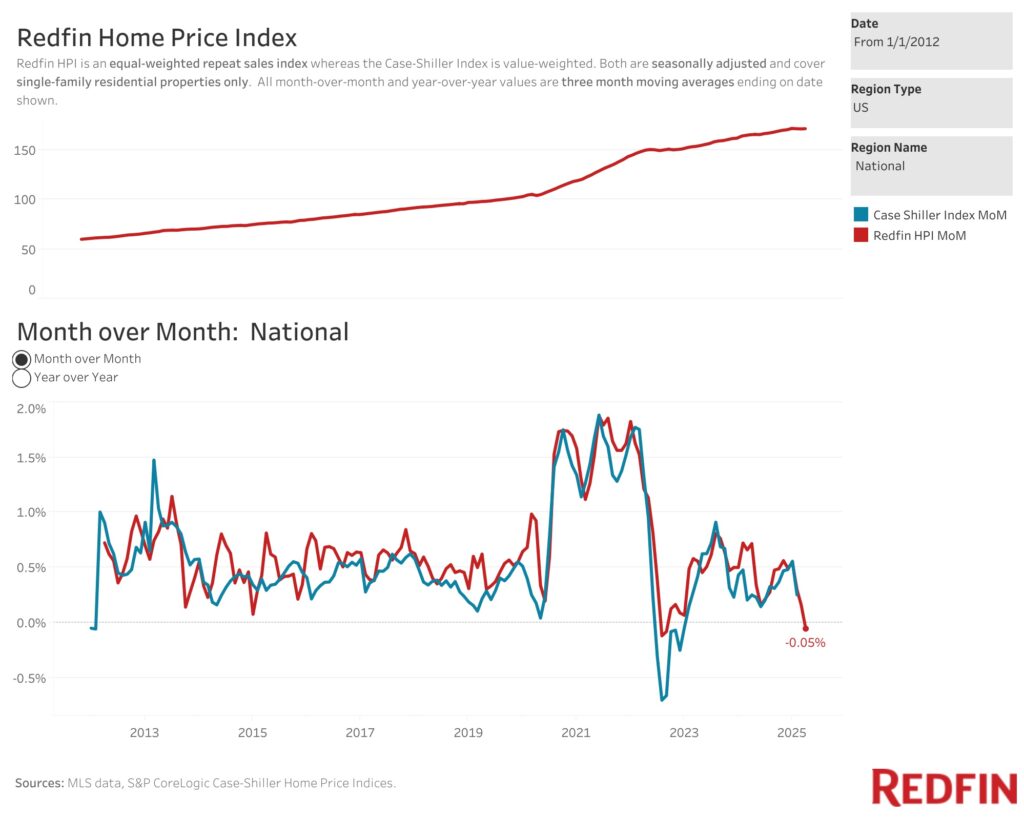

Seasonally adjusted, U.S. home prices fell just 0.1% in April, marking the first monthly drop since September 2022. On an annual basis, home prices have increased 4.1%, which was less than the 4.9% growth in March. Since July 2023, that is the lowest annual price growth recorded, according to new Redfin data.

The Redfin Home Price Index (RHPI) only reported a month-over-month fall in April; the other two months—August and September of 2022—followed a string of sharp increases in interest rates. Overall, and as prices remain elevated, the April decrease (-0.05%, rounded to -0.1%) is significantly slight compared to recent years.

The RHPI, which computes seasonally adjusted changes in single-family home prices using the repeat-sales pricing approach, calculates how much a home sold for over a specific time period and how much it has changed in value since the last time it sold.

From a metro-level standpoint, prices decreased month-over-month (MoM) in 25 of the 50 most populated metro regions in April on a seasonally adjusted basis, underscoring the general slowdown.

The top five metros with the biggest declines were:

- Charlotte, NC (-1%)

- Virginia Beach, VA (-1%)

- Miami (-0.7%)

- Los Angeles (-0.64%)

- Portland, OR (-0.61%)

The top five metros where prices ticked up most included:

- Nassau County, NY (1.8% MoM)

- Warren, MI (1.3%)

- New York (1.2%)

- San Fransisco (1.03%)

- Chicago (0.91%)

Note: RHPI data is subject to modification.

Buyers Desire Homes But Choosing to “Wait and See” What the Market Will Offer

Industry expert and Redfin Senior Economist Sheharyar Bokhari suggests that there are two main reasons why home values are virtually unchanged. Firstly, homebuyer demand remains much lower than it has been.

With the effects of U.S. tariff policy and a possible recession significantly influencing their decision to make large purchases, buyers are taking on a “wait-and-see” stance. In April, pending home sales decreased 3.5% month-over-month on a seasonally adjusted basis as more buyers stayed away from the market.

Secondly, and despite weakening demand, U.S. housing supply remains elevated. Due mostly to the fact that homes just aren’t selling, the overall number of properties listed for sale is at its highest level in five years. As a result, home sellers are making concessions at nearly all-time highs to draw in more buyers.

“Home prices are flat, and that’s good news for buyers after years of rapid increases,” Bokhari said. “But even with prices softening, affordability remains a major hurdle. Elevated mortgage rates and high prices mean that many buyers are stretching their budgets to make a purchase.”

Further, Mark Fleming, Chief Economist at First American, suggests prospective homebuyers still possess optimism as price appreciation moderates.

First American also released its April 2025 Home Price Index (HPI) report, tracking home price changes less than four weeks behind real time at the national, state, and metropolitan (Core-Based Statistical Area) levels and including metro price tiers that segment sale transactions into starter, mid, and luxury tiers.

| First American Data & Analytics’ National Non-Seasonally Adjusted (NSA) HPI | |

| Metric | Change in HPI |

| March 2025-April 2025 (MoM) | +0.4% |

| April 2024-April 2025 (YoY) | +2.0% |

“House prices nationally reached another record high in April, but the annual growth rate has slowed to its lowest level since 2012, underscoring the ongoing rebalancing in the market,” said Mark Fleming, chief economist at First American. “Persistently high mortgage rates have tempered demand, while increased inventory has boosted supply, dragging house price appreciation down. This normalization follows the unsustainable price growth seen during the pandemic. Although affordability remains a challenge, slower price appreciation is encouraging for potential home buyers as it lets their income-growth driven house purchasing power increase.”

First American reported that as of February 2020, home prices have increased nationwide by 57.2% from their pre-pandemic levels. Home price growth for February 2024–March 2025 that was published in the HPI last month was revised up by 0.2 percentage points, from +0.5% to +0.7%.

| Core-Based Statistical Areas (CBSAs) Ranked by Greatest Year-Over-Year Increases in Starter Tier HPI | |||

| CBSA | Change in Starter Tier HPI | Change in Mid-Tier HPI | Change in Luxury Tier HPI |

| Pittsburgh | +7.6% | +2.5% | +4.0% |

| Baltimore | +5.7% | +3.3% | +3.3% |

| St. Louis | +4.9% | +0.9% | +0.4% |

| Cambridge, MA | +4.7% | +5.0% | +1.3% |

| Warren, MI | +3.3% | +2.2% | +3.3% |

“The markets with the strongest growth in the starter home price tier are predominantly located in the Northeast or Midwest,” said Fleming. “These markets include Pittsburgh, Baltimore, and St. Louis, markets that are attractive to potential first-time home buyers due to their relative affordability. However, homebuilding has also lagged in these markets, leading to high demand relative to limited supply, fueling strong house price appreciation.”

To read more, click here.