-apartment conversions as of 2025: 49%

- Office space suitable for residential conversion: 83 million square feet

Thousands of homes have been destroyed by wildfires in the Los Angeles area, making the already acute housing scarcity in the metro area worse. However, with over 4,400 planned units—or 49% of all anticipated adaptive reuse projects—innovative office-to-apartment conversions are probably going to help meet some of this growing demand.

Furthermore, it is determined that over 83 million square feet of office space, or 25% of the metro’s total office inventory, should be renovated. The ARCO Tower makeover, which will convert the 33-story office skyscraper at 1055 Seventh St. into brand-new apartments, is one noteworthy project that will achieve this goal.

Metros With More Than 100% YoY Growth in O-to-A Conversions:

| U.S. Metro Area | Office-to-Apartments Pipeline as of 2025 | Change of Office-to-Apartments Pipeline (Y-o-Y) |

|---|---|---|

| Boston | 1,167 | 160% |

| Jacksonville, FL | 1,418 | 150% |

| Omaha, NE | 1,294 | 141% |

| Charlotte, NC | 1,787 | 107% |

With each metro’s pipeline more than doubling since 2024, four of the top 20 metros had impressive year-over-year growth in office-to-apartment conversions. More specifically, with 1,787 prospective conversions, Charlotte, NC, doubled, demonstrating its dedication to adaptive reuse. Omaha, NE, saw a 141% increase as well, with an anticipated 1,294 of these ambitious conversion projects.

The 1,418 prospective conversions in Jacksonville, FL, further south, signify an astounding 150% increase. At the same time, Boston experienced a massive 160% pipeline increase, the largest among the top 20. At that time, there were 1,167 planned conversion projects. These sharp rises demonstrate how office-to-apartment conversions are becoming more and more common as each metro aims to turn vacant premises into much needed housing.

At the regional level, with over 22,000 projects, the South leads the office-to-apartment conversion trend. In particular, the top three cities for upcoming apartment construction are Atlanta, Dallas, and Washington, D.C. With over 18,200 expected conversions, the Northeast comes in second. Of course, with 8,310 potential apartments, New York is the clear winner here. Pittsburgh comes in second with 1,250, and Bridgeport, CT, with 1,473.

The Midwest comes in second with 18,038 upcoming renovation projects. With 3,606 planned residential units, Chicago leads the field here, followed by Minneapolis (1,873) and Cincinnati (1,753). Lastly, with 12,291 units to be converted, the West lags behind. With 4,388 units, Los Angeles leads the region, followed by Phoenix (1,634) and Denver (1,398 units).

To read more data, charts, and methodology, including the full list of U.S. metros and street addresses where office-to-apartment conversions are projected to take place, click here.