New data from the National Association of Realtors (NAR) has found that pending U.S. home sales increased 6.1% in March–the greatest month-to-month increase since December 2023 (+7.0%). Regionally, the Northeast experienced month-over-month losses in transactions, while the Midwest, South and West reported gains, which were most substantial in the South. Year-over-year, contract signings grew in the Midwest, but fell in the Northeast, South and West–with the Northeast experiencing the greatest decrease.

New data from the National Association of Realtors (NAR) has found that pending U.S. home sales increased 6.1% in March–the greatest month-to-month increase since December 2023 (+7.0%). Regionally, the Northeast experienced month-over-month losses in transactions, while the Midwest, South and West reported gains, which were most substantial in the South. Year-over-year, contract signings grew in the Midwest, but fell in the Northeast, South and West–with the Northeast experiencing the greatest decrease.

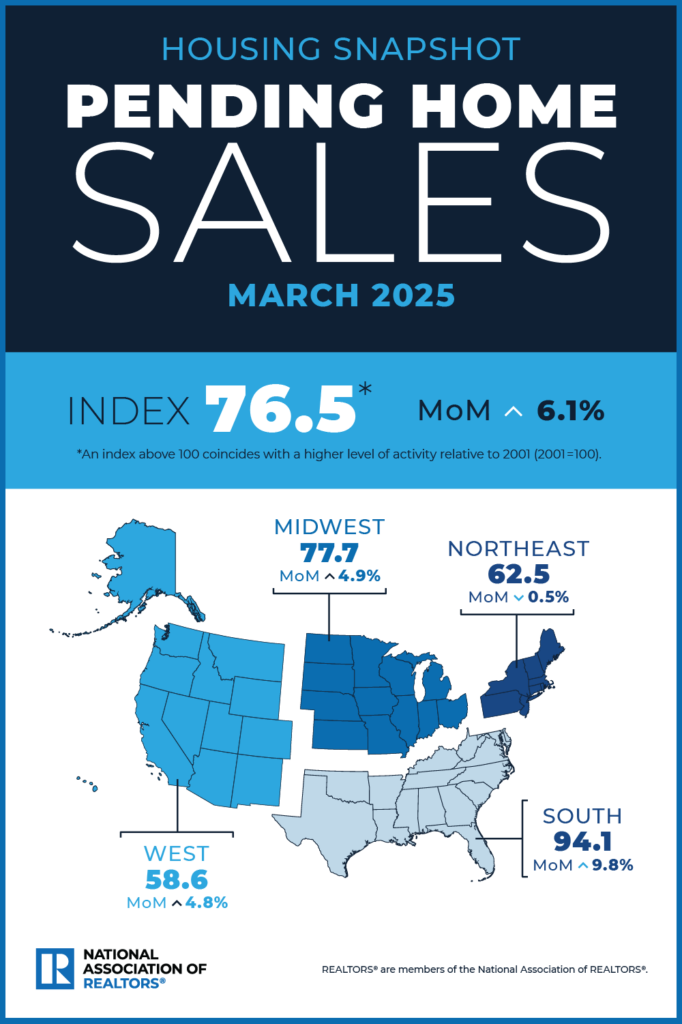

NAR’s Pending Home Sales Index (PHSI)–a forward-looking indicator of home sales based on contract signings–augmented 6.1% to 76.5 in March. Year-over-year, pending transactions fell by 0.6%. An index of 100 is equal to the level of contract activity in 2001.

“Home buyers are acutely sensitive to even minor fluctuations in mortgage rates,” said NAR Chief Economist Lawrence Yun. “While contract signings are not a guarantee of eventual closings, the solid rise in pending home sales implies a sizable build-up of potential homebuyers, fueled by ongoing job growth.”

For the week ending March 27, 2025, Freddie Mac reported the 30-year fixed-rate mortgage (FRM) averaging 6.65%. Since March 27, rates have risen slightly, clocking in at 6.81% as of April 24, 2025.

“Higher inventory levels also offered buyers more choices,” added First American VP, Deputy Chief Economist Odeta Kushi. “Although pending home sales are slightly down (0.6%) compared to last year, the monthly growth is a step in the right direction.”

Economists cite tariff issues as a major concern in their economic decisions of late, taking a wait-and-see approach to making major purchases such as automobiles and homes.

“Currently, buyers are still afflicted with mortgage rates in the high-6% range and consumer confidence is shaken by the trade war that’s roiling markets and leading would-be homebuyers to fear for their jobs,” said Realtor.com Senior Economist Joel Berner. “Though the employment numbers in March did not show much cause for concern, American consumers are closely attuned to the grim economic news and water cooler chat around them, which may be affecting their decisions about when or if to buy a home.”

A Look at Regional Trends

NAR found that the Northeast PHSI dropped 0.5% from last month to 62.5, down 3.0% from March 2024. The Midwest PHSI expanded 4.9% to 77.7 in March, up 1.4% from the previous year. The South PHSI rose to 9.8% to 94.1 in March, down 0.4% from a year ago, while the West PHSI climbed 4.8% from the prior month to 58.6, down 2.0% from March 2024.

“Consumers should note that the spring homebuying season typically brings in a surge of homebuyers and sellers compared to the winter months,” said Yun. “In March, signed contracts surged 34.1% from February based on non-seasonally adjusted raw data, reflecting a pattern consistent with previous years. In addition, inventory levels rose by 8.1% in March from the prior month, indicating a more dynamic housing-market environment.”

Despite the spring homebuying season underway, continued economic uncertainty stemming from tariff concerns and elevated building material costs have kept homebuilder sentiment in negative territory in April, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI).

“Policy uncertainty is having a negative impact on home builders, making it difficult for them to accurately price homes and make critical business decisions,” said NAHB Chief Economist Robert Dietz. “The April HMI data indicates that the tariff cost effect is already taking hold, with the majority of builders reporting cost increases on building materials due to tariffs.”

Berner added, “Pending home sales, or contract signings, measure the first formal step in the home sale transaction, namely, the point when a buyer and seller have agreed on the price and terms. Pending home sales tend to lead existing home sales by roughly one-to-two months and are a good indicator of market conditions. Unfortunately, without significant relief from mortgage rates or an end to the fears of recession, the year-over-year retreat this March may be a sign of things to come through the peak of the 2025 homebuying season.”

Click here fore more on NAR’s analysis of March 2025’s pending home sales.