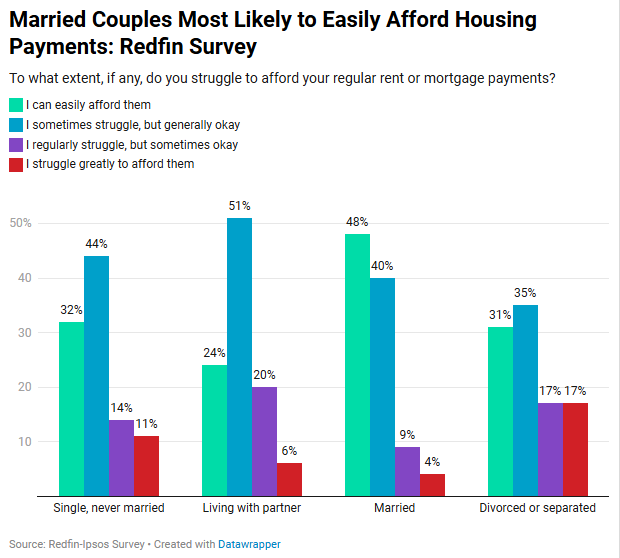

According to a recent Redfin research, slightly over half (52%) of married people find it difficult to make their regular rent or mortgage payments, while almost 70% of single, divorced, or separated people do the same. The respondents who are most likely to suffer with housing payments are those who live with their partner but are not married, as almost three-quarters (76%) of them do.

Because they usually just use their own salary to pay for housing, whereas many married couples use two incomes, single persons find it more difficult to finance housing payments. Compared to 26% of married survey participants, over three out of five (63%) single respondents and 69% of divorced respondents earn less than $50,000 annually.

Conversely, 29% of married respondents earn $100,000 or more per year, compared to 7% of single respondents and 6% of divorced respondents. Married couples are also better positioned for financial security because they obtain tax benefits that are not available to single people.

“The high cost of housing tends to hit single people hardest because they can’t pool resources with a partner to cover the same costs, unless they’re willing to have roommates,” said Daryl Fairweather, Chief Economist at Redfin. “Married couples make up a smaller and smaller share of U.S. households, so it’s important to include single people living alone or with roommates when examining ways to ease the affordability crisis.”

Most people pay their housing bills on time, even though the majority of married and single persons say they have trouble making their payments. As of September, the U.S. Census Bureau’s Household Pulse Survey found that just 1 in 20 homeowners, irrespective of marital status (married: 4%, never married: 5%, divorced: 6%), were behind on their monthly mortgage payments. Compared to 15% of divorced renters and 12% of never-married renters, 14% of married renters were behind on their rent.

Living Solo Costs Thousands More than Cohabitating

To illustrate the additional expense of living alone, consider the city of Washington, D.C. The nation’s capital has one of the largest percentages of single persons among U.S. cities, with over half of its adults unmarried. Redfin data shows that a studio or one-bedroom rental in the D.C. metro area costs $1,908 a month. While a married or cohabiting couple might split the rent and pay $954 apiece, a single person living alone would pay the entire amount on their own. Accordingly, a single person’s annual housing costs would be $11,448 higher than those of a love partner.

“People who aren’t yet married, or aren’t interested in getting married or living with a partner, often have to make more sacrifices to cover their housing costs than their coupled-up counterparts, which is one reason the government should consider zoning for single-room housing, like dormitories, and ADUs (Accessory Dwelling Unit),” Fairweather said.

The average studio or one-bedroom apartment in Los Angeles, one of the priciest rental markets in the United States, costs $2,480 a month, or $1,240 divided in half. An additional $14,880 would be paid annually by a single person paying payments alone.

Single Pringles Get the Short End of the Stick

Compared to married couples, single people are more inclined to make certain compromises in order to pay for housing. More than a quarter (27%) of those who are divorced or separated and 21% of those who are single report skipping meals entirely in order to pay for housing, compared to 14% of married persons.

Additionally, unmarried individuals are marginally more likely than married couples to take out loans from friends or relatives in order to pay for their accommodation and pursue side projects. Renters who are single or divorced are more likely to say that they won’t be buying a house anytime soon because they can’t afford it.

| Which of the following, if any, changes or sacrifices did you make in the past year to afford your monthly housing costs? (Redfin survey) Select answer choices. Respondents could select all that apply from a list of 22 options. | ||||

| Compromise | Single, never married | Divorced or separated | Living with partner | Married |

| Skipped meals completely | 21% | 27% | 31% | 14% |

| Worked a side hustle | 16% | 15% | 18% | 12% |

| Borrowed money from family/friends | 22% | 24% | 33% | 19% |

Single, Divorced Renters Stay on the Sidelines of Homeownership

Renters who are single or divorced are more likely to say that they won’t be buying a house anytime soon because they can’t afford it.

| Whether you are interested in being a homeowner or not, which of the following are reasons you won’t be purchasing a home in the near future? Select answer choices. Respondents could select all that apply from a list of 21 options. | ||||

| Reason | Single, never married | Divorced or separated | Living with partner | Married |

| I can’t afford a home in the area where I want to live | 26% | 30% | 24% | 20% |

| I am unable to save for a down payment | 24% | 30% | 23% | 18% |

| Regular upkeep/maintenance would be too expensive | 18% | 17% | 14% | 10% |

| I am not financially prepared for surprise costs | 24% | 29% | 27% | 15% |

This is according to a Redfin-commissioned survey conducted by Ipsos in September 2024. The survey was fielded to 1,802 U.S. residents aged 18-65.

To read the full report, including more data, charts, and methodology, click here.