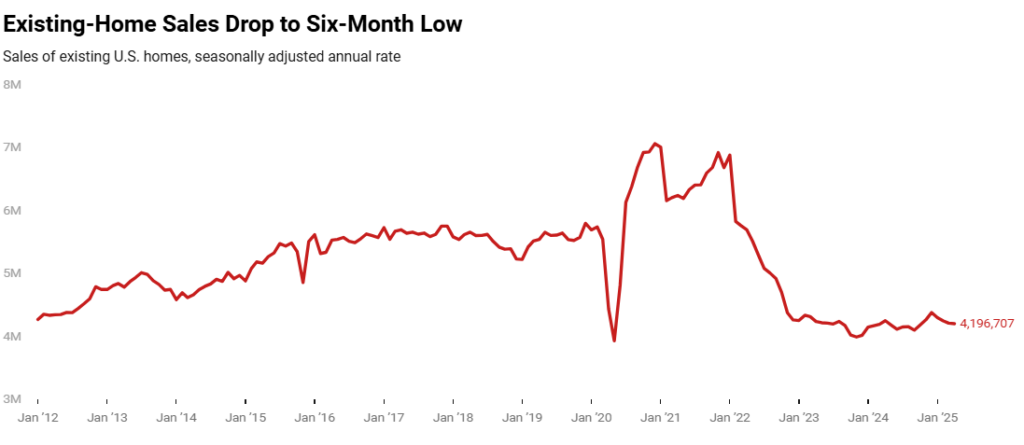

Redfin reports that sales of existing U.S. homes fell to a seasonally adjusted annual rate of 4,196,707 in April 2025, the lowest level reported since October 2024. That’s down 0.2% from a month earlier, and down 1.1% year-over-year—the first annual decline reported in seven months.

Pending home sales (a more current gauge of housing market activity that includes both existing and newly constructed homes) fell 3.5% month-over-month in April on a seasonally adjusted basis—marking the steepest monthly decline reported since August 2023. Redfin reports that pending sales dropped 2.7% year-over-year.

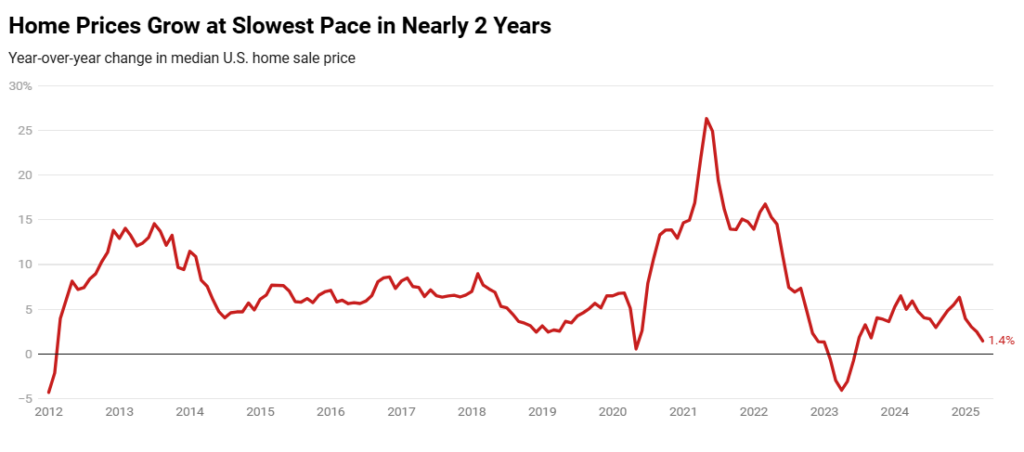

Overall sentiment finds that housing demand is sluggish due to the cost of buying a home is climbing, as the median home sale price rose 1.4% year-over-year to $438,466 in April, and economic uncertainty is making many Americans pump the brakes on big purchases. While that marks the slowest price growth in nearly two years, monthly housing payments still hit a record high last month due to elevated mortgage rates and prices. The average 30-year-fixed-rate mortgage (FRM) was 6.73% in April—up from 6.65% in March, and more than double the record low hit during the pandemic, but down from 6.99% in April 2024.

“There’s a general feeling of anxiety in the housing market because no one knows what they’re going to read in the news when they wake up,” said Dan Close, a Redfin Premier Real Estate Agent in Chicago. “That uncertainty is freaking prospective buyers out, even though in many cases it’s not having a tangible impact on their ability to buy a house.”

Spring Buying Season Stunted

Spring is typically the busiest season for the U.S. housing market, and with the housing shortage easing and mortgage rates slightly lower than a year ago, one might expect home sales to be stronger. Redfin reports that homebuyers and sellers have expressed concerns about tariffs and the ongoing trade war. The U.S. and China agreed last week to a temporary reduction in tariffs, which boosted the stock market and lowered the risk of a recession, but also drove up mortgage rates, according to Redfin Head of Economics Research Chen Zhao.

Median sale prices rose most year-over-year in April 2025 in Newark, New Jersey (13.4%); Cleveland, Ohio (11.9%); and Milwaukee, Wisconsin (9.7%). They fell in 12 metros, with the largest declines in Oakland, California (-5.9%); Jacksonville, Florida (-3.4%); and Austin, Texas (-3%).

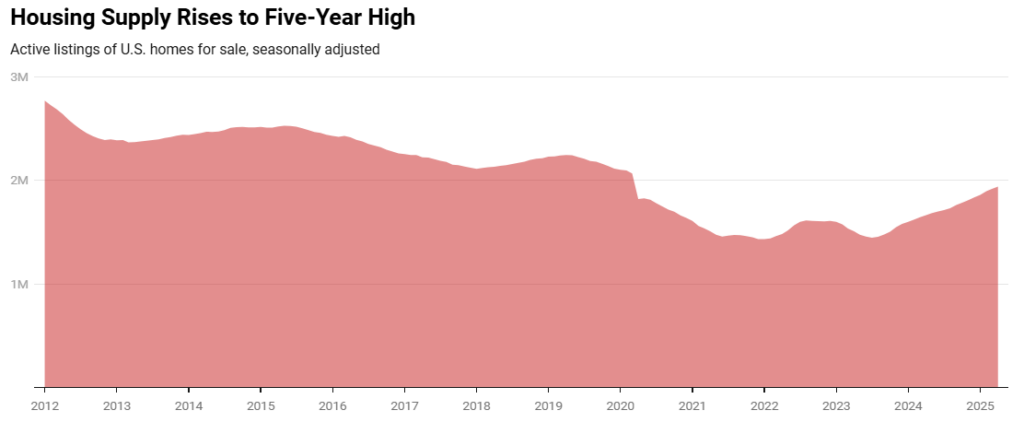

Inventory Climbs

Redfin found that active listings (the total number of homes for sale) last month hit the highest level since March 2020. They climbed 1.2% from a month earlier on a seasonally adjusted basis, and rose 16.7% year-over-year. New home listings rose to the highest level since July 2022, increasing 1.3% month-over-month on a seasonally adjusted basis, and 8.6% year-over-year—the largest annual gain reported since last May.

“A lot of people are selling their homes and downsizing because they’re worried about the economy,” said Meme Loggins, a Redfin Premier Real Estate Agent in Portland, Oregon. “During the pandemic, everybody wanted more space for a home office or for their kids to run around, but now people are more focused on saving money. A lot of folks are getting rid of their investment properties, and I’m working with a couple of federal employees who are afraid of losing their jobs, so they’re selling their homes and thinking of moving into condos.”

As Loggins mentioned federal layoffs, recent data from Redfin found that active listings of homes for sale in Washington, D.C. jumped 25.1% year-over-year to the highest level since 2022 during the four weeks ending April 27—the largest gain on record. By comparison, active listings nationwide rose 14.2%—the smallest increase since March 2024.

Elon Musk’s Department of Government Efficiency (DOGE) has been reducing the government’s workforce in an attempt to reduce federal spending. According to APM Research Lab, federal jobs represent 11.1% of all jobs in Washington, D.C.—the highest share among major U.S. metros analyzed.

Housing supply is also rising because the mortgage rate lock-in effect is easing. Many who have been sitting on historically-low mortgage rates locked in during the pandemic are now moving and giving up those low rates because it’s not realistic to stay put forever.

Redfin reports that Denver saw the largest gain in active listings among the major metros Redfin analyzed, with a 36.3% year-over-year increase, followed by Las Vegas, Nevada (35.8%) and Oakland, California (32.4%).

Homes Sitting on the Market Longer

An upward drive in home inventory is providing potential homebuyers with more choices, and when buyers have more to choose from, it often means they have room to negotiate and ask for concessions. That’s the primary reason home-price growth is slowing and homes are taking longer to sell.

New listings rose most in Boston, Massachusetts (20.9%); Las Vegas, Nevada (15.2%); and Denver, Colorado (14.6%), and fell the most in Milwaukee, Wisconsin (-5.8%); San Jose, California (-5.7%); and West Palm Beach, Florida (-4.1%).

The typical home that went under contract in April was on the market for 40 days. That marks the slowest April since 2019, compared to 35 days a year earlier and 18 days during the peak of the pandemic homebuying frenzy. Redfin agents report that overpriced homes are sitting on the market, causing stale listings to pile up. And when listings sit, sellers often end up accepting much less than their asking price. The typical home that sold in April 2025 sold for roughly 1% less than its asking price—the biggest discount for any April in five years. Less than one-third (30.2%) of homes that sold in April sold for above their asking price, the lowest April share in five years.

Active listings rose most in Denver, Colorado (36.3%); Las Vegas, Nevada (35.8%); and Oakland, California (32.4%), and fell in just two metros: Kansas City, Missouri (-3.7%) and Milwaukee, Wisconsin (-0.6%).

“I’ve written ridiculously low offers for buyers that have been accepted,” Loggins said. “I just had a buyer get nearly $50,000 under the asking price for a home listed at $849,000 even though similar homes have been selling for $830,000. You’d be surprised by what sellers are willing to take. I haven’t written a full-priced offer that didn’t request a concession in a long time.”

In San Jose, California, 67.5% of the homes sold above their list price, the highest share among the metros Redfin analyzed. San Jose was followed by Newark, New Jersey (65%) and San Francisco, California (61.1%). The lowest shares were in Florida: West Palm Beach (6.3%), Fort Lauderdale (7.7%), and Miami (7.8%).

Click here for more on Redfin’s analysis of April 2025 home sales.