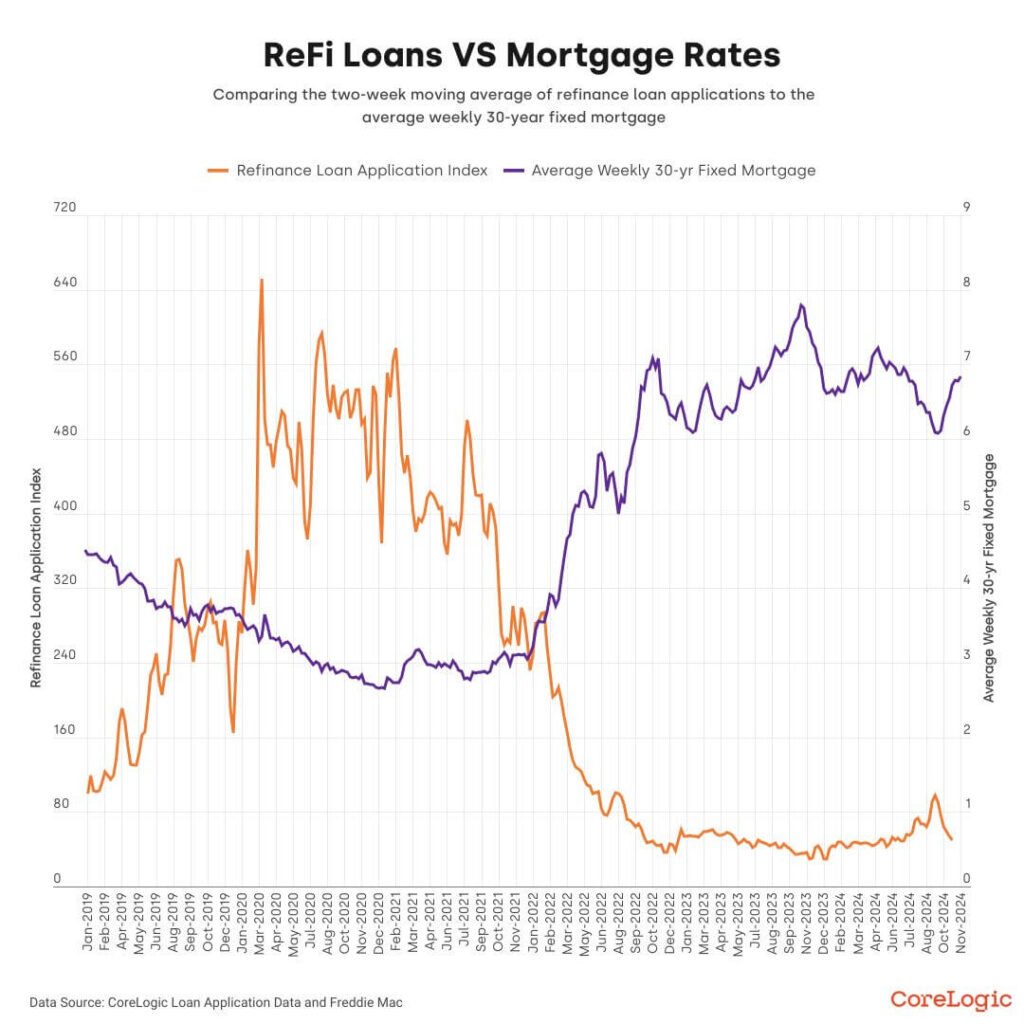

After hitting a two-year high in September 2024, mortgage refinance activity is once again slowing as interest rates remain elevated. While refinancing demand surged briefly when rates dipped, it quickly contracted again following another rate spike in October 2024.

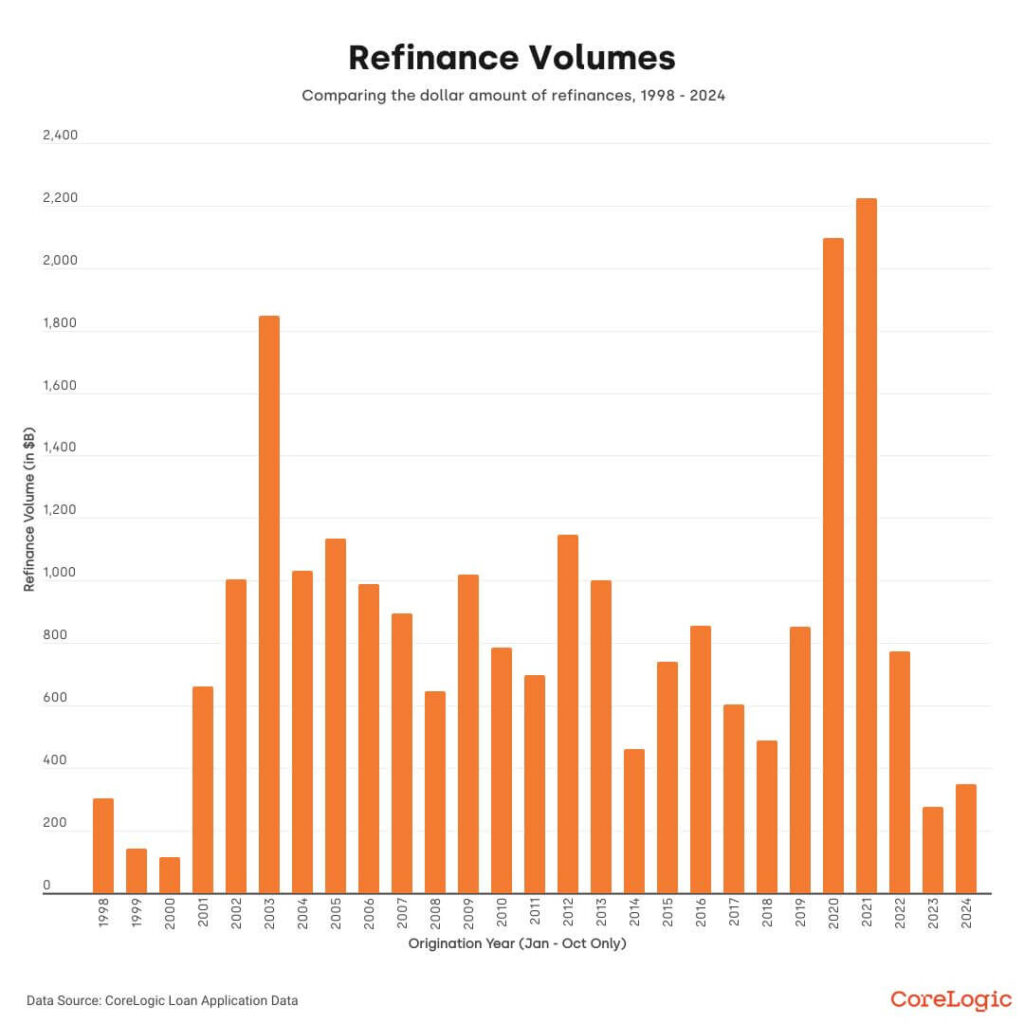

Refinance activity is historically tied to interest rate movements. When mortgage rates hit record lows in 2021, refinancing volume soared, exceeding $2.2 trillion in the first 10 months of the year. In stark contrast, as rates climbed, refinance volume plummeted to just $273 billion in the same period in 2023—the lowest level since 2001.

However, 2024 showed some signs of a modest recovery, with total refinancing volume rising to $347 billion in the first ten months of the year. While still far below historical highs, this increase signaled a slight return of demand as mortgage rates declined from their peak, as found in a recent study by CoreLogic.

Refinancing Trends and Interest Rate Impact

The relationship between refinance activity and mortgage rates is clear: when rates drop, refinancing applications rise. After reaching a 19-year peak of 7.6% in October 2024, the average 30-year fixed mortgage rate fell to 6.1% by September, marking a decline of 120 basis points from the same period in 2023.

This decline fueled a rise in refinancing applications, pushing activity to a two-year high in late September 2024. However, another sharp increase in mortgage rates in October quickly dampened demand again.

Despite this fluctuation, rates remain nearly 1% lower than they were a year ago, leaving some homeowners wondering whether refinancing is once again a viable option.

Does Refinancing Make Sense Right Now?

For most homeowners, refinancing is only financially beneficial if the new mortgage rate is at least 1% lower than their current rate. Given today’s higher-rate environment, relatively few borrowers stand to gain significant savings.

As of September 2024, nearly 80% of outstanding mortgages still carry interest rates below 5%, thanks to the historically low rates seen in 2020 and 2021. Only 12% of mortgage holders have loans with rates of 6% or higher, many of which were originated in 2023 and 2024.

For homeowners in this 6%+ category, refinancing could make sense—but only if rates drop below 6%. With current forecasts suggesting that mortgage rates are unlikely to return to 2020-2021 levels, a broad refinancing boom remains improbable in the near future.

Looking Ahead

While the recent dip in mortgage rates has revived some refinance activity, current rate conditions do not support widespread refinancing opportunities. Unless rates decline more significantly, most homeowners will likely hold onto their existing loans rather than refinance at a minimal savings.

For now, those considering a refinance will need to weigh potential rate movements carefully, keeping an eye on whether further rate reductions in 2025 could make refinancing worth it again.

Click here for more on CoreLogic’s report on refinancing trends.