According to recent research by MetroSight economists supported by the National Multifamily Housing Council (NMHC) and the National Apartment Association (NAA), excessive regulation may make rental housing less affordable by raising operating costs and discouraging new construction, which would raise housing costs and restrict access to it for Americans.

The study examined how state-level preemption rules, criminal and resident screening limits, right-to-counsel regulations, just-cause eviction laws, and source-of-income laws affected housing costs.

“Balancing the need to protect renters with the need to control costs and maintain operational viability is difficult, and despite the urgency of addressing housing affordability, there is limited rigorous research to measure the effects of such legislation,” said Issi Romem, Ph.D, Founder and Economist of MetroSight. “The data provided by the NAA offers a rare opportunity to look under the hood at housing providers’ operations and evaluate how policy decisions shape the housing outcomes that matter to people.”

Multifamily rental operators now face higher costs as a result of the proliferation of rental housing rules, which has probably resulted in higher rents for residents. States have lowered operational expenses and increased capital investment by attempting to restrict the scope of these municipal legislation.

“As housing continues to be a topic of discussion amongst state, local and federal lawmakers, this study importantly quantifies how regulations ultimately increase costs for housing providers and renters alike,” said Bob Pinnegar, President and CEO of NAA. “At a time that demands bold action on housing affordability, policymakers must reject damaging regulations and instead turn to sustainable solutions that lower costs and increase housing supply. We are proud to have worked with NMHC to identify the impact of these regulations and rather focus on advocating for real policy solutions.”

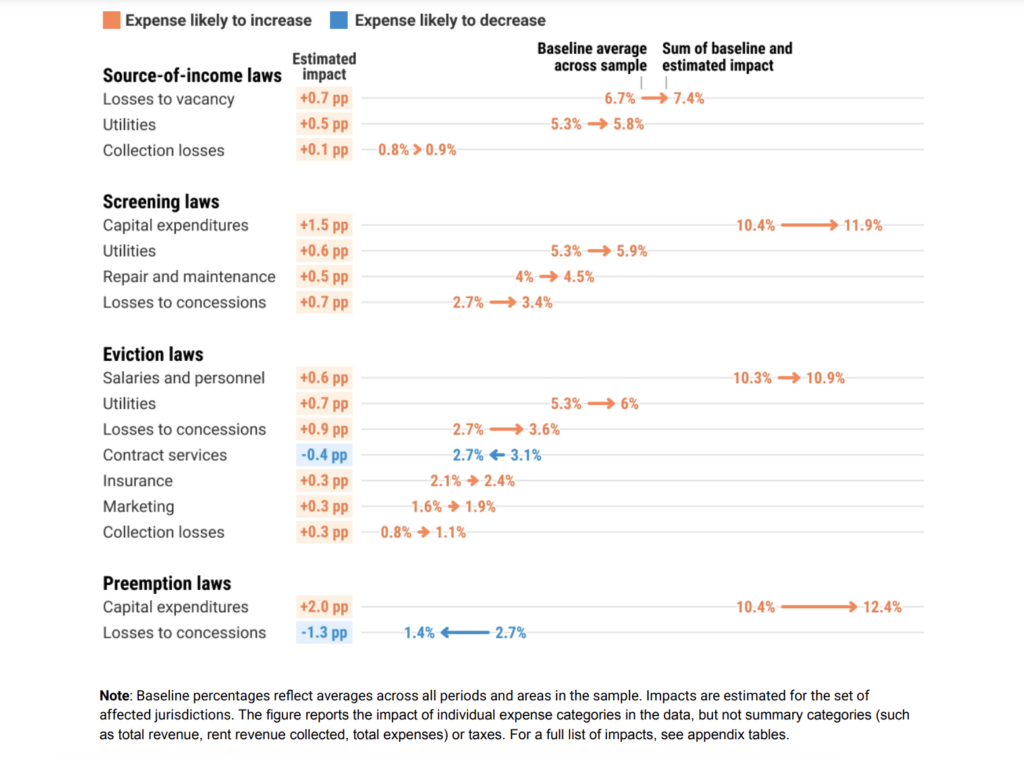

Some of the report’s key findings include:

- Source-of-income laws increase operational costs such as vacancy losses by more than 10% likely because of the Housing Choice Voucher’s complex and duplicative leasing process.

- Just cause eviction laws and right-to-counsel statutes increase collection losses by more than 37% probably as a result of a prolonged eviction process.

- Restrictions on criminal and resident screening increase capital expenditure costs by more than 17% likely as housing providers upgrade properties and increase rents to mitigate compliance costs associated with resident screening laws.

How Rising Rental Housing Costs Affect Americans

As long as the source of money is legal, source-of-income rules prohibit housing providers from making distinctions about prospective tenants based on it. These rules prohibit landlords and operators from turning away applicants based only on their reliance on non-traditional sources of income, such as Social Security payments, child support, disability benefits, or federal or state housing vouchers.

Few can argue against the well-meaning goals of these regulations, which are to guarantee lower-income renters equitable access to housing, but their actual implementation has generated controversy. While multifamily operators negotiate the expensive obstacles involved in taking part in housing assistance programs like Section 8 housing choice vouchers, this endeavor has resulted in higher expenses and postponed lease signings.

The housing voucher program, which is run by local public housing organizations and funded by the U.S. Department of Housing and Urban Development, is plagued with inefficiencies, bureaucratic roadblocks, and inadequate funds. These might increase expenses for operators, create uncertainty, and postpone lease agreements and rental payments. Voucher holders reported an average move-in time of one to three months, according to over 57% of respondents.

Nearly 86% of rental housing providers who departed HUD’s housing choice voucher program cited administrative costs, according to a 2023 NAA poll. To put it briefly, voucher programs force rental companies to engage with a problematic system without necessarily increasing the number of affordable housing options available.

“The debate over housing policy and affordability has never been more important than it is today. It is a kitchen table issue affecting individuals and families throughout the country,” said Sharon Wilson Géno, President of NMHC. “This new research on how regulations can drive up housing costs, discourage investment needed to build housing and ultimately negatively affect housing affordability and opportunity will help inform the discussion and educate lawmakers at all levels of government on how policies they propose may have unintended consequences. Working closely with our partners at NAA, we hope these results encourage policymakers to consider policy solutions that increase housing supply and lower costs.”

State source-of-income legislation are being supplemented by ordinances adopted by more municipal governments, which raises the bar for compliance. Advocates for fair housing keep pushing for more enforcement policies, such as required training and penalties for noncompliance, which raise expenses for property owners.

Note: The econometric analysis examined data from 600,000 to 850,000 units nationally using the NAA’s Survey of Operating Income and Expenses in Rental Apartment Communities, which was carried out yearly from 2004 to 2021.

To read the full report, click here.