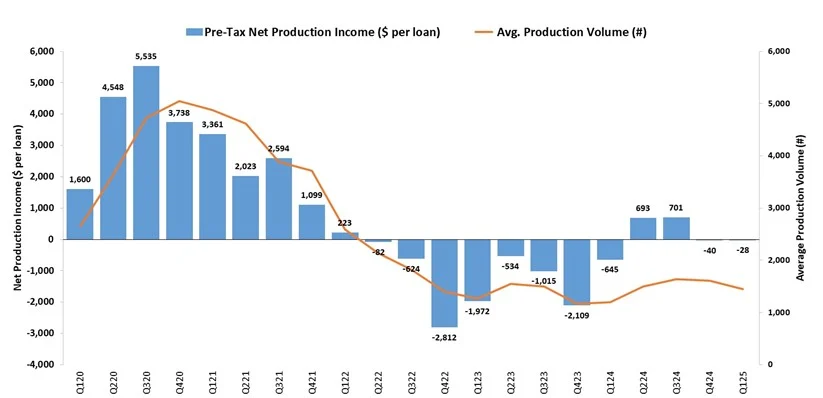

According to the recently released Quarterly Mortgage Bankers Performance Report by the Mortgage Bankers Association (MBA), independent mortgage banks (IMBs) and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $28 on each loan they originated in the first quarter of 2025, as opposed to a net loss of $40 per loan in Q4 of 2024.

“Production profitability was close to break-even in the first quarter of 2025 despite a decline in volume and an increase in production expenses,” said Marina Walsh, CMB, MBA’s VP of Industry Analysis. “Production revenues increased at about the same pace as costs, which mitigated losses.”

Lenders with lesser production volumes were still having the most difficulty, Walsh said. Lenders with a dollar volume under $100 million, for instance, reported average losses of more than $1,000 per loan. Furthermore, the average production losses for lenders with low average loan balances (less than $250,000) were more than $1,300 per loan.

Walsh went on to say, “58 percent of mortgage companies in MBA’s sample are profitable when accounting for both production and servicing operations combined, but that leaves 42 percent who are still in the woods.”

The following are some of the main conclusions of MBA’s First-Quarter 2025 Quarterly Mortgage Bankers Performance Report:

- The average pre-tax production loss was 7 basis points (bps) in the first quarter of 2025, compared to a loss of 4 bps in the fourth quarter of 2024. The average quarterly pre-tax production profit, from the first quarter of 2008 to the most recent quarter, is 40 basis points.

- The average production volume was $488 million per company in the first quarter, down from $540 million per company in the fourth quarter. The volume by count per company averaged 1,448 loans in the first quarter, down from 1,609 loans in the fourth quarter.

- Total production revenue (fee income, net secondary marketing income, and warehouse spread) increased to 373 bps in the first quarter, up from 339 bps in the fourth quarter. On a per-loan basis, production revenues increased to $12,551 per loan in the first quarter, up from $11,190 per loan in the fourth quarter.

- Total loan production expenses – commissions, compensation, occupancy, equipment, and other production expenses and corporate allocations – increased to 381 basis points in the first quarter of 2025 from 344 basis points in the fourth quarter of 2024. Per-loan costs increased to $12,579 per loan in the first quarter, up from $11,230 per loan in the fourth quarter of 2024. From the first quarter of 2008 to last quarter, loan production expenses have averaged $7,702 per loan.

- The purchase share of first mortgage originations, by dollar volume, was 81 percent. For the mortgage industry as a whole, MBA estimates the purchase share was at 65 percent in the first quarter of 2025.

- The average loan balance for first mortgages increased to $364,339 in the first quarter, up from $363,795 in the fourth quarter. The average loan balance for total mortgages (firsts, seconds, HELOCs, other) decreased to $346,714 in the first quarter, down from $347,794 in the fourth quarter.

- Servicing net financial income for the first quarter (without annualizing) was $22 per loan, down from $142 per loan in the fourth quarter. Servicing operating income, which excludes MSR amortization, gains/loss in the valuation of servicing rights net of hedging gains/losses, and gains/losses on the bulk sale of MSRs, was $90 per loan in the first quarter, up from $84 per loan in the fourth quarter.

- Including all business lines (both production and servicing), 58 percent of the firms in the report posted pre-tax net financial profits in the first quarter of 2025, down from 61 percent in the fourth quarter of 2024.

To read more, click here.