According to Realtor.com’s New Construction Quarterly Report for the first quarter of 2025, new homes are offering an affordability edge in today’s housing market, as the median list price for newly built homes fell slightly year-over-year to $448,393, reducing the price gap with existing homes to its lowest first-quarter level in five years. This price drop, when factoring in builders constructing smaller homes, and lower mortgage rates for new home buyers, is making newly built homes a more accessible pathway to homeownership, at least for now.

“America is short, approximately, four million homes, and new construction is stepping in to fill the affordability gap left by a tight existing-home market,” said Danielle Hale, Chief Economist at Realtor.com. “Builders are delivering smaller homes at lower prices and often offering financial incentives that make monthly payments more manageable. But looming tariffs on key building materials could limit this much-needed progress and create new cost pressures in the months ahead.”

The Double-Edged Sword

Despite the perceived progress, looming tariff concerns could threaten any affordability gains made in the nation’s housing market. A proposed hike in duties on Canadian lumber, from 14% to 34%, as well as tariffs on drywall and other construction materials from Mexico and China, may raise builder costs significantly. These increases could force home prices upward, once again putting affordable new construction out of reach for many.

The announcement regarding tariffs sent a ripple effect throughout the financial markets, as goods ranging from Italian coffee and Japanese whisky, to Taiwanese semiconductors and sportswear made in Asia, felt the impacted and hit consumers where it hurts the most … their wallets.

Tariffs will undoubtedly drive up the price of imported products, and that price increase will be absorbed by the importer and passed on to the end consumer of the product. For most goods, the cost is passed on to consumers. Any tariff on international building materials will raise the overall cost of housing, with consumers absorbing those costs in the form of higher home prices.

According to the National Association of Home Builders (NAHB), $204 billion worth of goods were used in the construction of both new multifamily and single-family housing in 2024. Of this share, $14 billion of those goods were imported from outside the U.S., with approximately 7% of all goods used in new residential construction having originated from a foreign nation.

While new construction offers a financial edge beyond list prices, buyers of newly built homes are securing mortgage rates approximately 0.5 percentage points lower than those buying existing homes, generally 6.1% vs. 6.6% in 2024. On a median-priced new home, given today’s mortgage rates, a half-percentage point difference translates to more than $160 in monthly savings. Builders’ ability to offer rate buydowns whether via in-house financing or close relationships with lenders helps make these deals possible.

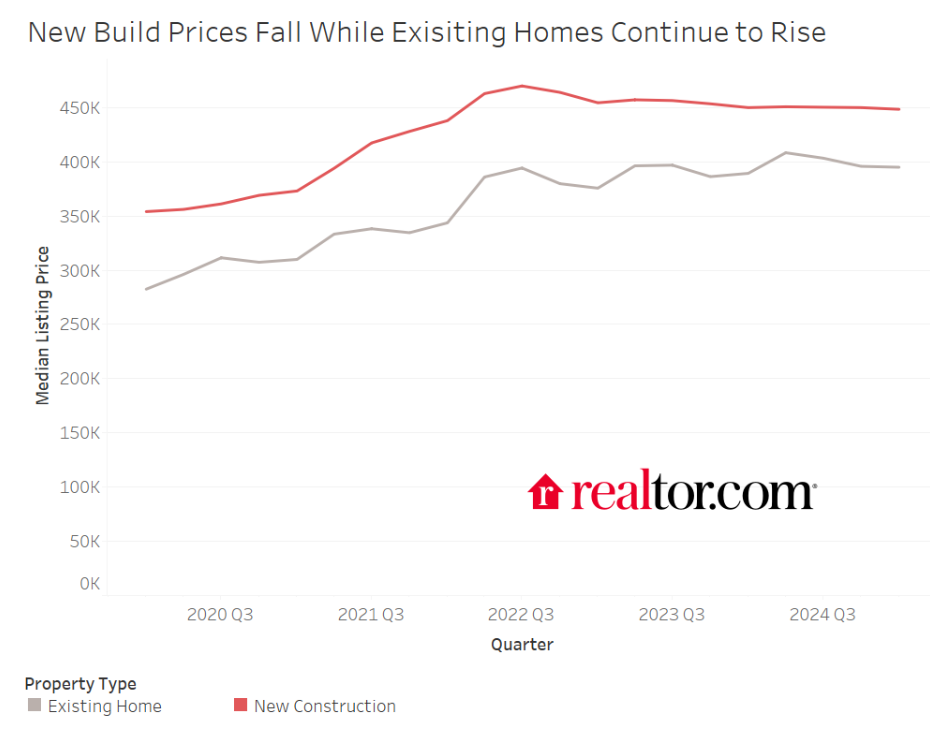

In the first quarter of 2025, the premium on newly built homes dropped to 13.5%, the lowest level for any first quarter since Realtor.com began tracking this metric in 2020. This trend is a result of falling new home prices, which have declined 1.3% since the first quarter of 2023, while existing-home prices have continued to rise. Even as resale inventory catches up, newly built homes now make up 18.5% of active listings, which is still higher than levels seen in Q1 of the pandemic-era years, 2020-2022. Compared to Q1of 2020, the number of new construction listings is 27.4% higher whereas existing listings were still 6.9% lower.

What Markets Are Finding Success?

Among the 100 largest U.S. metropolitan areas, 26 markets posted year-over-year declines in both the median listing price and square footage of newly built homes, highlighting where smaller and more affordable construction is gaining ground. The sharpest declines were concentrated in the South, including metros such as Atlanta and Nashville.

Little Rock, Arkansas recorded the largest year-over-year drop in the median listing price for new construction, down 12.9%. Cities with less recent new construction activity, including Philadelphia and Chicago, also appeared on the list, which is a promising sign for affordability in regions that have historically seen slower builder investment.

Out West, some of the most notable shifts occurred in Colorado Springs, Colorado where new home sizes fell 13.8%, and Oxnard, California, where new home prices dropped 11.6%.

Click here for more on Realtor.com’s look at affordability in the U.S. housing market.