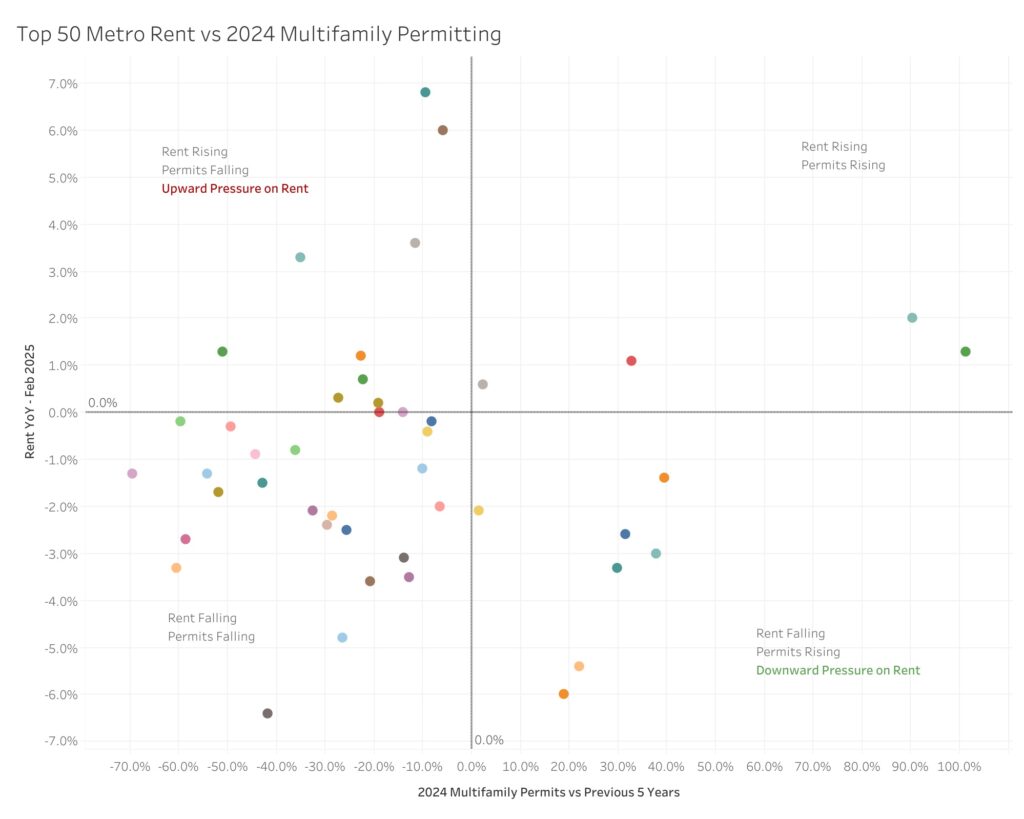

According to the Realtor.com February rent report, rents in the top 50 metro areas have been falling for more than a year, but low multifamily permitting activity is paving the way for rising rents. In actuality, only 294,000 multifamily units were allowed in the top 50 metro areas in 2024—much fewer than the 318,000 units allowed during the pandemic’s peak in 2020.

“During the pandemic, rent prices surged significantly. While there has been a gradual correction, the current trend of declining rents over the past 19 months and a still-sizable number of multi-family units under construction have impacted builders’ enthusiasm for new projects,” said Danielle Hale, Chief Economist at Realtor.com. “The nation is short 3.8 million homes according to Realtor.com research. As builders attempt to right-size their construction pipelines amid shifting economic and policy cross currents, multifamily builders nationwide have made headway, evidenced by vacancy rates trending up. Still, the shortfall varies by market and region. The low level of permitting for multifamily housing, particularly in markets where rents are still climbing, may become a catalyst for future rent growth.”

Low levels of multifamily housing permits will further constrain supply and raise the possibility of future rent increases in hot markets with high demand and rising rents. Rent increased in nine of the top 50 metro areas in 2024, including New York, Kansas City, MO; and Detroit, where multifamily permits were fewer than in recent years.

Top 10 Hot Markets Where Rent is Poised To Grow as Permits Decline

| U.S. Metro | Rent Increase YoY | Multifamily Permits vs5-year Baseline |

| New York-Newark-Jersey City, NY-NJ | 6.80 % | -9.50 % |

| Kansas City, MO-KS | 6.00 % | -6.00 % |

| Detroit-Warren-Dearborn, MI | 3.60 % | -11.60 % |

| Washington-Arlington-Alexandria, DC-VA-MD-WV | 3.30 % | -35.00 % |

| San Jose-Sunnyvale-Santa Clara, CA | 1.30 % | -51.00 % |

| Baltimore-Columbia-Towson, MD | 1.20 % | -22.60 % |

| Boston-Cambridge-Newton, MA-NH | 0.70 % | -22.30 % |

| St. Louis, MO-IL | 0.30 % | -27.30 % |

| Charlotte-Concord-Gastonia, NC-SC | 0.20 % | -19.00 % |

U.S. Rent Growth Weakens & Rises in Different Markets

However, nine of the top 50 metro areas, including Birmingham, AL, where rent decreased 5.4% year-over-year and multifamily building permits increased by 22.10% from the average of the previous five years, Cincinnati, Ohio, where rent decreased 3.3% while multifamily building permits increased 29.9%, and Cleveland, Ohio, where rent decreased 3.0% year-over-year and multifamily building permits increased 37.9% from the average of the previous five years, saw more multifamily permitting in 2024 than during the previous five years. The expansion of the multifamily supply in major metro areas will further drive down rents.

Although data indicates that changes are beginning to occur in the main metro areas’ for-sale markets, where federal employment is considerable, the rental movements in these markets are still rather variable and do not yet indicate any significant changes. Rent has increased 3.3% year over year in Washington, D.C., one of the five main metro areas with the largest number of federally hired workers. Oklahoma City, has had a small increase of 2.0%, while Baltimore, has seen a 1.25 percent increase. However, rent in San Diego, fell 6% from a year earlier, while it also decreased by 1.5% in Virginia Beach, VA.

The demand for larger rental apartments is still high as fewer tenants become first-time homebuyers; over the past five years, the longest-term rent rise has been 18.3% for 2-bedroom flats. This is in contrast to studio flats, which saw the slowest increase in rent, at 9.7%, and one-bedroom units, which saw a 14.3% increase.

Although activity in studio units is typically more volatile, this month’s rent growth for studio units decreased little at -0.8% YoY, more closely aligning with the -0.7% year-over-year declines in one and two bedroom units in February 2025.

Additionally, the 50 largest metro regions in the U.S. allowed the development of little under 294,000 units in projects with five units or more in 2024. Given that rents were declining annually throughout 2024, this marks a significant retreat in multifamily development permits. Even fewer multifamily apartments were granted in the top 50 metro areas last year than during the peak of the pandemic in 2020, when more than 318,000 units were approved. And now, multifamily permits fell once again and are still down 15.7% year-over-year in the Census Bureau’s most current new building data.

To read the full report, click here.