According to a recent study, more than half of Americans say they feel “overwhelmed” by rising utility costs, mortgage payments, and rent, leaving many consumers with little money left over after paying their monthly housing expenses. This highlights the harsh financial reality of owning a home in the current economy.

Per a new study from American Home Shield (AHS), paying utility bills is another typical expense of living at home, in addition to rent or mortgage payments. Utilities, such as cable, electricity, and water and heating, can mount up, especially electricity, which frequently runs air conditioners and HVAC systems in addition to appliances and devices.

American Consumers Overloaded with Financial Woes

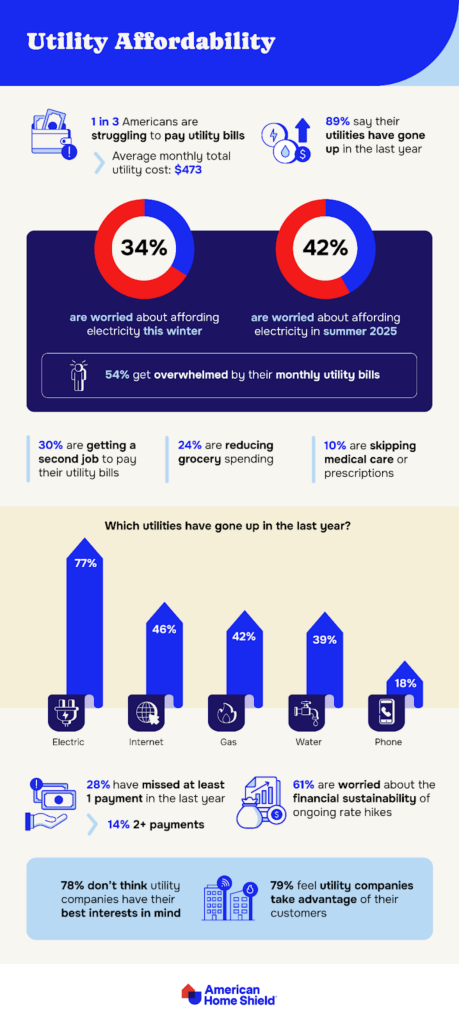

However, one in three Americans are thought to be having financial difficulties paying their power bills; the average monthly cost for all respondents was $473 and continues to rise. Almost nine out of 10 (89%) reported that their utility bills increased throughout the past 12 months.

As a result, people remain concerned, as more than two out of five are concerned about paying for electricity this summer, and one in three are concerned about paying for electricity this winter.

Although many are figuring out how to make ends meet, more than half are overwhelmed by their monthly utility costs. Nearly one in four people are cutting back on their grocery shopping to keep the lights on at home, and 30% have stated that they are taking on a second job to pay their electricity. In order to have enough money to pay their expenses, a startling one in ten people are forgoing prescription drugs or medical care.

The questions remains… in the past year, which utilities have increased the most? Roughly 77% of Americans report that their energy bills have gone up, making it the category with the highest rate of increase in the country. Gas, water, phone, and internet costs are among the other expensive services.

More than one in four Americans have missed at least one utility payment in the past year as a result of these rate increases, with 14% reporting missing at least two. More than three out of five people are apprehensive about whether these rate increases will be financially sustainable. Many people have concerns about the intentions of power providers: 79% believe utility firms exploit consumers, and 78% don’t believe their electrical companies have their best interests in mind.

Breaking Down the Bills

AHS surveyed Americans on their satisfaction with the services they receive from suppliers because electricity has the highest utility expenses and is also growing at the fastest rate. Americans’ average monthly energy bill is $232; more than half of them believe their price is too high, and rate increases in the past year alone have frustrated a comparable number.

In the past year, Americans reported an average rate increase of 11%, and more than three out of five are unaware of the reasons for these increases. Nearly half (49%) say their electricity supplier irritates them the most, and 67% say their electric bill is the most expensive of all utilities. This may be due in part to the fact that 69% of respondents are unable to select a provider, some 71% believe it is unfair that they are unable to do so, and 77% wish they had this option.

Service disruptions are another element that affects customer happiness. In the past year, Americans experienced an average of two power outages, with the largest outage lasting an average of eighteen hours.

Consumers Cutting Down the Bills This Year

The next obvious question Americans commonly ask is, “How can I lower my electric bill?” as electricity rates are rising and Americans are concerned about how they will pay for them.

The best method to identify unusual charges is to thoroughly examine your bills, which is what 63% of Americans now do. Almost half of the almost one in four Americans who have contested an electric bill ended up paying less than what was originally quoted, saving them an average of $433 in incorrect charges.

Americans are also thinking creatively on how to save: some 17% are installing solar panels to capture solar energy and lower their bills, and nearly three out of four would support a government-controlled electricity system to regulate prices.

adopting less light, switching to LED bulbs, keeping the temperature of their home closer to the outside, unplugging appliances, adopting energy-saving mode, and winterizing their home are the other top ways Americans are lowering their power bills in 2025.

Because Americans need all the cash they can save in today’s economy!

To read more, click here.