A new study by LendingTree examined overcrowding in U.S. homes, which impacts approximately 19.1 million Americans or 5.9% of the nation’s population.

Some of the key findings of LendingTree’s study were:

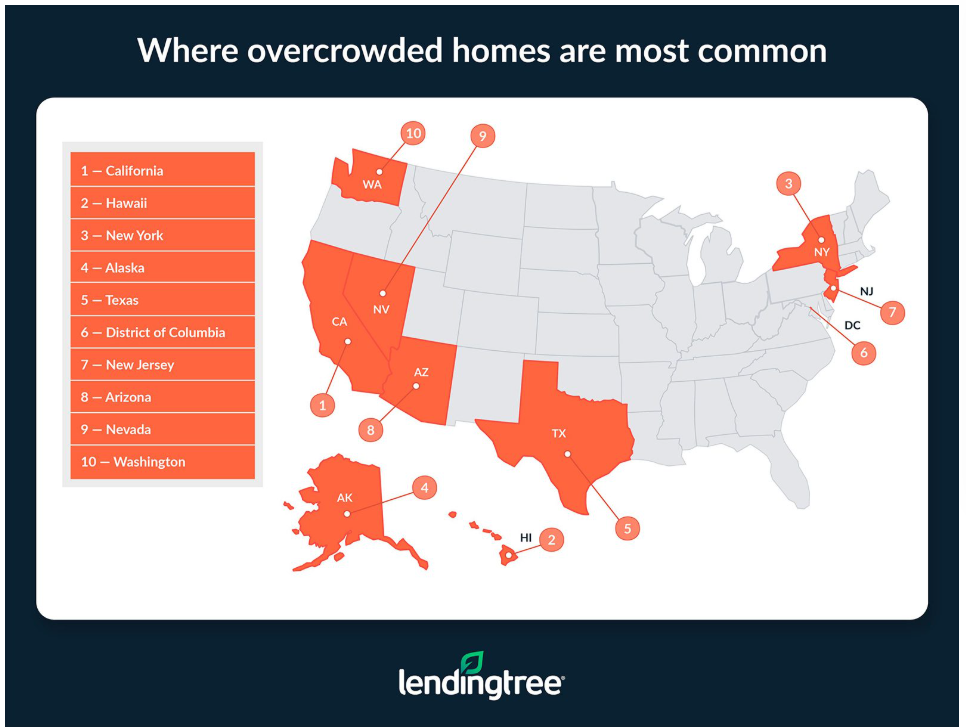

- 1 million Americans, or 5.9% of people in homes, live in overcrowded homes: The states with the highest rate of people in homes with more than two per bedroom are California (12.9%), Hawaii (11.5%), and New York (9.7%). Overcrowding is less frequent in rural states: Vermont (2.4%), West Virginia (2.5%), New Hampshire, and Maine (both 2.7%).

- 1% of Americans who live in homes have more bedrooms than people: Wyoming (47.2%), Delaware (46.9%), and North Dakota (46.4%) are most likely to have extra space; you’re least likely to find space in the District of Columbia (29.3%), Hawaii (29.8%), and California (31.3%).

- There are 93.8 million more bedrooms in the U.S. than people who don’t live in various group quarters: This is most common in the most populous states: Florida has 8.8 million more bedrooms, Texas has 6.6 million more, and California has 5.2 million more. New York is the only state below zero, having 2.2 million fewer

- Put another way, there are 289 extra bedrooms for every 1,000 U.S. residents not in group quarters: The states with the largest excess of bedrooms per 1,000 people—assuming one bedroom per person—are Maine (674), Vermont (630) and North Dakota (496).

California Leads the Pack

California (12.9%), Hawaii (11.5%), and New York (9.7%) have the highest rate of people living in overcrowded homes, and are also states with some of the most expensive housing costs.

This could prevent many families from being able to afford to give each kid their own bedroom, according to Matt Schulz, LendingTree Chief Consumer Finance Analyst and Author of Ask Questions, Save Money, Make More: How to Take Control of Your Financial Life. “That’s a real sacrifice, but it’s one that many Americans are willing to make to realize their dream of owning a home,” Schulz says.

Multigenerational housing—when three or more generations live under one roof—can make life more affordable, and is prevalent in California and Hawaii.

Overcrowding is least frequent in Vermont (2.4%), West Virginia (2.5%), and New Hampshire and Maine (both 2.7%).

What States Have the Most Room?

Almost 40% (38.1%) of Americans who live in homes have more bedrooms than people. Having just one extra bedroom (20.8%) is most common, but a significant 8.2% have at least three more bedrooms than residents.

Wyoming residents are the most likely to have extra space, with 47.2% of people living in homes with more bedrooms than residents. Delaware (46.9%) and North Dakota (46.4%) follow.

Lower housing costs there may play a role, just as states with higher housing costs are least likely to have extra space. The District of Columbia ranks at the bottom, with only 29.3% of residents in homes with more bedrooms than people. Hawaii (29.8%) and California (31.3%) follow.

Count of Extra Bedrooms Are Highest

There are 93.8 million more bedrooms (including vacant units) in the U.S. than people who don’t live in various group quarters, such as prisons, student dormitories, and nursing facilities (Note: This is different from our prior sections that looked at those who live in housing units.)

This is most common in the nation’s most populous states, though not in the exact order. Florida has 8.8 million more bedrooms than residents not living in group quarters, likely because of vacation homes. Texas (6.6 million) and California (5.2 million) are next.

Meanwhile, New York state has 2.2 million fewer bedrooms than people who don’t live in group quarters, making it the only state with fewer bedrooms than residents. Despite its lack of space, 31.4% of people live in homes with at least one extra bedroom.

Click here for more on LendingTree’s latest report.