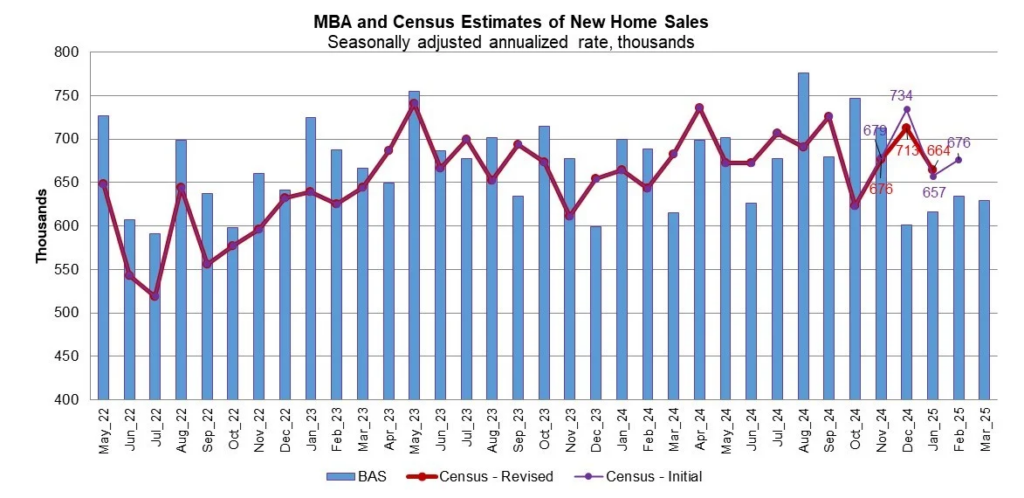

According to new data from the March 2025 Builder Application Survey (BAS) of the Mortgage Bankers Association (MBA), mortgage applications for new home purchases rose 5.5% over the previous year. The number of applications rose 14% from February 2025. Typical seasonal patterns have not been adjusted for in this update.

According to MBA, the number of new single-family home sales in March 2025 was 629,000 units, a seasonally adjusted yearly rate that has been a leading indication of the U.S. Census Bureau’s New Residential Sales report for years. The BAS’s mortgage application data, along with assumptions about market coverage and other variables, are used to calculate the new home sales estimate.

Key Highlights from the BAS:

- Compared to the rate of 634,000 units in February, the seasonally adjusted estimate for March represents a 0.8 percent decline.

- According to MBA’s unadjusted estimates, the number of new home sales in March 2025 was 61,000, up 7% from February’s 57,000 sales.

- Conventional loans accounted for 49.0% of loan applications by product type, followed by FHA loans (37.0%), RHS/USDA loans (0.9%), and VA loans (13%).

- In February and March, the average loan size for new homes was $397,516 and $381,921, respectively.

“Applications for new home purchases increased in March, consistent with typical seasonal patterns and supported by mortgage rates that had been drifting lower,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The growing inventory of newly built, move-in ready homes supported homebuyer interest over the month, pushing the index higher than last year’s levels. Our estimate of seasonally adjusted new home sales saw a slight decline in March but were stronger than last year’s pace of sales.”

The number of applications from mortgage subsidiaries of home builders nationwide is monitored by MBA’s Builder Application Survey. MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro levels by using this data along with data from other sources. Information about the kinds of loans taken out by first-time homebuyers is also included in this report.

Every month, the Census Bureau conducts official new home sales estimates. New home sales are included in that statistics at the time of contract signing, which usually occurs at the same time as the mortgage application.

To read more, click here.