As inflation continues to impact the wallet of Americans, potential home buyers are being impacted as well. Whereas 10% of the price of a home was the standard fare for down payments, a new report from Redfin has found that the typical U.S. homebuyer’s down payment was 16.3% of the purchase price in December 2024, up from 15% a year earlier. In dollar terms, the typical homebuyer’s down payment was $63,188—up 7.5% from a year earlier, marking the biggest increase in five months.

The amount of money homebuyers are putting down is higher than a year ago mainly because home prices are up: A higher price means buyers typically make a bigger deposit. The median U.S. home-sale price rose 6.3% year-over-year in December, to roughly $428,000. The percentage buyers are putting down is relatively high because mortgage rates are elevated near 7%, and some buyers are putting down more up front to bring down their monthly interest payments.

Down payments are no longer seeing the wild swings they were during the pandemic. The median U.S. down payment rose from the 10% range before the pandemic to the 15% range in 2021, which was the height of the pandemic homebuying frenzy. Mortgage rates also drove that increase, but the dynamics were very different then: Record-low rates under 3% were fueling intense bidding wars among homebuyers, which motivated many to put more money down to make their offers stand out in a competitive environment.

“While a larger down payment can lower monthly mortgage payments and help strengthen an offer in a bidding war, bigger isn’t always better,” said Sheharyar Bokhari, Senior Economist at Redfin. “Housing markets in much of the country have started tilting in buyers’ favor, allowing buyers to set the terms they want. That means house hunters don’t necessarily need to break the bank for a huge down payment if it makes more financial sense to save some money for things like future home renovations or other investments.”

All-Cash Down Payments Dwindle

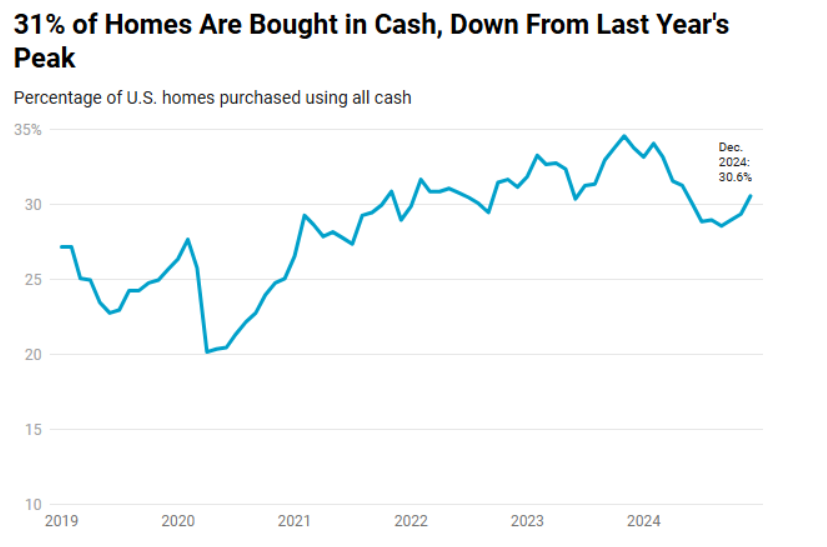

Roughly three in 10 (30.6%) U.S. homes were bought with cash in December. That’s down from 33.8% a year earlier, but up from September’s three-year low of 28.6%.

The share of buyers paying with cash peaked in 2023 because that’s when mortgage rates peaked, hitting a two-decade high of nearly 8%. Buyers who can afford to pay with cash are more inclined to do so when rates are high because they’re avoiding high monthly interest payments, and saving money overall.

Mortgage rates have since come down slightly and evened out in the 6% to 7% range, bringing down the share of buyers who are paying in all cash. Additionally, investors–who make up a big share of all-cash buyers–are purchasing fewer homes. On an annual basis, 32.6% of 2024’s home sales were made with cash, the lowest share in three years.

FHA vs. VA Loans?

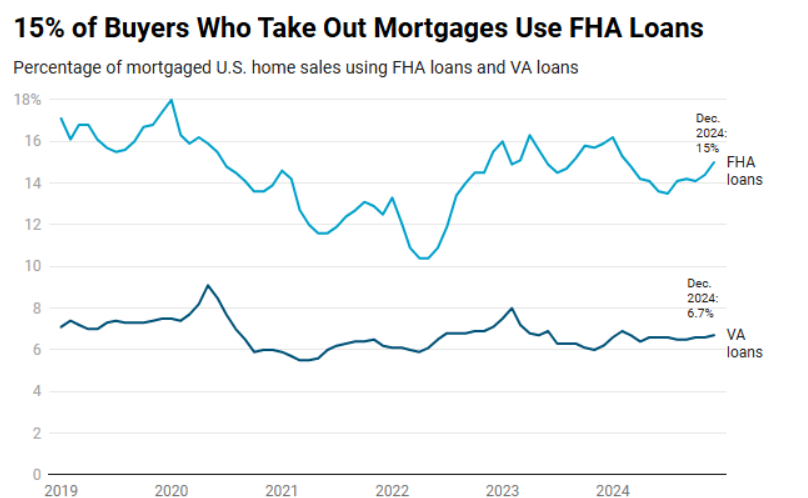

Roughly one of every seven (15%) mortgaged home sales used an FHA loan in December, down slightly from 15.9% a year earlier but up from mid-2022’s decade-low of roughly 10%. The share of mortgaged home sales using a VA loan rose to 6.7%, from 6.2% a year earlier.

More home buyers are reportedly using FHA loans now than in late 2021 and early 2022, when the ultra-competitive environment favored buyers with higher down payments and more ability to prove their financial security. Now, buyers are more likely to get an offer using an FHA loan accepted. Additionally, higher home prices mean more buyers find it hard to afford large down payments, making FHA loans more popular.

Conventional loans are by far the most common type of mortgage, with nearly four in five (78.4%) borrowers having used a conventional loan in December, little changed from 77.9% a year earlier.

Metro-Level Highlights

The data below is from December 2024, the most recent month for which data is available, and covers 40 of the most populous U.S. metros:

- Down payments: Down payment percentages were highest in San Francisco, where the typical homebuyer put down 26.4% of the purchase price. It’s followed by two other California metros: Anaheim and San Jose, at 25% apiece. They were lowest in Virginia Beach, Virginia (3%); Detroit, Michigan (6.5%); and Baltimore, Maryland (8.5%).

- FHA loans: FHA loans were most prevalent in Riverside, California, where 25.4% of mortgaged home sales used one. Next came Providence, Rhode Island (25.1%) and Las Vegas, Nevada (24.3%). FHA loans were least prevalent in California: San Francisco (2.1%), San Jose (2.2%), and Anaheim (5%).

- VA loans: VA loans were most prevalent in Virginia Beach, Virginia (39%); Jacksonville, Florida (16.3%); and Washington, D.C. (14.3%)—all three of those metros having a large military presence. VA loans were least prevalent in the Bay Area: San Jose (less than 1%), San Francisco (1.5%), and Oakland (1.8%).

- All-cash sales: All-cash home purchases were most prevalent in West Palm Beach, Florida, where more than half (50.4%) of homes were bought in cash. Next came Cleveland (46%) and Jacksonville (39.3%). All-cash sales were least prevalent in Oakland (16.2%), San Jose (17.8%), and Seattle (18.8%).

Click here for more on Redfin’s examination of down payment trends.