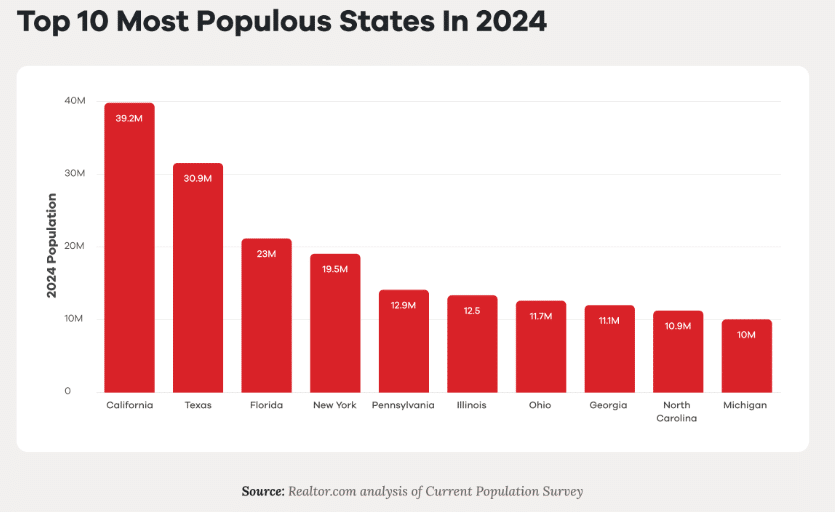

Realtor.com has released a report on housing, economic, and migratory conditions in Texas over recent years. As the fastest growing state in the U.S., the report examines who is moving to Texas, why they are coming, and what makes the Lone Star State an attractive destination for businesses that choose to invest here. The report found that by the year 2045, Texas will overtake California as the most populous state in the nation.

“The state has grown rapidly in the last several years, as people from across the country and across the world have seen what Texas has to offer,” said Danielle Hale, Chief Economist with Realtor.com. “In the years since the COVID-19 pandemic, the Texas economy has boomed, especially in high-demand industries like technology, education, manufacturing and construction. Already-scarce housing inventory from years of under-building was flooded with cash offers, and listing prices and rents soared. Texas has responded by building more and smaller homes to meet demand, helping the market settle and housing inventory climb back to pre-pandemic levels ahead of the nationwide recovery.”

“The Texas State of Real Estate” report found that the primary reasons households move to the Lone Star State from out of state are due to housing, jobs, and climate.

Who’s Coming and Why

More than one in four people shopping for homes in Texas, according to Realtor.com data, are from out of state. The two largest sources of immigration to Texas are international migration and relocation from California.

“The Texas economy is a model for other states,” said Damian Eales, CEO of Realtor.com. “Residents are attracted to Texas first and foremost for its affordable housing, followed by its favorable climate and abundant jobs. This has put Texas on a path to potentially become the largest state by the year 2045. Those are among the many reasons why at Realtor.com, we’re proud to call Texas home, as hundreds of our employees already do.”

Inventory on the Rise

Texas was the number one state for new house permits accounting for 15% of the 2024 U.S. total, punching above its 9% share of the U.S. population. The median newly constructed home on the market in Texas was 2,073 square feet, down from 2,189 in 2020, a 5.3% decrease. Over this time period, new homes in the U.S. at large have fallen from 2,112 square feet to 2,035, just a 3.6% reduction. Texas is a proven leader in the push to build more affordable new homes, and in the last two years, the share of new builds on the market priced under $350,000 has increased, while the shares of new builds priced from $350,000 to $750,000 and from $750,000 to $2,000,000 have both fallen.

“America is facing a severe housing affordability crisis, fueled by a staggering shortfall of approximately four million homes,” said Eales. “Our Texas report is just the beginning of a series that will shine a light on the gaps in our housing supply. By showcasing solutions from states like Texas and calling attention to those that are falling behind, we can drive a national conversation that leads to real, meaningful change.”

Lone Star State Affordability

The median-priced home in Texas has been less than the national median for a considerable time, despite significant recent price growth. After climbing rapidly during the pandemic, home prices in Texas have settled slightly as easing demand and increased inventory relieved some upward price pressure. As of December 2024, the median listing price in Texas was $360,000, roughly $40,000 below the national median.

In 2024, almost half (47.5%) of all for-sale inventory in Texas was priced at $350,000 or below compared to just 40.1% of national inventory. Over the past year, inventory growth helped with affordability, the report found there were 23.3% (roughly 50,000) more homes priced under $350,000 for sale in Texas in 2024 compared to 2023.

Though Texas offers considerable inventory in lower price tiers, the price distribution of for-sale homes does not match well to the state’s income distribution. Fifty-one percent of Texans make less than $75,000 per year, but just 17% of for-sale inventory is affordable to this income level. Even for 80th percentile earners, making up to $150,000 per year, just 66% of for-sale inventory is affordable.

Listings Up

Texas has claimed an increasing share of U.S. active listings nearly every year since 2016. In 2017, Texas homes made up 7.6% of all U.S. homes for sale. By 2024, this share climbed to 12.6%. Even as inventory levels suffered during the pandemic, Texas has managed to offer buyers more options than much of the country, helping to sustain buyer demand.

Inventory has reached pre-pandemic levels in Texas, relieving price pressure, and offering more time to decide and more options for home buyers. Despite more home options, buyers still face relatively-high home prices as the median listing price year-to-date in 2024 is roughly $80,000 higher than the 2019 average, and mortgage rates remain above 6%. Given the average mortgage rate and median listing price, the typical monthly housing payment in Texas was $2,100 in December, assuming a 10% down-payment.

Rent-Friendly Options

With a great combination of affordable rental options and abundant job opportunities, Texas stands out as an attractive place for renters. In 2024, Austin and San Antonio were ranked among the top 10 rental markets by Realtor.com and Austin, with its blend of affordable rents, job prospects, and vibrant lifestyle amenities, is also regarded as the top rental market for recent college graduates.

The median asking rents for 0-2 bedroom units in major Texas metropolitan markets have consistently been lower than the average rent in the Top 50 U.S. markets.

Price-Friendly Options

Pre-pandemic, the San Antonio metro area had the largest share of inventory priced below $350,000, followed by Houston, Dallas, and Austin. In 2024, this order remains the same, though all four major Texas metros have significantly smaller shares of lower-priced inventory than pre-pandemic.

The most expensive area, Austin, has seen the most significant recovery in lower-priced inventory this year, but remains the least affordable of the bunch. Austin also, despite some recovery, saw the largest drop off in affordable inventory relative to the beginning of the pandemic.

Click here for more on Realtor.com’s “The Texas State of Real Estate” report.