It’s no secret that buying a home has been exceedingly difficult in the past few years due to a number of affordability factors. From rates bordering the 7% range, to record high home prices, many home buyers are sitting on the sidelines waiting for a seismic change to hit the U.S. housing market.

New data from LendingTree shows that among those active in the market last year, first-time buyers received a larger share of offers than those who already own. Data shows that three in five buyers (60.9%) offers to users on LendingTree’s platform in 2024 went to first-time buyers. And while this figure may seem high, it’s actually down from 65.3% that LendingTree reported in 2023.

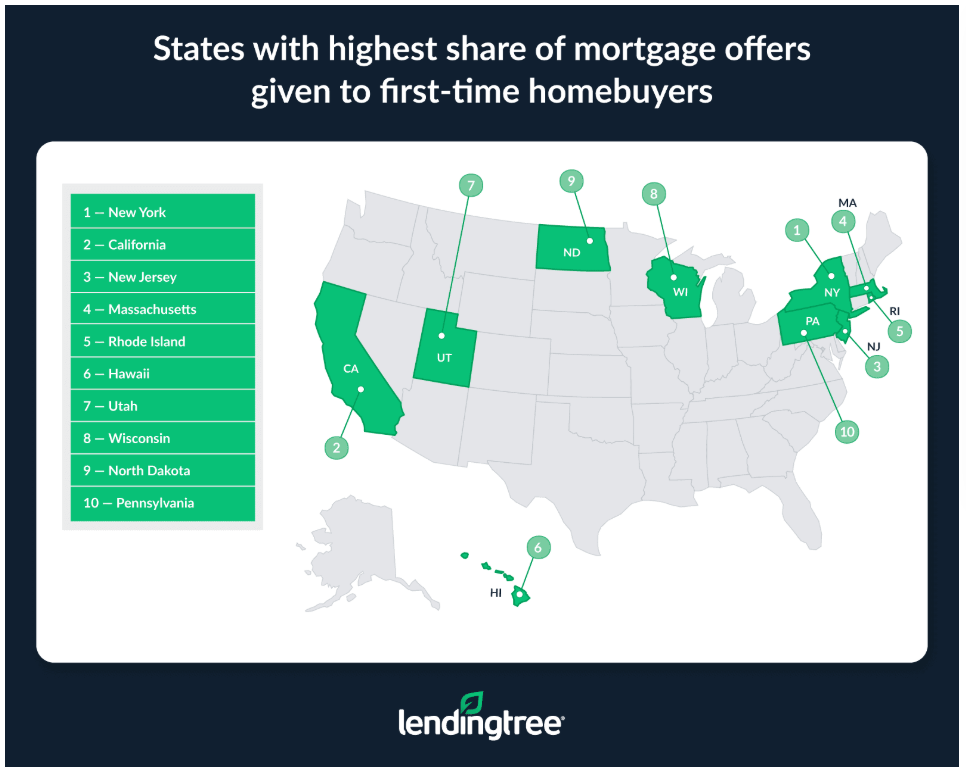

Of the nation’s markets, New York, California, and New Jersey saw the highest share of mortgage offers going to first-time buyers. In New York, 76.1% of offers went to first-time buyers, down from 77.3% in 2023, but still the highest share in the nation. California (70.0%) and New Jersey (69.2%) followed, also keeping their same rankings as in 2023.

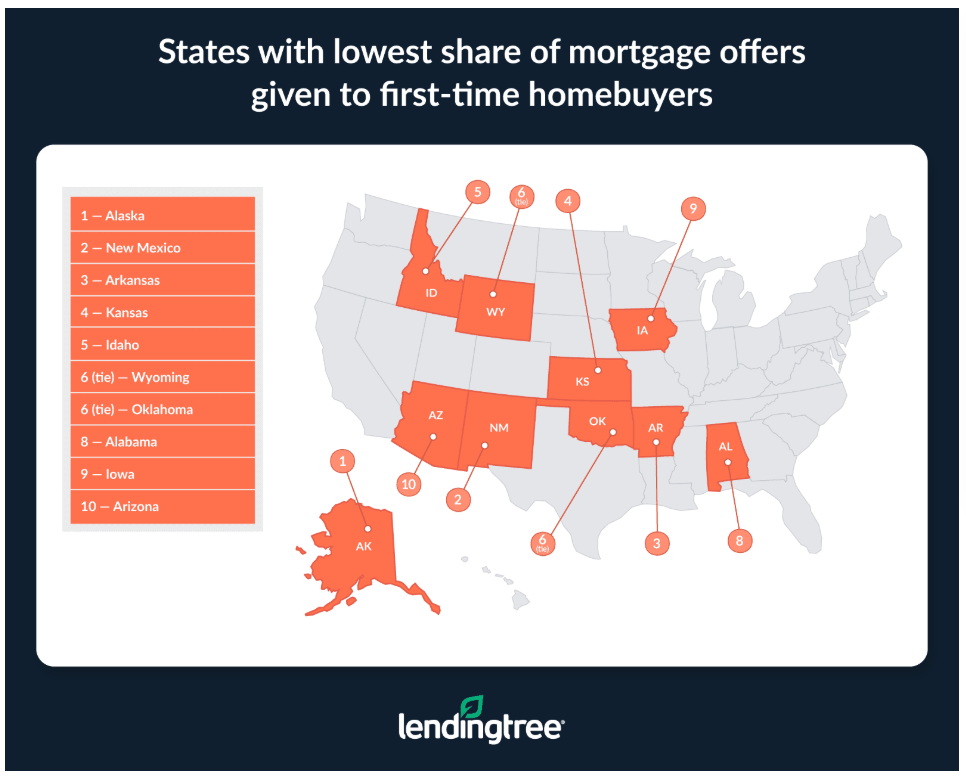

In Alaska, the lowest share of mortgage offers go to first-time buyers. At 47.1%, Alaska was the only state below 50.0%—a significant drop from 54.4% in 2023. Alaska was joined in the bottom three by New Mexico (51.2%) and Arkansas (52.4%).

When profiling this type of home buyer, first-time buyers tend to have lower credit scores, lower down payments, and mortgage amounts than repeat buyers. Credit scores for first-time buyers are an average of 32 points lower than those of repeat buyers, averaging 700 for first-time buyers versus 732 for repeat buyers. Down payments were an average of $63,449 lower—$47,654 versus $111,103—and loan amounts are an average of $56,131 smaller—$321,818 versus $377,949.

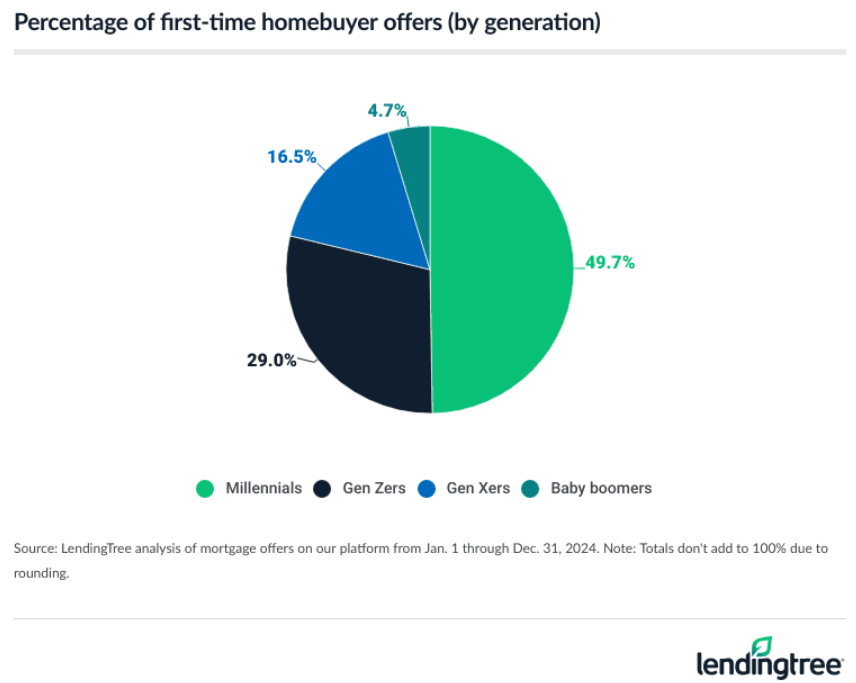

Millennials received nearly half of the first-time buyer offers, as 49.7% of mortgage offers that went to first-time buyers in 2024 went to millennials ages 28 to 43, ahead of Generation Z members ages 18 to 27 at 29%. The average age of first-time homebuyers is 36—right in the middle of the millennial range.

States Reporting the Highest Share of Offers Given to First-Time Buyers

Number One: New York

- Share of mortgage offers given to first-time homebuyers: 76.1%

- Average credit score of first-time homebuyers: 709

- Average down payment from first-time homebuyers: $81,188

- Average loan amount offered to first-time homebuyers: $375,534

Number Two: California

- Share of mortgage offers given to first-time homebuyers: 70%

- Average credit score of first-time homebuyers: 713

- Average down payment from first-time homebuyers: $94,967

- Average loan amount offered to first-time homebuyers: $518,883

Number Three: New Jersey

- Share of mortgage offers given to first-time homebuyers: 69.2%

- Average credit score of first-time homebuyers: 712

- Average down payment from first-time homebuyers: $69,553

- Average loan amount offered to first-time homebuyers: $400,037

States Reporting the Lowest Share of Offers Given to First-Time Buyers

Number One: Alaska

- Share of mortgage offers given to first-time homebuyers: 47.1%

- Average credit score of first-time homebuyers: 705

- Average down payment from first-time homebuyers: $27,529

- Average loan amount offered to first-time homebuyers: $316,063

Number Two: New Mexico

- Share of mortgage offers given to first-time homebuyers: 51.2%

- Average credit score of first-time homebuyers: 693

- Average down payment from first-time homebuyers: $33,642

- Average loan amount offered to first-time homebuyers: $268,861

Number Three: Arkansas

- Share of mortgage offers given to first-time homebuyers: 52.4%

- Average credit score of first-time homebuyers: 693

- Average down payment from first-time homebuyers: $26,191

- Average loan amount offered to first-time homebuyers: $229,102

Why First-Time Buyers?

As mortgage rates surpassed 7.00%, 2024’s housing market was again sluggish, and mortgage demand was near its lowest point in more than 20 years. Unlike repeat buyers, first-time buyers aren’t generally at risk of feeling “trapped” in their current homes due to low locked-in mortgage rates. First-timers may be more likely than repeat buyers to venture into a high-rate housing market since they don’t have to worry about sacrificing older, more attractive rates on their current mortgages. According to LendingTree, first-time buyers were likely more comfortable seeking new mortgages, making them a bigger part of a smaller pool of buyers.

Click here for more on LendingTree’s examination of first-time home buying trends.