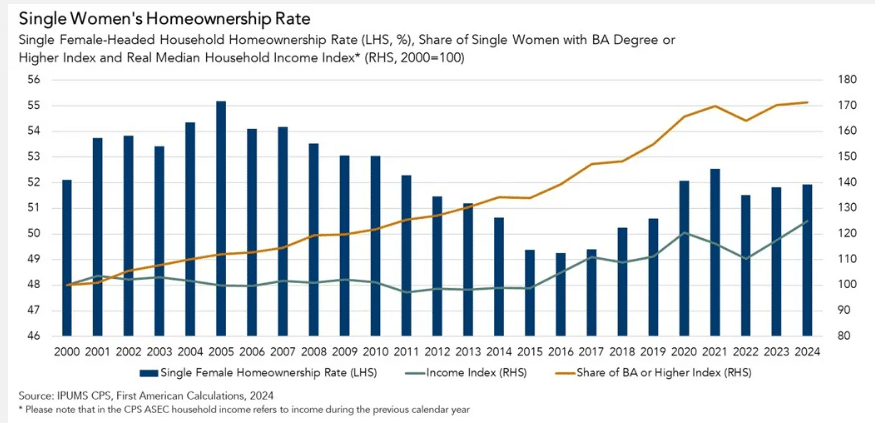

As housing affordability reached its lowest point since 2006, one group stood out in defying market trends—single women. In 2024, the homeownership rate among single women rose slightly to 51.9%, up from 51.8% in 2023. This modest increase continues a recovery from its 2016 low of 49.3% and contrasts sharply with the overall homeownership rate, which declined due to affordability challenges.

Single Women Are Prioritizing Homeownership

More than 20 million single women owned homes in 2024, surpassing single men, who owned 14 million homes. Not only do single women own more homes than their male counterparts, but they also maintain a higher homeownership rate of 51.9%, compared to 49.6% among single men.

Single women are making notable financial sacrifices to achieve homeownership. According to a National Association of Realtors (NAR) survey, many are cutting back on non-essential spending, canceling vacations, and even taking second jobs to save for a down payment and afford homeownership.

Homeownership as a Path to Wealth

Owning a home provides significant financial advantages, including equity gains and appreciation in home values. Each mortgage payment serves as a form of forced savings, helping homeowners build wealth over time. Historically, homeownership has been a major wealth-building tool in the U.S., and single women are taking full advantage.

Between 2019 and 2022, the median net worth of single women grew from $54,400 to $74,500. For those who own homes, the impact was even more significant—their median net worth jumped from $199,400 to $266,500 in the same period. Additionally, a home remains the largest asset for most single women, accounting for 66% of their total wealth in 2022.

Higher Education and Rising Incomes as Driving Factors

Women’s pursuit of higher education and career advancement has contributed to their increasing homeownership rate. The share of single women with a bachelor’s degree or higher has grown from 20% in 2000 to 34% in 2024. At the same time, their real median household income has risen more than 20% from 2000 to 2023, significantly improving their ability to purchase homes.

A Growing Market Force

With increasing education levels, rising incomes, and financial discipline, single women are proving to be a resilient and growing force in the housing market. As they continue to prioritize homeownership, their numbers are likely to keep rising in the years ahead.

Click here for more on First American’s study on single women and U.S. housing trends.